GDP set for a fall in Q1 which may nudge RBI’s MPC to look at monetary easing

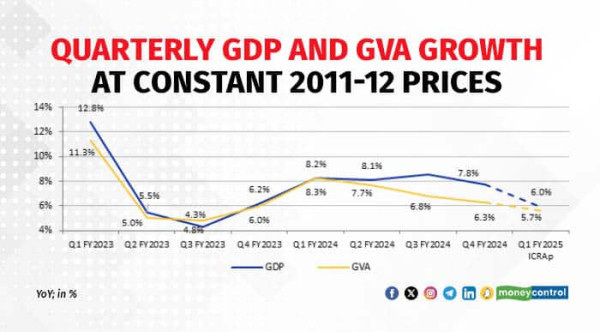

India’s Q1 FY2025 GDP data is set to be released at end-August 2024. ICRA expects the GDP growth to moderate sharply to a six-quarter low of 6 percent from 7.8 percent in Q4 FY2024, significantly lower than the Monetary Policy Committee’s (MPC’s) forecast of 7.1 percent for the quarter. However, we don’t believe that this is a cause for alarm, as it is based on some temporary and technical factors, and growth is set to rebound above 7 percent in H2 FY2025.

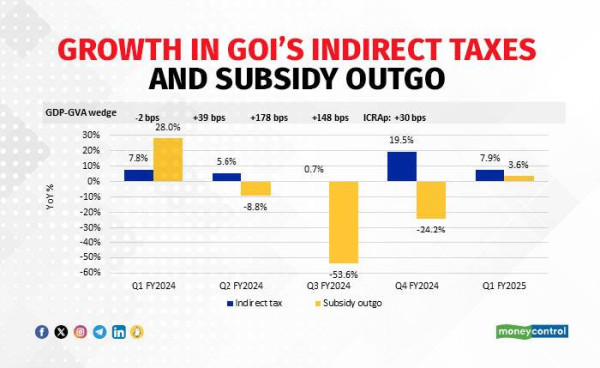

A large part of the deceleration in the GDP growth in Q1 FY2025 vis-à-vis Q4 FY2024 is expected to be driven by a ‘technical’ factor- the narrowing of the wedge between the GDP and the GVA growth between these quarters. The difference between GDP and GVA is defined as net indirect taxes, i.e. indirect taxes less subsidies. A steep year-on year (YoY) fall in the subsidy bill in H2 FY2024 widened the GDP-GVA growth wedge to 178 bps in Q3 and 148 bps in Q4 FY2024.

Growth in GoI’s indirect taxes and subsidy outgo

The single digit growth in the Government of India’s (GoI) subsidy outgo and indirect taxes in Q1 FY2025 suggests that the wedge is likely to come off quite sharply, to around 30 bps, which would compress the GDP growth, even as we expect the gross value added (GVA) growth to ease by a relatively lower 60 bps to 5.7 percent in the quarter from 6.3 percent in Q4 FY2024.

In addition to the aforesaid technical factor, there are clear indications of a slowdown, albeit temporary, in investment activity in Q1 FY2025, as reflected in the multi-year low new project announcements and project completions, as well as the YoY deterioration in a majority of investment-related indicators, compared to Q4 FY2024. This can be attributed to the impact of parliamentary elections and the associated uncertainty and delays in project commissioning. Moreover, capital expenditure by both the Centre and state governments (capital outlay and net lending for states except Arunachal Pradesh, Assam, Goa, Gujarat, Manipur, and Sikkim) contracted sharply by 35 percent and 23 percent, respectively, in the quarter. Consequently, we expect the gross fixed capital formation (GFCF) growth to have slowed down further in Q1 FY2025, with the adverse base also compressing growth.

The May and July 2024 rounds of the RBI’s Consumer Confidence Survey revealed that urban consumer sentiments weakened continuously relative to the March 2024 round. This is likely on account of the heatwave in parts of Q1, a transient factor, which affected footfalls in certain retail-focused sectors followed by excess rainfall in early-July as well as elevated food prices. This could also have been led by the temporary impact of lower government capital spending on employment in certain sectors.

Moreover, the lingering impact of last year’s unfavourable monsoon and an uneven start to the 2024 monsoon is likely to have prevented a broader improvement in rural sentiment. Thus, the growth in consumption demand is likely to have remained sluggish in Q1 FY2025.

On the production side, i.e. GVA, the deceleration in growth is expected to be largely driven by the manufacturing and construction sectors. The profit margins of manufacturing companies eased slightly in Q1 FY2025 vis-à-vis Q4 FY2024, amid an uptick in global commodity prices. Besides, the YoY growth in manufacturing IIP volumes decelerated, which is also likely to weigh on manufacturing GVA growth in the quarter. Additionally, construction activity likely witnessed a transient lull in its momentum in Q1 FY2025, based on the weakening in performance of most indicators pertaining to infra/construction sector, compared to Q4 FY2024.

Looking ahead, Government capex should pick up sharply in H2 FY2025. Moreover, a healthy kharif harvest should boost rural demand. We are cautiously optimistic that urban consumer confidence will improve in the next survey round; if it doesn’t, this would be a cause for concern.

If the Q1 FY2025 GDP growth turns out to be in line with ICRA’s expectations, it is likely to lead to a downward revision in the MPC’s GDP estimate of 7.2 percent for FY2025. This is also likely to prompt the Committee to assign a relatively higher weight to the growth outlook in the next meeting in October 2024.

The CPI inflation number for July 2024, that were released earlier this month, was optically compressed by a high base to 59-month low of 3.5 percent from 5.1 percent in June 2024. The August 2024 reading, which will also be available before the October MPC meeting, is expected to remain benign at sub-3.5 percent. The prints for July and August are likely to prompt a downward revision in the MPC’s CPI inflation estimate of 4.4 percent for Q2 FY2025. Accordingly, we foresee a shift in the MPC’s tone in favour of monetary easing in the October 2024 meeting. However, the views of the new external MPC members would be key to determine monetary policy outcomes.