Global Market Quick Take: Asia – April 17, 2024

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

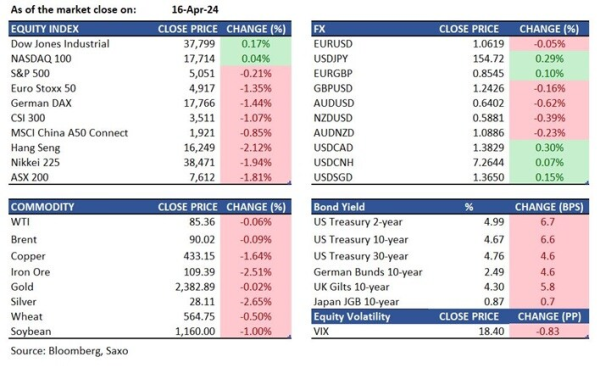

Equities: US equities finished Tuesday in a mixed tone amid rising bond yields, after a hawkish remark from Powell. The S&P 500 Index slid 0.2% to 5,051. The Nasdaq 100 closed nearly unchanged from the day before at 17,714, helped by gains in semiconductor names. Nvidia, AMD, ASML, KLA, Applied Materials, and Lam Research, which rose 1%-2%. Tesla extended declines, falling 2.7% to a closing price of $157.11.

Asian equity markets slid, with the Nikkei 225 losing 1.9% and the CSI300 shedding 1.1%. Despite larger-than-expected 5.3% Y/Y growth in Q1 GDP in China, activity data showed declines in momentum across the board in March. The tightening of regulation over the stock market continued to linger over A-share small and micro-cap, with the CSI 2000 index plummeting 7.2%, falling sharply for the second day in a row. The Hang Seng Index declined 2.1%. On the back of the news of Tesla’s global layoff, which added fuel to anxiety in an increasingly competitive environment, Chinese EV stocks traded in Hong Kong plunged. Amid reports of an EU probe, Chinese medical device makers dropped.

For an update of our views on the markets, please read this latest article from Peter Garnry, Head of SaxoStrats.

FX: The US dollar gained modestly, with the USDJPY rising to 154.72, while the AUDUSD slid to around 0.6400 as US Treasuries extended their rise in yields.

Commodities: Crude oil slid modestly, while gold remained nearly unchanged on Tuesday as traders awaited the next headlines on developments in the Middle East.

Fixed income: The 10-year Treasury yield added 7bps, reaching 4.67%, after Fed Chair Powell said the Fed would need more time to achieve confidence regarding inflation and potential rate cuts.

Macro:

- Fed Chair Jerome Powell said on Tuesday that “the recent data have clearly not giving us greater confidence and instead indicate that it is likely to take longer than expected to achieve that confidence”. His remarks echoed messages from other Fed officials about the shift of the Fed’s stance towards postponing the start of the easing cycle to later than what had been implied in the communication earlier in the year.

- US housing starts and building permits came in weaker than expected at 1,321k and 1,458k respectively. However, industrial production rose 0.4% month-on-month in March, and the prior month’s figure was revised up to 0.4% from the previously reported 0.1%.

- China’s Q1 GDP data surprised to the upside, growing at a hefty 5.3% Y/Y, surpassing the consensus estimate of 4.8% and Q4’s 5.2%. However, the deceleration across key activity data in March sent a signal of losing growth momentum in the Chinese economy in March from the first two months of the year. Industrial production slowed to 4.5% Y/Y, below the consensus forecast of 6% and the 7.0% in the first two months of the year. Retail sales growth also slowed to 4.7% Y/Y in March, from February’s 5.5% and the consensus forecast of 5.4%. The loss of growth momentum in March set a path to potentially slower GDP growth in Q2.

- In March, China’s real estate investment contracted 16.8% Y/Y, softer than the 13.4% Y/Y decline in the prior two months. Property sales value dropped by 28.5% Y/Y and volume decreased by 23.7% Y/Y. Overall, the property sector remains weak.

- China’s Q1 industrial capacity utilization rate declined to 73.6% from Q4’s 75.9%, with motor vehicle manufacturing, electric machinery and equipment, chemical fibres, and special equipment industries experiencing the most notable deterioration.

Macro events: US Fed Beige Book, UK CPI, RPI and PPI, New Zealand CPI

Earnings: ASML, Volvo, CSX, Kinder Morgan, Abbott Laboratories, US Bancorp, Jiangsu Hengrui Pharmaceutical, Chongqing Changan Automobile

In the news:

- Powell Dials Back Expectations on Rate Cuts (WSJ)

- Japan's exports grew for fourth straight month in March (Nikkei)

- IMF Lifts Growth Forecast for Global Economy, Warns of Risks (Bloomberg)

- China Moves to Calm Small-Cap Panic, Downplaying Delisting Risk (Bloomberg)

- Israeli war cabinet puts off third meeting on Iran's attack to Wednesday (Reuters)

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration