Global Market Quick Take: Asia – April 26, 2024

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

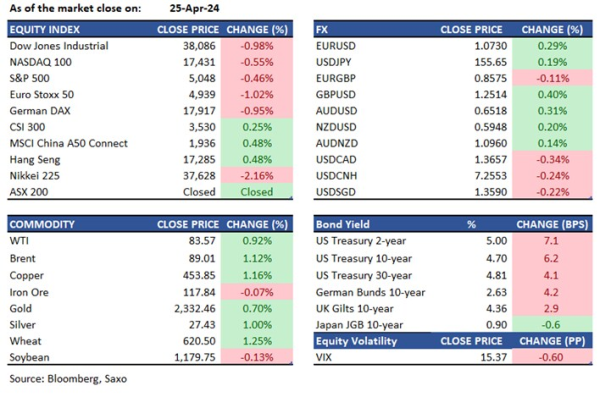

Equities: Wall Street rebounded from its lows after Meta’s 15% pre-market decline led to a gap lower at the open, but still closed in the red. US GDP data brought stagflation concerns back to the table with growth weaker but prices higher, and focus turns to March PCE data out today. Markets have pushed out expectations of Fed rate cuts for 2024 with first full rate cut now only priced in for December. Meta eventually ended the day over 10% lower, and IBM was down 8% on weak first-quarter earnings. Caterpillar fell 7% after the heavy machinery manufacturer reported a mixed first quarter of 2024, with earnings surpassing analysts' expectations but revenue falling short.

Tech sentiment, however, rebounded after the close with a strong set of earnings from both Microsoft and Alphabet, and US equity futures are pointing higher. This could help Japan’s Nikkei 225 to rebound after over 2% decline yesterday, but Bank of Japan announcement in the day ahead will be key. HK stocks have outperformed global equities this week, and HSI has cleared a key level at 17,200 – the high from January – and closed right at the 200DMA.

FX: Choppy price action seen in the US dollar which rose to test the 106 handle as Q1 US GDP report garnered a hawkish reaction on the back of hot PCE print, but risk sentiment improved later in the session as equities recovered from the lows, pushing dollar lower. USDJPY saw some volatility as Jiji Press report suggested BOJ bond purchases may be pruned at the announcement today, but reaction was limited, and pair remains near record highs. We discussed the JPY weakness, intervention risks, and BOJ meeting in detail in this article. Cable was back above 1.25 and AUDUSD is choppy around 0.65. AUDJPY has cleared the psychological barrier at 101, while CNHJPY has also reached record highs of 21.45 prompting yuan devaluation concerns.

Commodities: Crude oil prices rose slightly, recovering from an earlier drop as US GDP data prompted stagflation concerns. Focus likely to stay on macro ahead of PCE release today, and further acceleration in prices could send jitters on demand prospects. Copper stayed hot, rising back to fresh highs, while price action in gold and silver was choppy as Fed’s rate cuts continue to be pushed out from 2024 market pricing.

Fixed income: While the weaker headline GDP growth for Q1 from the US prompted a spike higher in Treasuries, price action shifted as the report was digested and greater concern seen coming through from the sticky Q1 PCE print paving the way for risks of an upside surprise from the March PCE data due today. There was little reaction to the 7-year auction, and Treasury yields ended 6-7bps higher as Fed rate cut expectations for 2024 were shifted further out.

Macro:

- US Q1 GDP data sparked fears of stagflation as growth slowed and came in weaker-than-expected, but the price index measures accelerated. Headline GDP growth eased to 1.6% from 3.4%, beneath the 2.4% forecast, while the Core PCE Prices for Q1 surged to 3.7% from 2.0%, above the 3.4% forecast, and above the top-end of analyst expectations.

- PCE preview: Th hot Q1 PCE print is especially key ahead of the March PCE due later today, where consensus expects the core print to ease to 2.7% YoY from 2.8% in February and come in unchanged MoM at 0.3%. Market pricing for the Fed has shifted hawkish to expect the first full rate cut only in December.

- If March core PCE came in above 0.4%, that will fuel risk aversion bringing equities lower, bonds higher, USD strength, Gold down and a risk of intervention from the Bank of Japan if they fail to stem the yen weakness at their meeting today.

- If March core PCE, however, comes in at 0.3% or lower, that will be a relief for the markets but not enough of a reason to bring forward rate cut expectations. This could spell a relief rally with equities higher, bonds lower, dollar weaker and a recovery in yen and gold.

- BOJ preview: The BoJ will conclude its 2-day policy meeting on Friday where the central bank is likely to maintain its policy settings after a rate hike in March. Big focus on comments around FX with yen at record lows. Intervention threats have been modest at best, given the strong USD could make any intervention futile. At this stage, a rate hike can do less damage than the risk of further devaluation of the yen, so a surprise action from the BOJ cannot be ruled out. At the very least, markets will be looking for a stronger language on FX suggesting that rate hikes could come forward if yen weakness persisted. Jiji press has reported overnight that BOJ is likely consider measures to reduce its government bond purchases, suggesting bond yields will be allowed to rise to 1% or higher. This is a two-way threat as higher JGB yields also push global yields higher, making it tough for the yen to rally.

- Japan’s Tokyo CPI for April showed a sharp deceleration as headline prices eased to 1.8% YoY from 2.6% in March vs. 2.5% expected. Core CPI came in at 1.6% YoY and core-core was at 1.8% YoY from 2.4% and 2.9% in March respectively. While this may make a hawkish rhetoric from the BOJ difficult today, numbers carry a one-off impact from the start of education subsidy which is unlikely to be reflected in the nationwide CPI print due on May 24.

Macro events: BoJ Announcement and Outlook Report, CBR Announcement, Japanese Tokyo CPI (Apr), US PCE (Mar)

Earnings: Chevron, Exxon Mobil, AbbVie, TotalEnergies

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.