FX Analysis – USD whipsaws , AUDNZD hits new lows, Gold holds key support

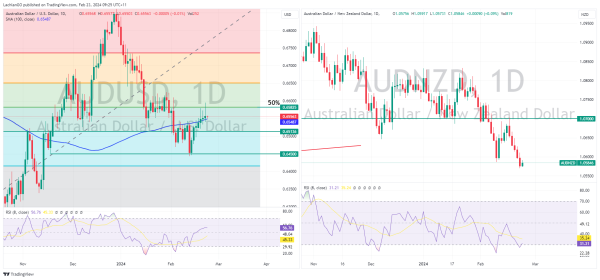

USD was ultimately flat in Thursdays session after a rollercoaster of a ride, DXY printed a low in the European session of 103.43 before rallying up to the 100 Day SMA at 104.10 after better than expected US Jobless claims. Flash PMIs for February were mixed with a fall in Services but a rise in Manufacturing, DXY heading into the APAC session just below the 104 level.

JPY was softer vs the Dollar with USDJPY holding above the psychological 150 level which has become a short term support level. Comments from BoJ Governor Ueda saying that Japan’s trend inflation is heightening and the BoJ will make appropriate monetary policy decisions, failing to offer much support for the Yen.

AUD and NZD – saw notable strength during the APAC and European session tracking higher with equities after the big beat in NVDA earnings. Both currencies came off highs though after USD rallied on strong jobless claims data. For the fifth straight session AUD again underperformed its Kiwi rival, seeing AUDNZD dropping well below 1.06, setting new lows for 2024 and not far off the lows of 2023.

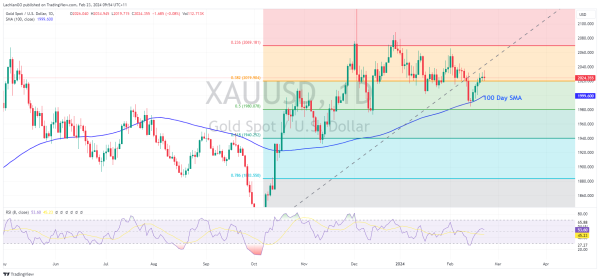

Gold again tested the support at 2020 USD an ounce, and again held in a whipsawing session. Trading at around 2024 heading into the APAC session.