Forecast for EUR/USD on August 9, 2024

On Thursday, the euro had a volatile day, with a range of just over 30 pips, closing the day down by four pips. There is a struggle at the MACD line on a weekly time frame.

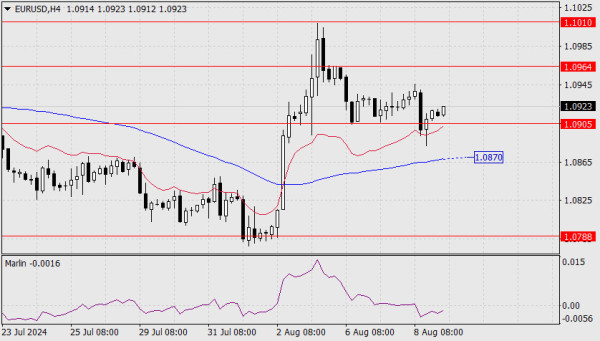

A daily close below the 1.0905 level would mark a significant victory for the bears, potentially initiating a medium-term decline toward the target of 1.0636. However, today is Friday, so there's a high likelihood of the week closing with a white candle, which would mean a weekly close above the MACD line, indicating medium-term growth.

In the daily time frame, the Marlin oscillator is declining right after forming a divergence.

The situation on the 4-hour chart requires additional confirmations of the bears' strength—breaking through the MACD line (1.0870) and the Marlin oscillator not falling deeply into the oversold zone. Otherwise, the euro buyers may intercept the initiative. It's a situation of uncertainty and waiting. The likelihood of growth is 55%.