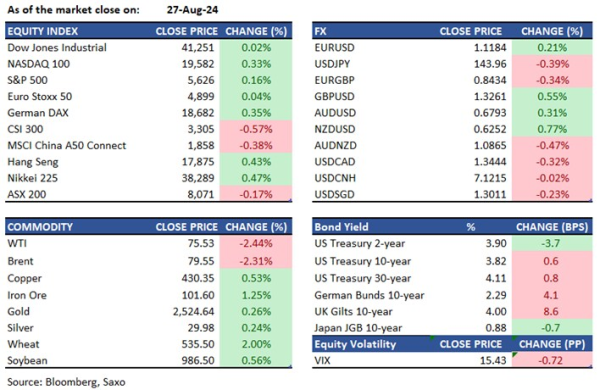

Global Market Quick Take: Asia – August 28, 2024

Key points:

- Equities: All eyes on NVIDIA earnings

- FX: US dollar bears returned after a strong 2-year auction

- Commodities: Oil falls 2.4%, ending 3-day rally

- Fixed income: US two-year auction yield lowest in two years

- Economic data/events: Fed’s Bostic

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

In the news:

- Stock Market Today: Dow clinches record close as focus shifts to Nvidia earnings (Investing)

- SentinelOne lifts annual revenue guidance after Q2 results top analyst estimates (Investing)

- Shares climb, oil slips amid Mideast risks and looming Nvidia earnings (Investing)

- Copper prices near six-week high as one strategist says the ‘worst of the correction is over’ (CNBC)

- Super Micro stock falls after short seller Hindenburg Research calls company 'serial recidivist' in new report (Yahoo)

- Fortescue’s Profit Edges Up as It Shrugs Off China Downturn (Bloomberg)

- Eli Lilly launches cheaper vial version of blockbuster weight-loss drug (FT)

Macro:

- US consumer confidence rose to 103.3 in August from 101.9 (revised higher from 100.3), coming in above the 100.8 expected. The upside was due to a tick up in both the Present Situation Index, to 134.4 from 133.1, and the Expectations Index, to 82.5 from 81.1. Respondents were more concerned about the labor market, but the changes were marginal suggesting only a gradual deceleration in employment picture.

- China’s industrial profits climbed at the fastest pace at 4.1% YOY in July from 3.6% in the prior month. Gains came on the back of a soft base and overseas orders, although domestic demand remains stubbornly weak. This continued to emphasize the need for stimulus and rate cuts.

- ECB’s Klass Knot, a known hawk, spoke at a panel and said that he’s awaiting more information before deciding on whether to support an interest rate cut at the September 12 meeting. Key reports therefore will be the Eurozone inflation print due this Friday, and a softer print could mean that the ECB could continue to cut rates gradually.

Macro events: Australia CPI (Jul), Fed’s Bostic and Waller, Treasury 5-year Auction

Earnings: Abercrombie & Fitch, Chewy, Kohl’s, Foot Locker, Bath & Body Works, RBC, Nvidia, Crowdstrike, Salesforce, HP

Equities: Asian stocks are projected to decline after a lackluster session on Wall Street, as traders turn their attention to Nvidia Corp.'s earnings for insights into whether the artificial intelligence-driven bull market can sustain its momentum. Futures for equity indices in Tokyo, Hong Kong, and Sydney pointed lower, with US futures also trending down in early trading. The major chipmaker is set to announce its earnings after Wednesday’s session, with investors keen to see if Nvidia will meet the high expectations. Investors are bracing for significant volatility in Nvidia’s shares after the $3.2 trillion company, led by Jensen Huang, releases its earnings report. Our Chief Investment Officer, Peter Garnry, thinks that Nvidia earnings will show another quarter of explosive growth. Options market activity suggests a nearly 10% move in either direction following the results. Nvidia's stock has surged about 160% this year and 1,000% from its October 2022 bear-market low. To read our traders’ take on Nvidia earnings, read this article. S&P 500 edged up to around 5,625, while the Nasdaq 100 rose by 0.3%. A key index of chipmakers increased by 1.1%, and Nvidia climbed 1.5%. Conversely, Super Micro Computer Inc. fell 2.6% after Hindenburg Research disclosed a short position on the server equipment manufacturer.

Fixed income: Treasuries ended with mixed results, leading to a steeper yield curve. Short-term tenors saw strong demand, particularly benefiting from the most favorable two-year note auction since August 2022. Conversely, longer-term yields edged up slightly, mirroring larger, supply-driven increases in yields across most European bond markets. Two-year yields dropped by over 3 basis points, hitting session lows after the monthly auction of new notes yielded 3.874%, approximately 0.6 basis points lower than the WI yield. Meanwhile, 10-year yields rose by about 2 basis points, compared to increases of 3 to 7 basis points for most European counterparts. Despite concerns that a yield below 4% might deter investors, the auction was successful. Upcoming auctions include $70 billion in five-year notes and $44 billion in seven-year notes over the next two days, both expected to achieve the lowest yields in over a year. Fed-dated OIS contracts adjusted to lower rate levels, indicating slightly more anticipated policy easing by year-end. The December contract resumed pricing in over 100 basis points of cumulative rate cuts. Additionally, the Monetary Authority of Singapore will auction S$2.8 billion of a July 2029 government note.

Commodities: WTI crude oil futures dropped 2.44% to $75.53 per barrel, and Brent crude fell 2.31% to $79.55 per barrel, driven by concerns over slower economic growth in the US and China potentially reducing energy demand after a recent price surge. Natural gas prices decreased by 3% to a four-month low due to milder weather forecasts. Gold prices rose 0.26% to settle at $2,524, remaining below recent record highs. Meanwhile, Arabica coffee futures surged past $2.62 per pound, reaching their highest levels since mid-2011, driven by tight supply concerns due to adverse weather affecting crops. To read more on our oil view, read this article.

FX: The US dollar drifted lower again on Tuesday after a strong 2-yaer Treasury auction indicated that markets continue to bet on an aggressive rate cutting cycle from the Fed. The weakness in the US dollar could be crucial to understand for investors with a global portfolio, and we discussed some risk management strategies in this article. The kiwi dollar outperformed while the Australian dollar lagged gains, and Australia’s July inflation print will be on the radar today which will need to be significantly higher than expected to prompt markets to price out an RBA rate cut this year. Sterling extended to over two-year highs against the US dollar with no key data on tap this week that could challenge the view of gradual BOE easing. The Canadian dollar also extended gains for a third straight day despite oil prices slipping lower, signaling a potential squeezing of short positions in the Loonie.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.