FX analysis – USD decline continues post FOMC, JPY outperforms on probable BoJ intervention

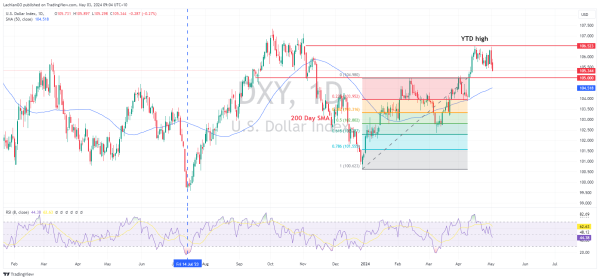

USD continued the move lower sparked by a somewhat dovish Powell in Wednesdays FOMC meeting. And ahead of today’s key NFP print. DXY did hit highs after hot labour costs data, though quickly reversed to hit 3-week lows of 105.29, closing at session lows and looking to test the major support at 105.

JPY was the clear outperformer of G10 currencies, helped by a Reuters report that BoJ data suggesting that the sharp spikes in Yen strength on Monday and Wednesday this week were indeed BoJ intervention. USDJPY dropping almost 4.5% from the spike high early in Monday’s session to be hovering just above the 153 mark coming in to today’s APAC session.

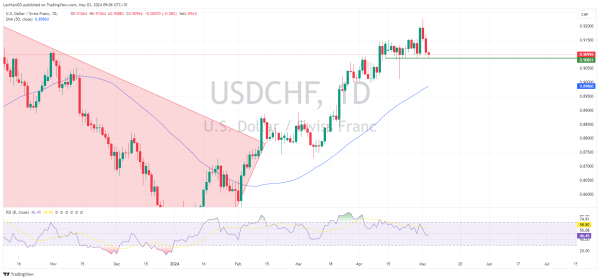

CHF was also an outperformer in Thursday’s session, led higher by a hot April Swiss CPI print where the headline figure of 1.4% Y/Y was well above the expected 1.1%. USDCHF dropped to a low of 0.9094 before finding some buyers at the April support level of 0.9085, this will be a key level to watch in this pair ahead oh US NFP later today.