Global Market Quick Take: Asia – August 2, 2024

Key points:

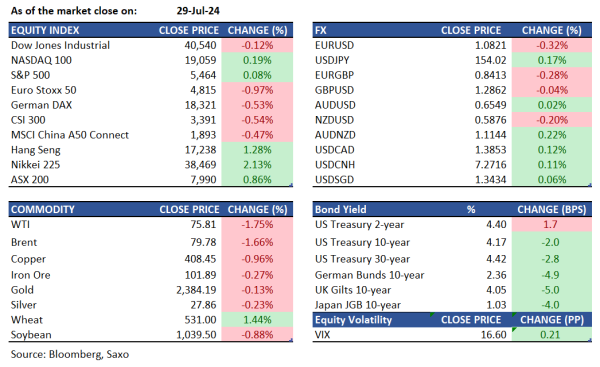

- Equities: Intel fell 19% post market after announcing dividend suspension

- FX: Havens outperformed activity currencies

- Commodities: Copper falls on China demand concerns; Brent crude drop below $80

- Fixed income: 10-year Treasury yield sinks sub 4%

- Economic data: US non-farm payrolls

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

- Stocks Sell Off a Day After Furious Rally as Volatility Returns (Bloomberg)

- Apple Q3 results tops estimates as services growth offsets softer iPhone sales (Yahoo)

- Coinbase posts third consecutive quarterly profit despite crypto price retreat (Yahoo)

- OCBC's Q2 profit tops expectations, says on track to meet 2024 targets (CNA)

- Intel suspends dividend as Q2 results miss estimates on margin woes; shares slump (Investing)

- Amazon stock slips 5% in afterhours trading as outlook trails estimates (Investing)

Macro:

- US ISM manufacturing PMI for July was very soft as the headline unexpectedly fell to its lowest since November of 46.8 (exp. 48.8) from 48.5. Prices paid rose more than forecasted to 52.9 (exp. 51.8, prev. 52.1), while employment and new orders fell to 43.4 (exp. 49.0, prev. 49.3) and 47.4 (prev. 49.3)

- US initial jobless claims (w/e 27th Jul) rose to 249k from 235k, well above the expected 236k, which saw the 4-wk average lift to 238k (prev. 235.5k). Continued claims (w/e 20th Jul) jumped to 1.877mln (exp. 1.856mln) from the prior, revised lower, 1.844mln. Seasonal factors maybe at play but slow cooling of the labor market continues.

- Bank of England: The BOE cut rates for the first time since March 2020, taking the Bank Rate to 5.0% from 5.25%. The decision to loosen policy was made via a 5-4 vote with dissent from Pill, Greene, Mann and Haskel. Governor Bailey stated that policymakers need to be careful not to cut rates too quickly, or by too much. Market has, however, priced in further easing of 40bps from the BOE for this year.

Macro events: US Jobs Report (Jul)

Earnings: Exxon Mobil, Chevron, Magna, Enbridge, Asbury

Equities: US stock futures continued to decline on Friday after major tech companies reported disappointing quarterly results, negatively impacting market sentiment. In extended trading, Amazon dropped around 7% due to missed revenue expectations for the second quarter and weak forecasts. Intel saw a nearly 20% plunge after announcing workforce cuts of over 15% and the suspension of its dividend starting in the fourth quarter to aid in the company's turnaround. Snap reported earnings that met estimates but issued weak Q3 guidance that led to the shares falling more than 20% after hours. On Thursday, the Dow decreased by 1.21%, the S&P 500 fell by 1.37%, and the Nasdaq 100 dropped by 2.44% as recent US manufacturing and labor market data raised concerns about the economy's health. The ISM Manufacturing PMI revealed a larger-than-expected contraction in the manufacturing sector, marking the deepest decline in eight months, while employment levels fell to 2020 lows. Initial jobless claims rose to 249K, the highest in a year, and labor costs increased at half the market's predicted rate for Q2, despite productivity improvements.

Fixed income: Treasuries rally extended, fueled by ISM manufacturing data and weekly jobless claims, as traders priced in at least three rate cuts for this year. The 10-year yields fell below 4%, their lowest since February, while 2-year yields dropped 10 basis points in the late US session. Thursday's gains followed a strong rally on Wednesday after the Fed's policy announcement and aggressive month-end buying. SOFR options were active, skewed towards dovish protection, with some bullish positions being unwound. Primary dealers' Treasury holdings hit an all-time high, indicating that balance sheets are filling up just as the government plans to increase issuance. Balances at the Federal Reserve’s overnight reverse repurchase agreement facility plunged to a six-week low as month-end cash exited.

Commodities: Gold prices eased to around $2,446 per ounce on Thursday, after a 1.6% rise in the previous session, remaining close to record highs amid expectations of lenient US monetary policy and safe-haven demand. WTI crude oil futures fell by 2.05% to $76.31 per barrel, while Brent crude decreased by 1.63% to $79.52 per barrel. Investors are weighing OPEC+'s decision to maintain its current output policy against concerns of potential escalation in the Middle East following the killing of a Hamas leader in Iran. Copper futures fell 2.25% to $4.08 per pound, nearing the four-month low of $4.05, amid demand concerns from China. The Chinese government is prioritizing advanced technologies and new energies over stimulus for the manufacturing sector.

FX: The US dollar rose modestly against the cyclical currencies, while safe havens Japanese yen and Swiss franc outperformed in Thursday’s session. Softer US data continues to fuel market expectations of Fed rate cuts exceeding the June dot plot expectations as market is getting nervous about achieving the soft landing. Sterling underperformed despite the Bank of England’s hawkish rate cut, and we see this as a temporary decline. The Australian dollar and Canadian dollar were also lower as the focus turns to US jobs data out later today. Japanese yen could remain prone to more gains after gains of over 3% so far this week against the US dollar, in case of softness in the US jobs data.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.