Global Market Quick Take: Asia – April 11, 2024

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

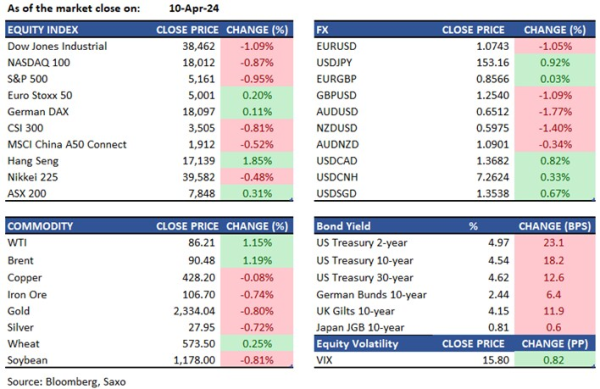

Equities: US stock futures pointed lower, extending losses seen on the Wall Street in Wednesday’s session following inflation fears coming back to the forefront after a third consecutive print of hot CPI in the US which saw the door to a June Fed rate cut closing. Stocks were also spooked by escalating geopolitical tensions amid an expected Iran response. Energy sector outperformed the broader index as reflation theme underpinned, and the interest rate sensitive real estate sector led the losses. Big tech was mostly lower, but Nvidia rose 2%.

Delta Airlines kicked off the Q1 earnings season with stronger-than-expected results, and focus turns to bank earnings due on Friday. But before that, Japan’s Uniqlo-owner Fast Retailing reports Q2 results today and a weak yen is expected to have boosted international sales.

FX: The dollar surged on the back of Fed policy path being re-assessed after a third consecutive month of hotter-than-expected CPI print. DXY index surged past the 105 level to its highest levels since November, and PPI today could be the next big test where another hot print could send jitters about a hot PCE print. Dollar strength weighed the most on activity currencies, and losses in G10 were led by AUD and NOK despite another surge in oil prices. AUDUSD slip over one big figure to test 0.65 handle while a hawkish RBNZ hold saw AUDNZD sliding below 1.09. Japanese yen remains a key focus as USDJPY finally pierced through 152 and rose above to fresh record highs of 153.24 and verbal intervention from Japanese authorities gathered momentum. EURUSD hit a trough of 1.0730 and ECB meeting is eyed today. USDCAD broke above resistance at 1.3625 and touched the 1.37 handle. Key to watch today will be the PBOC yuan fixing and USDCNH rose towards 7.2650 from 7.24 area.

Commodities: Geopolitical risks were heightened again with reports of an imminent Iran attack on Israel which brought fresh gains in oil despite a higher dollar post-CPI. This came after a decline in oil prices earlier as EIA reported that US crude stocks climbed 5.8 million barrels in the week of April 5, more than double of the expected increase. Gold prices however could not get a safety bid as delay of Fed rate cut expectations underpinned. Copper prices also retreated on the back of stronger dollar and China’s FX response and inflation numbers will be on the radar today.

Fixed income: Treasuries saw the biggest one-day selloff since late 2022 as hot US CPI delayed Fed rate cut expectations and 2-year yields rose over 20bps. This was also accompanied by a dismal 10-year auction which also saw a move of over 15bps higher in 10-year yields. 10-year Japanese government bonds were also sold-off in the Asian morning, and yields rose above 0.8%, the highest since November.

Macro:

- US CPI came in hotter than expected for a third consecutive month in March. Headline was up 0.4% MoM (vs. 0.3% exp and 0.4% prev) and 3.5% YoY (vs. 3.4% exp and 3.2% prev). Core CPI also came in higher at 0.4% MoM (vs. 0.3% exp and 0.4% prior) and YoY measure unchanged at 3.8% despite expectations of a cooling to 3.7% YoY. Gains were broad-based across goods and services categories and the door for a June rate cut seems to have closed. Market now expects 20% odds of a rate cut by June, and is pricing in less than 50bps of rate cuts for the year.

- FOMC minutes were stale but the vast majority of Fed members agreed that it would be prudent to begin slowing the pace of balance sheet runoff fairly soon.

- Bank of Canada held rates unchanged at the meeting yesterday and a dovish shift in language and comments from Governor Macklem was seen, opening the door to a June rate cut especially after the dismal jobs report seen last week. We discussed the BOC meeting in this article, and continue to expect hard landing risks for the Canadian economy to rise if BOC was to wait for the Fed to make the first rate cut.

- ECB Preview: While no change to interest rate is expected, but the ECB is likely to lay the ground at the press conference for a rate cut in June. This could send European equities running higher as two-year Schatz yield drops towards 2.8% and EURUSD could test 1.07.

Macro events: ECB Announcement, OPEC MOMR, China Inflation (Mar), US PPI (Mar)

Earnings: Fast Retailing, Fastenal, Constellation Brands, CarMax

In the news:

- Fed looks to slice balance sheet runoff pace by half (Reuters)

- Biden and Kishida Enlist Amazon, Nvidia to Fund AI Research (Bloomberg)

- Meta debuts new generation of AI chip (Reuters)

- Delta expects summer travel demand to produce record second-quarter revenue (Reuters)

- Goldman Says It’s Time to Take Tech Profits and Invest Elsewhere (Bloomberg)

- Germany May Be Europe’s Achilles’ Heel in First-Quarter Earnings (Bloomberg)

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration