Global Market Quick Take: Asia – August 12, 2024

Key points:

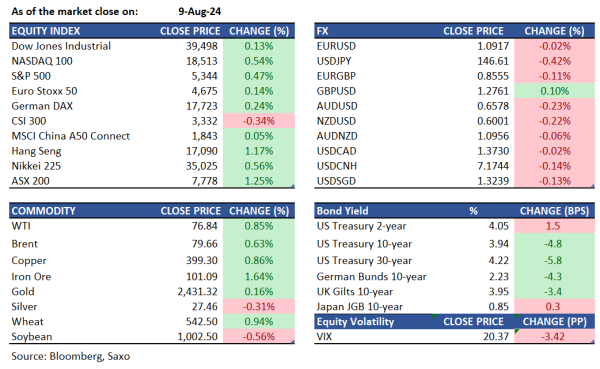

- Equities: Eli Lily rose 5.5% following full year earnings upgrade.

- FX: US dollar started the week higher with geopolitical risk on the radar

- Commodities: Oil and natural gas prices rose due to supply and tensions

- Fixed income: Yield curve flattens with easing bias subside

- Economic data: US NY Fed 1-Year Inflation Expectations

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

- US stock futures steady as inflation data looms (Investing)

- What Eli Lilly, Novo Nordisk earnings reveal about the future of GLP-1 sales (Yahoo)

- Short bets in five-year Treasury futures largest on record, CFTC says (Reuters)

- Tesla stops taking orders for cheapest Cybertruck, offers $100,000 version now (Investing)

Macro:

- Global markets breathed a sigh of relief after US weekly jobless claims declined by the most in nearly a year, alleviating some concerns that labor market is cooling too fast following last week’s disappointing jobs report. The weekly figure fell by 17,000 to 233,000 versus 240,000 expected, signalling an economy that at this point at worst is slowing, not contracting. With every data point, markets try to answer the question on whether the US economy is facing a recession or it can achieve a soft landing, and jobless claims last week tilted expectations in favour of soft landing once again. US CPI comes out next on Wednesday.

- Fed speakers still hinted at a possible start of easing, but remain cautious. Collins and Schmid, both 2025 voters, said that it will be appropriate soon to begin adjusting policy and easing how restrictive the policy is, but cautioned against emphasizing the importance of one or two data releases. Bowman, however, cautioned against upside risks to inflation in a weekend speech.

- Canada’s unemployment data came in mixed. The unemployment rate was unchanged from last month. The employment change was negative by 2.8K vs expectations of a gain of 22.5K, but making it not so bad, is there was a gain of 61.6K in full-time jobs. The part-time jobs fell -64.4K.

- China’s consumer prices rose more than expected in July, largely due to seasonal factors like weather, leaving intact concern over sluggish domestic demand and boosting the case for more policy support. The CPI climbed 0.5% from a year earlier, exceeding the 0.3% estimate. Excluding volatile food and energy costs, core CPI rose 0.4%, the least since January, indicating lingering weakness in overall demand.

Macro events: OPEC Monthly Oil Market Report, US NY Fed 1-Year Inflation Expectations

Earnings: Barrick, Terawulf, Monday.com, Esperion, Freightcar

Equities: Wall Street ended a turbulent week on a quieter note, with the session featuring little activity and no significant economic reports or earnings announcements. The S&P 500 rose by 0.4%, the Nasdaq by 0.5%, and the Dow Jones gained 51 points. All sectors finished in positive territory except for materials. Notable gains included Expedia, which surged 10.2% after reporting second-quarter results that beat expectations. Eli Lilly also rose by 5.5% following price target increases from several Wall Street firms, including Morgan Stanley. Take-Two Interactive Software climbed 4.3% after exceeding analysts' expectations. On the other hand, elf Beauty shares plummeted 14.4% due to disappointing quarterly results and concerns about slowing growth. Wrapping up a week of significant volatility, the S&P 500 recorded its fourth consecutive week of losses, down 0.04%, while the Nasdaq fell 0.2%, and the Dow Jones declined 0.6%. Investors are now focused on US producer inflation data due on Tuesday and consumer inflation figures on Wednesday for signs that price growth is stabilizing. US retail sales numbers will follow on Thursday.

Fixed income: Treasury futures fell as no US cash bonds were traded during Asian hours due to a holiday in Japan. Kiwi bonds also edged lower ahead of the Reserve Bank of New Zealand’s rate decision later this week. On Friday, the Treasury yield curve flattened significantly as the expected Federal Reserve easing priced into swap contracts for this year decreased. Long-term yields improved by nearly 5 basis points, while short-term 2-year yields rose by about 2 basis points. The 10-year yields ended around 3.95%, down roughly 4 basis points but still near the upper end of the weekly range of 3.665%-4.02%. Among curve spreads, the 2s10s spread flattened by 6 basis points, and the 5s30s spread by 2 basis points. Fed-dated Overnight Index Swap (OIS) contracts priced in about 100 basis points of rate cuts for the year, down from approximately 120 basis points at Monday’s close. For the September meeting, around 36 basis points of cuts were priced in, compared to nearly 50 basis points on Monday.

Commodities: WTI crude oil futures rose 0.85% to $76.84 per barrel, and Brent crude futures increased 0.63% to $79.66 per barrel, marking their first weekly gain in five weeks due to tightening supplies and Middle East tensions. Oil prices rebounded from a seven-month low thanks to improved risk appetite, positive U.S. jobs data, and a sixth consecutive weekly decline in U.S. crude inventories. Natural gas prices surged nearly 9% for the week to $2.143 per million BTUs. Gold climbed 0.16% to $2,431.32 an ounce, remain supported by geopolitical risks and anticipated Federal Reserve rate cuts amid heightened tensions involving Iran, Israel, and Ukraine.

FX: The US dollar had a choppy amid a volatile last week, slumping earlier but recovering later to end the week nearly unchanged as US recession concerns eased. Focus ahead will remain on US economic data, such as inflation and retail sales to continue to assess the recession probability. Eventually, activity currencies such as Australian dollar, Kiwi dollar and Norwegian krone rose for the week after being thrashed lower at the start of the week. The Canadian dollar also rose as oil prices jumped higher and Canadian jobs data was less bad than feared. Japanese yen also ended the day barely changed as it lost its early gains amid Thursday’s jobless claims lowering the chance of a US recession and risking a rapid unwinding of carry trades. Monday’s early Asian hours saw US dollar rising higher and geopolitical risk is on the radar.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration