Global Market Quick Take: Asia – August 13, 2024

Key points:

- Equities: Jetblue Airways falls 20.7% after taking more debt

- FX: NZD leads gains ahead of RBNZ rate decision on Wednesday

- Commodities: Oil and gold surge on rising tension in Middle East

- Fixed income: Treasuries demand returns dragging yield lower

- Economic data: US PPI

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

- Yen dips, markets stabilize ahead of US inflation data (Investing)

- Oil prices jump on prospect of widening Middle East war shrinking supply (Investing)

- Singapore Q2 GDP up 2.9% y/y, matching advance estimate (Yahoo)

- Japan July wholesale prices rise 3.0 pct yr/yr (Yahoo)

Macro: The NY Fed July consumer inflation expectations for the 1yr and 5yr ahead remained unchanged at 3.0% and 2.8%, respectively, but the 3yr dropped dramatically to 2.3% from 2.9%, which is the lowest since the start of the survey in June 2013.

Macro events: IEA Oil Market Report, Australia Wage Price Index (Q2), UK Jobs (Jun/Jul), German ZEW Survey (Aug), US PPI (Jul)

Earnings: Sea Limited, Tencent Music Entertainment, Home Depot, Nu Holdings, Paysafe

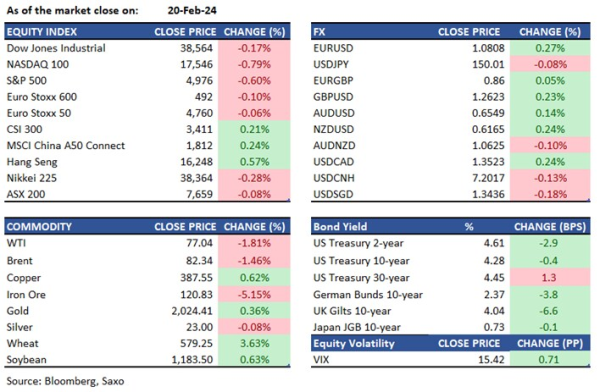

Equities: On Monday, US stocks struggled to sustain the previous week's momentum amid economic uncertainty. The S&P 500 remained nearly flat, the Nasdaq gained 0.2%, and the Dow Jones dropped by 140 points. Investors are closely watching key economic indicators this week, including the Consumer Price Index, Producer Price Index, retail sales, and industrial production, to gauge the US economy's robustness and ongoing inflation issues. Real estate and communication services saw the biggest losses, while technology, energy, and utilities sectors finished in positive territory. Nvidia shares increased by 4% as the company tackled concerns about its next-generation processors, whereas Qualcomm fell 1% following a downgrade to Peer Perform from Outperform. JetBlue Airways tumbled 20.7% after revealing plans to borrow $2.75 billion, securing it with its loyalty program.

Fixed income: Treasuries maintained a strong bid tone throughout the US session, despite a busy schedule of corporate issuances and rising oil prices amid escalating geopolitical tensions following reports that Israel is preparing for a large-scale attack from Iran. Despite over $18 billion in new corporate deals, Treasury yields continued to decline. Yields were richer by 2 to 4 basis points across the curve, with gains led by the front and belly, steepening the 2s10s and 5s30s spreads by 0.5 and 2.5 basis points, respectively. The US 10-year yield ended the session near its daily lows, trading around 3.91%, 3 basis points richer compared to Friday's close. At Monday’s Treasury bill auctions, buyers preferred the three-month benchmark over the six-month, influenced by the recent increase in Federal Reserve interest-rate cut bets. The Treasury sold $76 billion of three-month bills at 5.07% and $70 billion of six-month bills at 4.795%.

Commodities: WTI crude oil rose 4.2% to $80.06 and Brent crude oil rose by 3.3% to close at $82.3 on Monday due to Middle East conflicts and increased US military presence. Positive US economic data and potential rate cuts also supported prices. OPEC lowered its 2024 oil demand growth forecast and extended output cuts until September. Gold rose 1.71% to $2,472.90 as US Treasury yields decline before crucial CPI data, with the 10-year yield at 3.902%. Unresolved Middle East tensions fuel demand for Gold as a safe-haven asset. Copper futures surpassed $4 per pound, recovering from a recent drop to a five-month low of $3.95 on August 7th, as markets evaluated potential supply disruptions and assessed demand levels.

FX: The US dollar was range-bound as it awaited the US inflation and retail sales reports this week for further insights into the state of the US economy and how fast the Fed may need to cut rates. The New Zealand dollar outperformed most of the other major currencies ahead of the Reserve Bank of New Zealand’s rate decision due on Wednesday and the shadow board recommending a rate cut. The Australian dollar also gained, as did the British pound and the latter may be subject to come volatility today as UK’s labor data is reported. The Japanese yen and the Swiss franc weakened, but the Swiss franc clawed back its gains amid safe-haven demand to hedge geopolitical risks. The Japanese yen only recovered slightly and awaiting key US data in the week ahead. For more on our macro and FX views, go to this weekly article.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.