GBPUSD falls by more than 1% 📉

🏛️Bailey's dovish comments weakens British pound

The British pound is losing 1% against the U.S. dollar today following comments by BoE Chairman Bailey, who suggested that, as a banker, he sees an opportunity for a more aggressive pace of interest rate cuts in the UK. This is largely due to the already not so onerous price pressures on basic goods and services in the economy. The information comes from the Guardian, which interviewed a BoE banker.

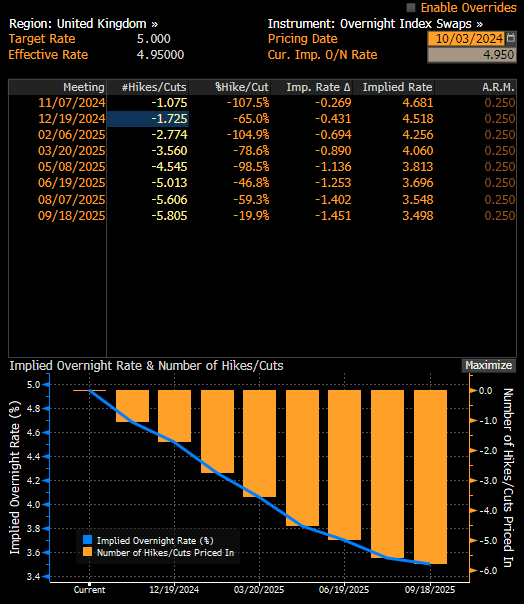

The market has long expected another cut from the BoE in November. However, the likelihood of another move in December is growing. The market also sees chances that interest rates will be cut three times by February. Source: Bloomberg Finance LP, XTB

Source: Bloomberg Financial LP

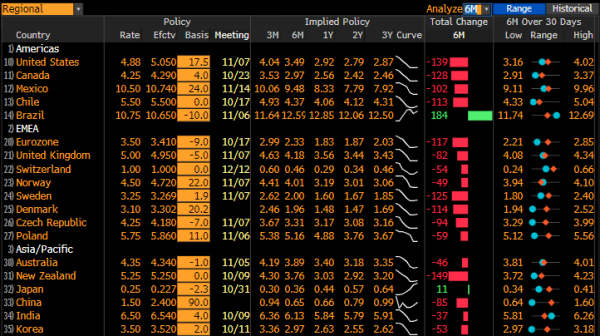

From a fundamental point of view, looking only at current interest rate levels and the market's implied change in interest rates over the next six months, it seems that it is the pound that has all the time escaped as the more valuable currency (rates currently 4.88% in the US, in the UK 5.00%; implied change in rates in the US 139 points; in the UK it is expected to be 82 points). Source: Bloomberg Financial LP

The GBPUSD pair today breached the uptrend limit set by the 50-day exponential moving average (blue curve in the chart below). From a technical point of view, it is on the maintenance of this zone (and other moving averages), that may determine whether a structure for a permanent trend change will emerge on the pair, or whether we are, however, observing only a technical pullback.

Source: xStation