FX 101: Using FX for portfolio diversification

Diversification is the only free lunch in investing, and it is the process of spreading your investments across asset classes, sectors, countries and industries to lower your portfolio risk. The goal of diversification is to minimize the impact of any single investment's poor performance on the overall portfolio.

However, the use of FX to add diversification to portfolios has been under-acknowledged, given the high volatility and complexity in trading FX. Despite these challenges, FX can still play a key role in portfolio diversification. This is especially important in the current environment of persistently high inflation which can negatively impact returns of both equities and bonds.

Below are the ways in which FX can add diversification to your portfolio.

Currency Diversification

Most investors are over-exposed to their home currency given that they may hold property and other assets in their country of residence.

Investors also may have specific needs relating to future exposure to currencies due to potential liabilities or planned expenditures, such as repayment of a foreign currency loan or to send your children to foreign universities. To avoid an asset-liability mismatch, investors need to consider currency diversification.

Hedging

If your portfolio consists of assets denominated in foreign currencies, then the performance of those currencies will impact the return of your investment. This can either enhance or diminish your actual investment returns.

If an investor holds foreign assets denominated in a currency expected to depreciate, they can use FX instruments such as forward contracts or options to hedge against potential losses due to currency fluctuations. More such strategies to hedge FX exposure in Japanese equities were discussed in this article.

Geographical Diversification

FX trading allows investors to gain exposure to economies and markets around the world. By investing in currencies from different countries, investors can diversify their geographic risk. This is particularly important when specific regions or countries experience economic downturns or geopolitical instability.

For instance, US-China trade tensions can negatively impact the Chinese yuan, and the weakness can also filter through to the currencies of its main trading partners such as Australian dollar or the Euro.

Also, escalation in geopolitical risks results in a rush into safe-havens such as Japanese yen or Swiss franc. Emerging market currencies are generally more susceptible to geopolitical risks due to less stable political environments and economic vulnerabilities.

Enhancing Returns

Active currency trading strategies can be employed to potentially enhance returns or generate a passive income, which provides an offset for any declines in portfolio values. This involves speculating on currency movements based on factors such as interest rate differentials, economic indicators, and geopolitical events. However, it's important to note that currency trading carries its own risks and requires a deep understanding of the FX market.

Commodity Exposure

Some currencies are closely tied to commodity prices. For instance, the Australian dollar is often influenced by movements in commodity prices, particularly those of metals such as gold and iron ore. Investing in currencies with strong correlations to specific commodities can provide indirect exposure to those commodities, thus diversifying the portfolio.

Using Currency ETFs

Experienced traders can participate in the forex market by trading currency pairs in spot, futures, or options markets. At the same time, investors can leverage currency ETFs for easier access to international currency markets, allowing them to speculate on currency movements, enhance yields, hedge risks, and diversify their portfolios.

Currency ETFs are a simple and low-cost way to trade currencies during normal trading hours. They are designed to track the performance of a single currency in the foreign exchange market against the US dollar or a basket of currencies.

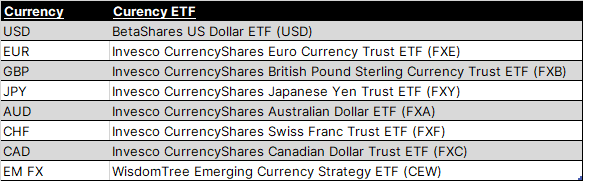

For instance, the Invesco CurrencyShares Japanese Yen Trust ETF (FXY) tracks the price of Japanese yen (JPY). If you think that the Japanese yen is set to rise against the US dollar, you may want to purchase this ETF, while a short sell on the ETF can be placed if you think the Japanese currency is set to fall. More such examples are listed below:

When incorporating FX into a portfolio, it's essential to consider factors such as risk tolerance, investment objectives, time horizon, and the overall portfolio construction. Additionally, investors should be mindful of the unique risks associated with currency trading, including volatility, liquidity constraints, leverage, and political/regulatory risks.

-----------------------------------------------------------------------

Other recent Macro/FX articles:

19 Apr: Global Market Quick Take - Asia

18 Apr: JPY: Intervention alert, or a BOJ alert?

16 Apr: Chinese Yuan’s Double Whammy - Dollar Strength and Yen Weakness

12 Apr: Riding the Fed-ECB Policy Divergence

11 Apr: ECB rate decision: How to trade the event

9 Apr: CAD vulnerable as market underprices dovish Bank of Canada risks

9 Apr: US inflation report: How to trade the event

8 Apr: Macro and FX Podcast: NFP, CPI, ECB and Japan

3 Apr: Chinese yuan bears are undeterred by PBoC’s grip

3 Apr: FX Quarterly Outlook: The rate cut race shifts into high gear

22 Mar: Swiss National Bank’s bold move will kickstart the G10 rate cut cycle

20 Mar: Thematic Podcast: Japan's route to abolish negative interest rates

20 Mar: Japan’s exit from negative rates: Implications for the economy, yen and stocks

14 Mar: FOMC vs. BOJ: Who moves the Yen?

12 Mar: Dampening equity sentiment could test GBP resilience

6 Mar: Bitcoin fever is running high, again

28 Feb: Navigating Japanese equities: Strategies for hedging JPY exposure

23 Feb: Nvidia momentum spills over to FX markets

15 Feb: Swiss Franc’s bearish view gets more legs

14 Feb: Sticky US inflation could make dollar strength more durable

9 Feb: Japanese Yen is throwing a warning

8 Feb: FX 101: USD Smile and portfolio impacts from King Dollar