FX analysis – Gold and USD eye key CPI figure

After last week’s blockbuster NFP figure FX traders have a key US CPI reading to look forward to later today. Rates markets have seen see-sawing expectations on when the Fed will start cutting rates and today’s CPI will be another big part of that puzzle.

US CPI for March is expected to come in at a 0.3% increase, a slight cooling from Februarys 0.4% but still stubbornly holding the Year-on-Year rate at 3.4%, showing that not progress in the battle to bring down inflation is slow going and not over yet.

USD has been in a holding pattern during April with the US dollar Index range trading between the support at 104 and resistance at 105, the 104 support is certainly in play should a cooler than expected CPI reading come in, with the next support at the 200-day SMA at 103.81

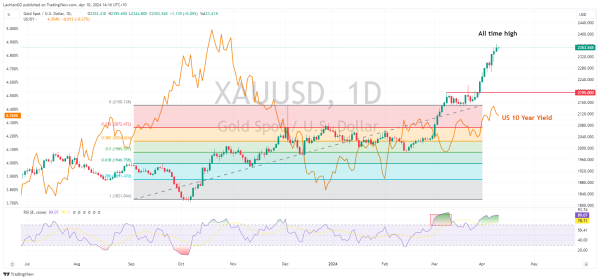

Golds record run-up to all time highs has seen the precious metal take headlines during April. As an inflation hedge it should benefit from a hot CPI reading, but a cool reading would see yields and the USD drop which is also gold positive. It’s hard to predict how gold will react fundamentally to todays CPI, though from a chartist point of view XAUUSD is in serious overbought territory and a correction is overdue.