Global Market Quick Take: Asia – April 12, 2024

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

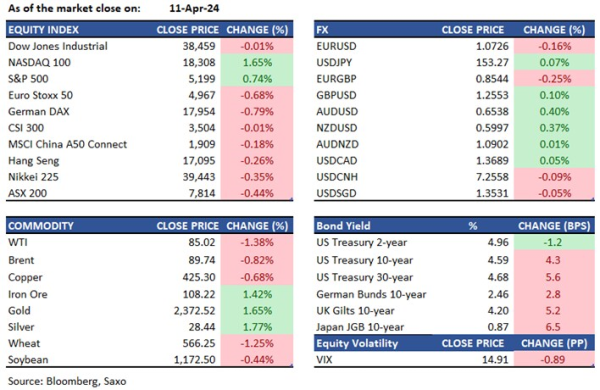

Equities: US stocks ended the day higher after a cooler PPI eased inflation concerns sparked by a hot CPI earlier in the week. Fedspeak was also modest, and Big Tech led the gains. Apple was up over 4% amid reports that its new M4 chip products would overhaul the entire Mac line of products. Amazon, meanwhile, closed a record high after CEO Andy Jassy talked up the opportunity for AWS as cloud computing is set for a major boost from generative AI. Earnings season begins with big banks reporting today, and this could be the next key catalyst for stocks. Tune in to the Saxo Market Call on equities to know what to expect as earnings season kicks off.

In Asia, Nikkei 225 opened higher with tech strength underpinning as yen remains weak. China’s CPI disappointed yesterday signaling sustained economic weakness, and CSI 300 ended almost unchanged while HK stocks were down 0.3%.

FX: The dollar remained pinned around its highs with US PPI data colling some of the recent inflation fears, while a relatively dovish ECB was broadly priced in. Still, EURUSD was the underperformer in G10 as it tested the 1.07 handle but bounced back higher. JPY also remained weak, with USDJPY back above 153 as intervention threat lingers. However, it is worth noting that the yen weakness post-US CPI has been less broad-based which may reduce the urgency of an actual intervention until 154 is breached. AUDUSD bounced higher after a test of 0.65 support. USDCNH moved lower to 7.2550 after PBoC reaffirmed its grip on the yuan band, but traders are likely to continue to test their limits.

Commodities: The resilience of Gold despite the pushback to rate cut expectations has been the highlight of this week. But softer PPI last night gave more reasons to continue its rally and fresh new highs of $2,380 were printed. Silver also back at $28.50 which has been a key resistance level. Crude oil inched lower potentially on profit-taking and was on track for a weekly loss despite heightened geopolitical concerns this week. Brent trades just above $90/barrel and a report from the IEA on market outlook is on tap.

Fixed income: Softer PPI and a dovish ECB helped the Treasury sell-off to cool. The 30yr auction, which was poor but not near as poor as the 10yr rally, saw little sustained reaction. Focus today will be on more Fedspeak after conflicting signals from CPI and PPI as well as the UoM sentiment survey.

Macro:

- US PPI was slightly cooler than expected. Headline rose 2.1% YoY (exp 2.2%) but accelerating from the 1.6% prior, with the M/M rising 0.2%, beneath the 0.3% forecast but down from 0.6% in February. Core PPI however was above forecast Y/Y at 2.4% (exp. 2.3%), while the M/M was in line at 0.2%. The data relieved the markets after a third consecutive print of hot CPI earlier this week that led to markets paring their expectations for Fed rate cuts this year.

- The ECB kept its policy rate unchanged but the statement changed modestly noting a key addition that if the Governing Council was to gain further confidence that inflation is converging to the target in a sustained manner, it would be appropriate to reduce the current level of monetary policy restriction. Markets see that as key to ECB’s rate cut in June.

- Fed member Willaims (voter) said there is no need to change monetary policy "in very near term", saying rate hikes are not part of his forecast but "eventually", the Fed will need to cut rates. Barkin (voter) said that it is smart for the Fed to take its time and see if inflation slows. Collins (2025 voter) said she still expects rate cuts this year but a strong job market reduces the urgency to cut rates.

Macro events: IEA OMR, Chinese Trade Balance (Mar), German Final CPI (Mar), UK GDP (Feb), University of Michigan Prelim. (Apr)

Earnings: Progressive, Aeon, JPMorgan Chase, Wells Fargo, State Street, Citigroup, BlackRock

In the news:

- US quarterly earnings to feature big growth in tech-related companies (Reuters)

- Rivian, Lucid at New Lows as Ford Price Cut Fans EV Concerns (Bloomberg)

- Apple Plans to Overhaul Entire Mac Line With AI-Focused M4 Chips (Bloomberg)

- Singapore’s MAS keeps monetary policy unchanged for fourth time in a row (CNA)

- Corona beer maker Constellation Brands forecasts annual profit above estimates (Reuters)

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration