Global Market Quick Take: Asia – April 22, 2024

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

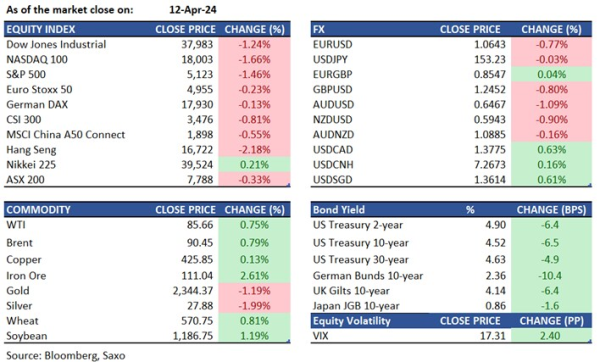

Equities: US equity futures pointed higher after a brutal week for stocks saw NASDAQ 100 down over 5% and S&P 500 down 3%. Expectations of Fed’s rate cuts have continued to be pushed forward in recent weeks, which has brought the focus on the steady equity rally which is making US stocks look expensive. Geopolitical escalations, as well as a disappointing start to the earnings season have also underpinned. Netflix was down 9% on Friday after its outlook came in short of expectations.

Semiconductor and tech stocks will be a big focus this week, after Nvidia slipping 10% on Friday as chip sentiment was soured earlier by ASML and TSMC earnings, and aided by Super Micro (SMCI) on Friday which did not pre-announce its earnings as per the usual format sending its stock down 23%. More than half of the Magnificent Seven stocks report earnings this week, and the AI sentiment will get a health check. EV-maker Tesla reports earnings on Tuesday after it slashed prices of its car and self-driving software across the world over the weekend and CEO Musk also abandoned plans to visit India and announce investments. Facebook-parent Meta reports on Wednesday, followed by Microsoft and Google-parent Alphabet on Thursday.

FX: The dollar was only marginally higher in the week despite further pushback to Fed’s easing expectations, an escalation in geopolitical tensions and also a pullback in equities momentum. Safe havens such as Silver, Gold and Swiss Franc led the gains against the dollar for the week, while NOK, NZD and JPY underperformed. Sterling fell sharply on Friday, with GBPUSD breaking below the 1.24 handle for the first time since November. Some of this came on the back of dovish Ramsden commentary, but this is also a reminder that sterling has become one of the more high-beta currencies lately along with AUD. AUDUSD was relatively steady around 0.6420 after an earlier drop to 0.6360 on Mideast worries, while USDNOK may test a break below 11. USDJPY trades one big figure higher from the lows seen post-escalation of geopolitical worries on Friday at 154.60, and BOJ meeting this week will be the next key catalyst. Also, read our article on how FX can be used for portfolio diversification in this high inflation era when both equity and bond returns may come under pressure.

Commodities: Crude oil prices ended lower last week with Brent below $88/barrel as geopolitical tensions eased with Iran downplaying Israel’s attacks and showing no urgency to retaliate. Base metals led the commodity sector higher last week, amid fears of tightening supplies with US and UK sanctions on Russian-sourced copper, aluminum and nickel. Copper rose 5.5% and structural case for higher prices remains on the back of AI and green transformation demand while ore downgrades are likely to continue to limit supply. Gold made another attempt at $2,400 last week on surging Mideast tensions, signaling a short-term top followed by an overdue period of consolidation. To know more about our views on different commodities, read this Commodity Weekly update.

Fixed income: Treasuries were bid earlier on Friday as geopolitical tensions escalated with Israel’s attack on Iran. However, risk premium was eroded quickly as Iran downplayed the strikes and showed a lack of urgency to retaliate. Hawkish comments from Fed’s Goolsbee came back to hurt bonds, and yields ended the day nearly unchanged. Record auction week comes as the next big test this week.

Macro:

- Chicago Fed President Goolsbee (2025 voter) was on the wires on Friday, and echoed the same hawkish narrative that has now become the Fed baseline. He said the Fed has done great on the unemployment mandate, but not succeeded on the inflation mandate. But he did also mention about the policy trade-offs and the likely impact on jobs if rates were restrictive for too long. With regards to a rate hike, he also said that “don't think anything is not on the table”. The Fed will be in the quiet period now ahead of its May 1 policy decision, and PCE data will be in focus for Friday.

- UK retail sales cam in weaker-than-expected, fueling concerns of consumer slowdown in Britain. Ex-auto retail sales were down 0.3% MoM in March from +0.3% previously.

Macro events: PBoC LPR, US National Activity Index (Mar)

Earnings: Verizon, SAP

In the news:

- Tesla cuts prices in China, Germany and around globe after US cuts (Reuters)

- China slaps anti-dumping levy on import of a US chemical amid rising trade tensions (Reuters)

- AmEx surpasses profit estimate; small-business strategy in focus (Reuters)

- Apple pulls WhatsApp, Threads from China app store after Beijing order (Reuters)

- The Bitcoin Halving Is Here, and With It a Giant Surge in Transaction Fees (CoinDesk)

- Salesforce's talks to buy Informatica fizzle, WSJ reports (Reuters)

- China Is Front and Center of Gold’s Record-Breaking Rally (Bloomberg)

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.