📈GBPUSD gains ahead of BoE decision

What to expect from the Bank of England's September decision❓

The Bank of England's decision comes a day after a larger-than-consensus interest rate cut by the Federal Reserve. This raises questions about the state of the U.S. economy and the conduct of monetary policy by other central banks. However, analysts at Bloomberg Intelligence predict that the Bank of England will maintain a cautious approach and leave interest rates unchanged at 5%. The BoE is expected to take a cautious approach to signaling the pace of rate cuts in the future. The main point may be the decision on the reduction of the bank's balance sheet in the coming year and its implications for the country's fiscal strategy. A unanimous decision to reduce the balance sheet by £100 billion is expected, matching the 2023 target.

Key facts about today's BoE decision:

- Analysts expect interest rates to remain at 5%, despite yesterday's cut by the Fed

- A unanimous decision to reduce the balance sheet by £100 billion is expected, matching the 2023 target

- Bank likely to maintain cautious stance on future rate cuts

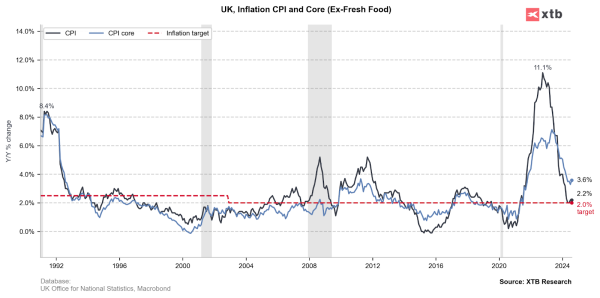

- August CPI inflation remained at 2.2%, below BOE forecasts, which could influence future decisions

- GDP growth in the second quarter of 2024 was slightly weaker than forecast, indicating a slowdown in the economy

- The decision will be announced at 12:00 BST

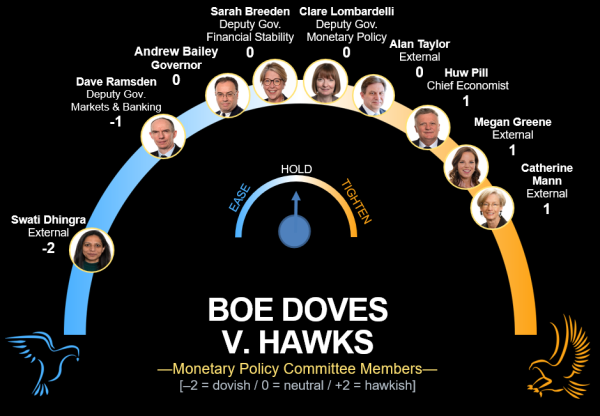

Bloomberg's analytical model, which assesses the attitudes of individual BoE bankers in terms of the comments they make, appears to confirm that on average they maintain a neutral stance on current interest rates. Source: Bloomberg Financial LP

What do the current macro data show?

The main measure of British inflation currently remains within the Bank of England's target zone. On the other hand, however, core readings remain high all the time, effectively reducing the chances of a dovish BoE stance in the near term. Source: XTB

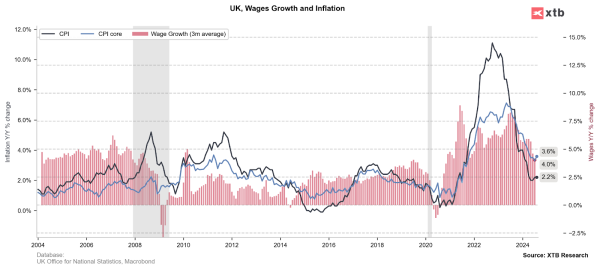

Wage growth in the UK, however, is slowing, which will encourage bankers to loosen monetary conditions in the economy in the medium term. Source: XTB

How might the pound react to the decision itself?

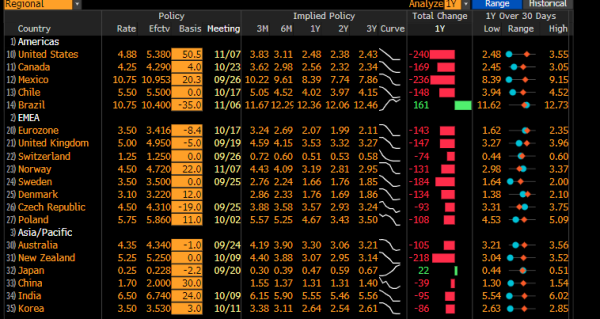

Looking solely at interest rates and the current market-priced path of their changes 12 months ahead, we can see that BoE policy may remain one of the most hawkish, which could theoretically support the pound on the currency market in the broader term. Source: Bloomberg Financial LP

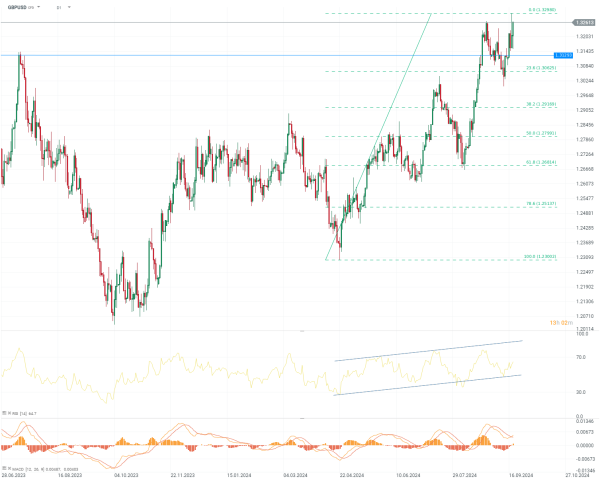

GBPUSD Technical Analysis (W1 and D1)

The pound is maintaining a dynamic uptrend against the US dollar and thus breaking out to new local peaks, which have not been seen on the GBPUSD pair since March 2022. At this point, it seems that the fundamentals may further support the trend currently visible. Source: xStation

GBPUSD is holding above the peak from last year and above the 23.6% Fibonacci retracement. An uptrend has been evident on the RSI indicator since April, and a move out of the neutral zone at the top could indicate a bullish signal. The MACD is also trading higher peaks and lower lows. For bears, the first test would be a move below support at the 23.6% Fibonacci retracement. Source: xStation