Global Market Quick Take: Asia – August 19, 2024

Key points:

- Equities: Markets recover as we look to Jackson Hole this week

- FX: Safe-haven currencies on backfoot as recession odds wane

- Commodities: Gold increased 2.08% due to market volatility and geopolitical tensions

- Fixed income: Foreigners log their biggest purchase of Japanese debt in 17 months

- Economic data: Democratic Convention, Fed’s Waller

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

- Australia's Westpac posts steady Q3 profit, helped by higher capital earnings (Investing)

- Morning Bid: US soft landing hopes lift EM assets (Investing)

- Fed’s Powell Will Set the Stage for the First Rate Cut in Years at Jackson Hole (Barron’s)

- Wall St Week Ahead: S&P 500 rebounds as 'soft landing' hopes boost US stocks (Reuters)

- Oil falls 2% to end volatile week, focus on China demand concerns (Investing)

Macro:

- Headline University of Michigan Consumer Sentiment beat in the prelim August reading, rising to 67.8 from 66.4, above the 66.9 forecast. The upside was led by an improvement in forward looking expectations, which rose to 72.1 from 68.8 but the current conditions index fell to 60.9 from 62.7.

- Chicago Fed President Goolsbee (2025 voter, dove) reiterated his cautious tone. He noted that some leading indicators of a recession are flashing warnings and when the labour market starts to turn it tends to worsen quickly. However, he concluded that GDP is still strong and there are pockets of strength in the economy.

- UK’s retail sales rebounded in July to 0.5% MoM from -0.9% in June as wage growth and looser fiscal policy helped households to deal with cost-of-living pressures. Data continued to point towards a healthy Q3 growth remaining likely for the UK economy but September meeting may still be live if services inflation continues to slow and Fed starts to cut rates in September.

Macro events: US Democratic National Convention (Aug 19-22), New Zealand Trade Balance (Jul). Speakers: Fed’s Waller

Earnings: Estee Lauder, Palo Alto, Agora, American Resources

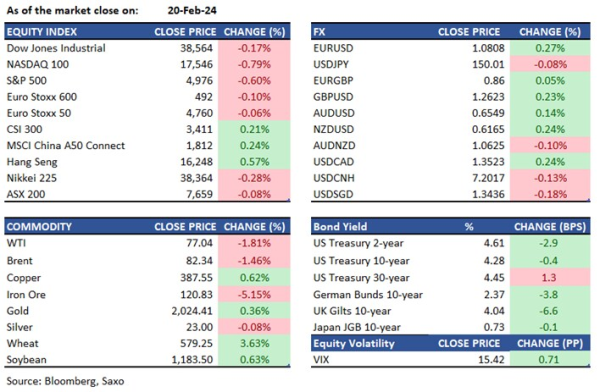

Equities: US stocks closed higher on Friday, with the S&P 500 and Nasdaq each rising 0.2%, and the Dow Jones adding 96 points, building on Thursday's strong rally. A week full of economic data fueled this recovery from August’s early losses where softer inflation, strong retail sales, and fewer unemployment claims alleviated recession fears. Investor sentiment also improved with Federal Reserve officials hinting at a potential rate cut in September. Communication services and the financial sector led the session's gains, while real estate lagged. Investors are now focused on Fed Chair Jerome Powell’s upcoming speech in Jackson Hole and the latest FOMC minutes for monetary policy guidance. Palo Alto Networks and Estee Lauder report earnings on Monday.

Fixed income: New Zealand debt declined in early trading after the government announced a new bond issue. Treasury note futures also fell as investors monitored oil prices to evaluate global inflation, with the yield on this tenor dropping 3bps to 3.88% on Friday. New Zealand’s 10-year note yield rose 2bps to 4.15%. Japanese 10-year note futures ended Friday’s session down 1 tick at 144.82, while the benchmark yield increased by 4bps to 0.87%. During the week ending August 9, foreign investors bought a net ¥1.14 trillion in Japan’s 10-year note futures and ¥1.44 trillion in Japanese debt, including government and other types. These combined purchases were the highest since March 2023, according to data from the Japan Exchange Group and the Ministry of Finance. Commodity Futures Trading Commission data show hedge funds were notably bearish on 10-year note futures, increasing their net short position by $12.5 million/DV01 before August 13. Leveraged accounts also extended net shorts in 2- and 5-year note futures. In contrast, asset managers were mostly bullish, significantly increasing net long positions in 10-year and ultra 10-year note futures.

Commodities: Gold surged to new intraday highs, closing up 2.08% at $2,508.01, as investors sought a safe haven amid early August volatility in US equities and ongoing geopolitical tensions. Meanwhile, WTI crude futures declined by 1.93% to $76.65, trading within a narrow range throughout the day. Brent crude also fell 1.68% to $79.68, was influenced by reports of Qatar urging Iran to reduce tensions with Israel during Gaza cease-fire talks, as well as concerns over weakening demand from China, the world's largest oil importer.

FX: The US dollar ended the week lower despite recession odds weakening as US economic growth continued to look resilient last week. But markets remain positioned for more than 25bps of rate cut at the Fed’s September meeting which sent precious metals soaring. UK’s sterling and Australian dollar also gained as bets on their easing cycles continue to look less aggressive than the Fed’s. New Zealand’s central bank kicked off its easing cycle last week, but the kiwi dollar still ended the week higher as rate cuts remain well priced in. The Japanese yen, however, continued to reverse it gains with the Bank of Japan diluting its hawkish posturing and US recession odds decreasing. We see the FX markets facing a tug-of-war between inflation and recession concerns, and a scenario analysis can be found here.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.