GBP/USD. May 6th. Bulls continue to attack, but their momentum is fading

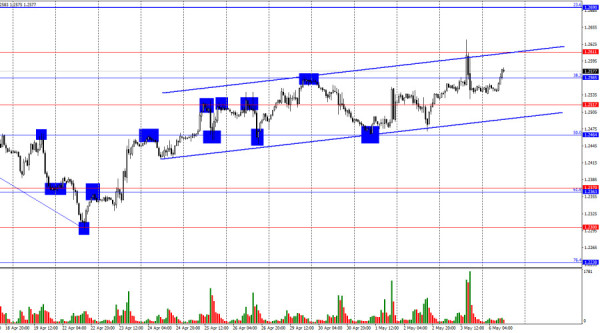

On the hourly chart, the GBP/USD pair continued upward movement on Friday, reaching 1.2611. The bounce of quotes from this level favored the US dollar, but the decline of the British currency was short-lived. The ascending trend channel continues to characterize traders' sentiment as "bullish," but only in the short term. In the longer term, the trend remains "bearish." A resumption of the "bearish" trend can be expected after the quotes consolidate below the ascending channel.

The wave situation remains unchanged. The last completed downward wave broke the low of the previous wave, and the new upward wave is still too weak to break the peak from April 9 (although its formation has been ongoing for several weeks). Thus, the trend for the GBP/USD pair remains "bearish," and there are no signs of its completion. The first sign of bulls taking over could be the break of the April 9 peak. A new downward wave, if it turns out to be weak and does not break the low from April 22, could also indicate a trend reversal.

On Friday, reports on unemployment, labor market, and business activity in the US services sector prevented bull traders from taking the lead. The bears also did not exert too much pressure on the GBP/USD pair, but they have been in control in recent weeks. Although the "bearish" trend persists, it won't be long before the bears finally bottom out. If the Bank of England takes a hawkish stance this week and Andrew Bailey does not mention interest rate cuts, the British currency may continue to rise. Regardless of the outcome of the Bank of England meeting, we can always determine the end of the "bullish" trend by consolidating below the channel. The "bullish" impulse started quite strongly, but now it is weakening. It is much easier to expect "dovish" rhetoric from the Bank of England now, as inflation in the UK is decreasing every month.

On the 4-hour chart, the pair rose to the level of 1.2620 and rebounded from it. The upper line of the descending trend channel has been broken, but it is still too early to bury the "bearish" trend. This week, a decline towards the levels of 1.2450 and 1.2289 may begin. Consolidation of the pair above the level of 1.2620 increases the likelihood of further growth towards the next corrective level of 61.8%–1.2745. There are no imminent divergences today.

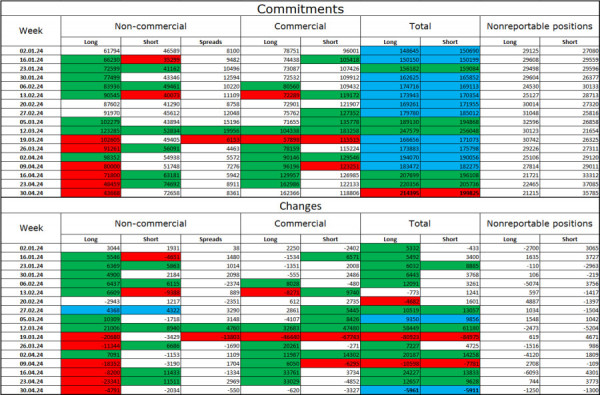

Commitments of Traders (COT) report:

The sentiment of the "non-commercial" trader category became more "bearish" over the past reporting week. The number of long contracts held by speculators decreased by 4791 units, while the number of short contracts decreased by 2034. The overall sentiment of major players has changed, and now bears dictate their terms in the market. The gap between long and short contracts is 30 thousand: 43 thousand versus 73 thousand.

There are still prospects for a decline in the British pound. Over the past three months, the number of long contracts has decreased from 62 thousand to 43 thousand, while the number of short contracts has increased from 47 thousand to 73 thousand. Over time, bulls will start getting rid of buy positions or increasing sell positions, as all possible factors for buying the British pound have already been worked out. Bears have demonstrated their weakness and complete unwillingness to take the lead in recent months, but I still expect the British pound to undergo a more significant decline.

News calendar for the US and the UK:

On Monday, the economic events calendar contains a few interesting entries. The impact of the information background on market sentiment will be absent today.

Forecast for GBP/USD and trading advice:

Selling the British pound may be possible today if it consolidates below the level of 1.2565 on the hourly chart with a target of 1.2517 or if it bounces from the level of 1.2611 with the same target. Buying can be considered on a rebound from the lower boundary of the ascending channel, with targets at 1.2565 and 1.2611.