Global Market Quick Take: Asia – April 2, 2024

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

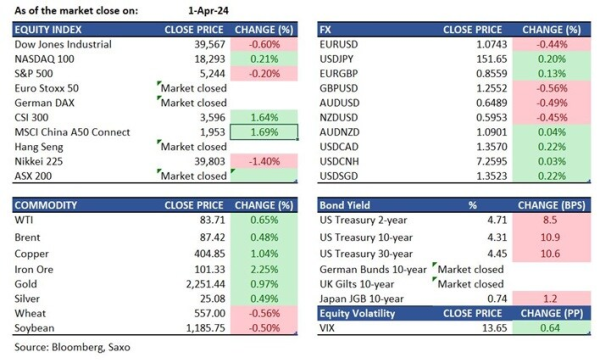

Equities: Trump Media & Technology had a sharp decline of 21.5% after the social media company disclosed that it had nearly depleted its cash reserves before going public. Upon returning from a long weekend, major US equity indices showed mixed performance, with the Nasdaq 100 gaining 0.2% while the S&P 500 dipped 0.2%. Despite opening mostly higher following a softer core PCE last Friday, equity indices soon retreated due to a much hotter-than-expected ISM Manufacturing survey. This reignited doubts about the extent to which the Fed can ease policy rates and led to higher bond yields.

The Nikkei 225 Index plummeted 1.4% to 39,803 on the first day of Japanese companies' new fiscal year amid a decline in the current business conditions of large manufacturing enterprises according to the BoJ's Tankan survey. In contrast, the CSI300 surged 1.7% as China's official NBS manufacturing PMI rebounded to 50.8, indicating expansion and the private Caixin China manufacturing PMI ticked up to 51.1. The Hong Kong equity market resumed trading today after a holiday.

FX: The dollar rose sharply at the start of the new quarter after closing Q1 as the strongest G10 currency yet again. The laggards in Q1 were JPY and CHF, although GBP resilience prevailed. Yesterday’s strong ISM data coupled with the latest Fed commentary turning less dovish brought Treasury yields to jump higher and USDJPY rose again towards 151.80 despite threat of intervention. USDCNH remains north of 7.25 despite firmer China PMIs and PBOC’s efforts to bring it back lower. The relative GBP underperformance theme is also catching up, with GBPUSD down one big figure to 1.2540 overnight, testing key support. Other activity currencies also fell with AUDUSD below 0.65 and NZDUSD at 0.5950. EURUSD could test 1.07 with German CPI on the radar today, especially if it follows the trend seen in French and Italian CPI from Friday which underperformed expectations.

Commodities: Oil prices are edging close to five-month highs as geopolitical tensions remain rampant and supply threat now a key focus as Iran starting to get involved in Mideast crisis after an Israeli airstrike on Iran’s embassy in Syria killed a top military commander. The OPEC meeting is scheduled for this Wednesday, and expectations are that the group will reaffirm its current supply policy. Supply issues also stemming from Mexico’s state-run oil company Pemex planning to halt some crude oil exports over the next few months. Gold’s strong run continued into the start of the new quarter, with prices now close to $2,250 despite Fed rate cut bets being pared.

Fixed income: The return to expansion territory in the ISM Manufacturing Index, coupled with a red-hot Prices Paid sub-index, led to a significant surge in Treasury yields across the yield curve. The 2-year yield surged by 9bps to 4.71%, while the 10-year yield jumped by 11bps to 4.31%.

Macro:

- US ISM manufacturing rose back to expansionary territory as it came in at 50.3 for March from 47.8 previously and 48.4 expected. Prices metric was hotter than forecast at 55.8 from 52.5 (exp. 52.7), showing an acceleration of prices in March from February ahead of the March CPI data due March 10th, with the upside stemming from commodity inflation. Employment PMI rose but remained in contraction and focus will be on the NFP report due this Friday. The probability of Fed rate cuts was pared, with June odds now priced at 63% vs. 67% at the end of last week. Fed officials, including key members Powell and Waller, have all dialed back the idea of three rate cuts this year.

- Caixin China manufacturing PMI ticked up to 51.1, better than the anticipated 51.0 and the prior month’s 50.9.

Macro events: EZ/UK Manufacturing PMI (Mar F), German CPI (Mar P), US JOLTS job openings (Feb)

Earnings: Paychex

In the news:

- Australian Manufacturing Activity Deteriorates At Fastest Pace Since Early 2020 (WSJ)

- Australia to Switch to New System for Monetary Policy Implementation (Bloomberg)

- Japan stock splits jump 60% as Fujitsu and Suzuki join bandwagon (Nikkei Asia)

- Nikkei dividend index hits a record high for third straight year (Nikkei Asia)

- Chinese carmakers Li Auto, Nio, Xpeng and BYD report March sales rise, but ‘difficulties are looming’ as competition intensifies in world’s largest EV market (SCMP)

- Zhang Kun, China’s biggest money manager, issues stock valuation warning, says days of fast economic growth are gone (SCMP)

- Investors Are Unwinding the ‘Buy India, Sell China’ Stocks Trade (Bloomberg)

- Disney Winning Proxy Fight Against Trian With More Than Half of Votes Cast (WSJ)

- Calvin Klein Owner PVH Tumbles 20% on Warning of Europe Weakness (Bloomberg)

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration