Global Market Quick Take: Asia – April 29, 2024

Key points:

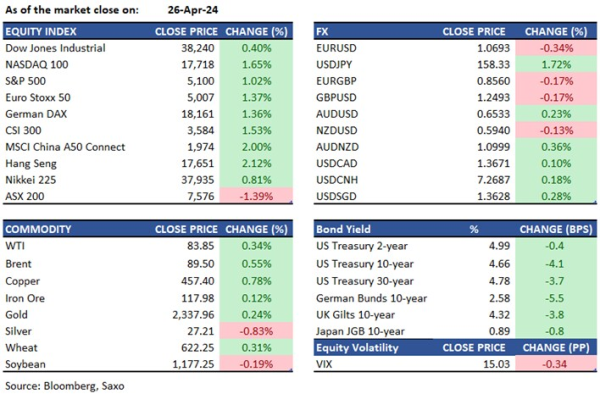

- Equities: US tech sentiment upbeat, FTSE 100 at record highs, HK stocks lead

- FX: Yen weakness extends on dovish BOJ and lack of intervention signals

- Commodities: Copper correction looming

- Fixed income: Quarterly financing estimates due today

- Economic data: Spain/Germany CPI

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Equities: Megacaps drove the S&P 500 to its best week since November on the back of stronger earnings from tech giants Alphabet and Microsoft spurring a rally across tech stocks. Alphabet surged over 10% on Friday, pushing the company's market value above $2 trillion for the first time. Earnings season continues this week with Amazon, Coca-Cola, AMD, Eli Lilly reporting on Tuesday.

In Europe, UK’s FTSE 100 also reached a fresh record high on Friday, up over 3% last week, even as the index remains cheaper than US indices. Gains were, however, led by Hong Kong’s Hang Seng index that was up 8.8% on valuation discount and China’s pledge to support HK as a financial hub. HSI tech index was up over 13% and China’s biggest EV-maker BYD reports earnings today.

FX: Despite strong gains on Friday, the US dollar DXY index ended the week marginally lower despite the expectations of the first full Fed rate cut shifting to December from a November cut seen at the start of last week. The decline in JPY accelerated post-BOJ announcement on Friday and USDJPY rose to 158+ levels just as we expected, given the usual dovish narrative from the BOJ and lack of an intervention. Yen crosses also reached record levels, with AUDJPY at a decade-highs, NZDJPY highest in 17 years, and CNHJPY knocking at the 22 handle where once 21 was considered to be the line-in-the-sand. GBPUSD making another stride above 1.25 while EURUSD still struggling at 1.07.

Commodities: Gold recorded its first weekly decline in six weeks, as expectations of Fed rate cuts faded. Silver was down over 5% for the week, despite dollar still marginally weaker. Crude oil rose last week amid lingering risks to supply. Tensions in the Middle East remain elevated despite tit-for-tat attacks between Israel and Iran not leading to any escalation in the Israel-Hamas war. Supply risks are also emerging as Russia and Ukraine target each other’s energy infrastructure. Base metals remained strong last week, with Copper up over 1% even as BHP’s bid for Anglo American failed and risk of a correction is seen. Grains sector was also in focus with Wheat prices up close to 10% for the week on weather concerns.

Fixed income: While Friday’s core PCE data cooled the hawkish risks around Fed policy, the impact was small compared to a slew of strong data seen over the last few weeks. 2-year yield was back to test 5% while 10-year was above 4.65%. Today’s focus is on quarterly financing estimates ahead of Wednesday's Quarterly Refunding Announcement and the FOMC with Powell expected to tow a more hawkish line given the data, followed by NFP on Friday.

Macro:

- US core PCE for March rose 0.32% MoM, in line with the expected +0.3%, and relieving concerns of a potential 0.4% or even 0.5% print after Thursday's Q1 Core PCE prices came in significantly on the upside. Core YoY gains were unchanged at 2.8% vs. expected 2.7%, but there was a revision higher in January and February prints. Focus now turns to the Fed announcement due Wednesday (Thursday morning for Asia) where the central bank will likely keep its options open after the disinflation trend has become bumpy.

- The Bank of Japan kept policy settings unchanged, with the short-term interest rate unchanged at between 0.0-0.1% as expected and CPI outlook raised to 2.8% for 2024 fiscal year from 2.4% previously. There was no clear mention of FX concerns, and while there was a change in the language around bond purchases - the amount 6 trillion yen per month was not mentioned – details were patchy and the message was not clearly hawkish.

Macro events: Spanish Flash CPI (Apr), German Prelim CPI (Apr), EZ Sentiment Survey (Apr); Japan Market Holiday (Showa Day)

Earnings: ON Semiconductor, MicroStrategy, Paramount Global, NXP Semiconductors, Yum China, Domino’s Pizza, Logitech, China Construction Bank, BYD

News:

- Elon Musk visits China as Tesla seeks self-driving technology rollout (Reuters)

- Singtel sees $2.3 billion impairment hit, net loss in 2024 second-half (Reuters)

- Insurer AIA's Q1 new business value rises 31%, announces $2 billion buyback (Reuters)

- Earnings for Big Oil backpedal as natgas prices tumble (Reuters)

- Elliott Said to Have Built ‘Large’ Stake in Buffett-Favored Sumitomo (Bloomberg)

- Copper at $10,000 and BHP's Mega Bid Expose Mining’s Biggest Problem (Bloomberg)

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.