Global Market Quick Take: Asia – October 18, 2024

Key points:

- Equities: TSMC’s shares spiked 11% after reporting strong earnings

- FX: USDJPY reached a session high of 150.30, its highest since August 1

- Commodities: Gold extends record high; Iron ore falls on property briefing in China

- Fixed income: Treasury yield curve steepens as long end pushes higher

- Economic data: China GDP, China Industrial Production, China Retails Sales, UK Retails Sales, US Building Permits Preliminary

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

- Netflix third-quarter subscribers barely beat estimates as ad-tier members jump 35% (CNBC)

- Nvidia hits record high as chip stocks rally on TSMC's rosy AI-powered outlook (Reuters)

- Chinese robotaxi firm Pony AI files for U.S IPO (CNBC)

- China will win ‘tough battle’ to preserve property sector, housing minister says (SCMP)

- US dollar buoyed by retail sales data, euro falls as more cuts underway (Reuters)

- Gold hits record highs on US election uncertainty, more policy easing (Reuters)

- Oil prices edge higher on US crude stockpiles draw (BT)

Macro:

- Japan's annual inflation rate dropped to 2.5% in September 2024 from 3.0% in the previous month, the lowest level since April. The core inflation rate also fell to a five-month low of 2.4% from August's 2.8%, slightly above the expected 2.3%. On a monthly basis, the CPI decreased by 0.3% in September, marking the first decline since February 2023.

- US retail sales increased by 0.4% MoM in September 2024, exceeding both the 0.1% gain in August and market expectations of a 0.3% rise. Significant growth was seen in miscellaneous store retailers (4%), clothing (1.5%), health and personal care stores (1.1%), and food and beverages stores (1%). However, sales dropped at electronics and appliance stores (-3.3%), gasoline stations (-1.6%), and furniture stores (-1.4%), while auto dealer sales remained flat. Excluding food services, auto dealers, building materials stores, and gasoline stations, sales used to calculate GDP rose by 0.7%, the highest in three months.

- US industrial production fell by 0.3% in September 2024, more than the expected 0.2% decrease, following a revised 0.3% rise in August. A strike at a major civilian aircraft producer and the impact of two hurricanes each reduced production growth by 0.3%. Manufacturing output, which makes up 78% of total production, declined by 0.4%, mining output decreased by 0.6%, and utilities output increased by 0.7%. Capacity utilization dropped to 77.5%, below its long-term average. For the third quarter, industrial production declined at an annual rate of 0.6%.

- US unemployment claims fell by 19,000 to 241,000, below market expectations of 260,000. This drop follows a surge due to Hurricanes Helene and Milton. Despite the decrease, claims remain higher than earlier this year, indicating a softening labor market. Outstanding claims rose by 9,000 to 1,867,000, and the four-week moving average increased by 4,750 to 236,250. Non-seasonally adjusted claims fell by 11,416 to 224,763, with notable decreases in Michigan and Florida.

- ECB cut its key interest rates by 25 bps in October 2024, following similar reductions in September and June. The new rates are 3.25% for the deposit facility, 3.40% for main refinancing operations, and 3.65% for the marginal lending facility. This move follows improved disinflation, with Eurozone inflation dropping below the 2% target for the first time in over three years. The ECB aims to keep rates restrictive to meet its medium-term inflation goal, using a flexible, data-driven approach.

- China property briefing: China announced a CNY 4 trillion credit support expansion to aid property builders, ease purchase restrictions, ensure timely home deliveries, and cut mortgage rates. Housing Minister Ni Hong noted stabilization in first-tier city property sales, indicating the market has 'bottomed out.' Current policies will extend until the end of 2026, with expected adjustments to deposit and loan interest rates. The finance ministry will allow local governments to use special bond funds to buy unsold homes and idle land, and the PBoC reduced the minimum down payment ratio to 15% for all buyers.

Earnings: Procter & Gamble, American Express, Schlumberger, Comerica, Fifth Third Bank

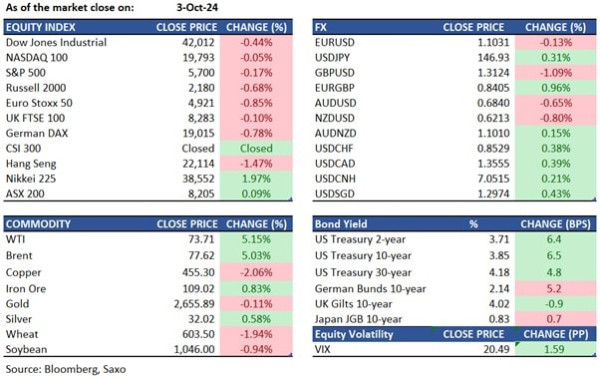

Equities: US stocks traded mostly higher Thursday afternoon, with semiconductor shares driving the gains after strong corporate and economic news. The S&P 500 ended the session flat after briefly touching a new record, the Dow Jones was up over 100 points after hitting all time highs of 43,272, and the Nasdaq 100 rose 0.3%. Nvidia surged 3% to a new record high after its key supplier, Taiwan Semiconductor (TSMC), posted robust Q3 earnings that showed a 54% yoy growth and also raised its revenue outlook. TSMC’s shares spiked 11%, lifting other chipmakers higher like Broadcom (2.6%) and Micron (2.57%). US data continues to outperform with retail sales data for September showing a 0.4% rise vs 0.3% est, which further bolstered sentiment. Additionally, jobless claims came in lower than forecast, reinforcing the view that consumer spending remains resilient. Netflix reported earnings after the close which showed that they beat top and bottom line estimates and they added more than 5 million subscribers in Q3, exceeding expectations of about 4 million.

Fixed income: Treasuries fell after stronger-than-expected September retail sales and upward revisions to August figures, along with a drop in weekly initial jobless claims. Initial losses led by the front end flattened the yield curve, but it ended steeper due to long-end underperformance. Long-end yields rose about 9 basis points, while front-end and belly yields increased by 3 to 7 basis points. The 10-year yield climbed over 7 basis points to 4.09%, just 1 basis point below the day's high. Movement was driven by economic data releases and supported by euro-zone bonds, where investors anticipated larger ECB rate cuts following comments from President Lagarde. German front-end yields declined by about 2 basis points.

Commodities: Gold prices rose by 0.71% to $2,692, reaching new all-time highs earlier in the session. This increase occurred despite gains in yields and the US Dollar. The rise is attributed to uncertainty ahead of the US elections and ongoing tensions in the Middle East, which continue to position gold as a safe-haven asset. Technical indicators also favor buyers. Although economic data was stable this morning, investors anticipate future easing by the Federal Reserve. Meanwhile, November WTI crude futures climbed by 0.40% to $70.67, and Brent crude increased by 0.31% to $74.45. These gains were supported by better-than-expected US economic data and a weekly inventory draw, contrary to the expected build. The improved economic outlook has led investors to lean towards a soft landing rather than a recession for now. Iron ore futures fell below $100 as a Chinese government briefing failed to introduce aggressive property sector policies. Officials announced expanding a 'white list' of real estate projects and increasing bank lending to 4 trillion yuan, but markets were disappointed by the reliance on existing measures.

FX: A Bloomberg index of the dollar rose after strong US consumer spending and labor data led traders to scale back their expectations of interest-rate cuts from the Federal Reserve. The euro declined as European Central Bank officials highlighted growth risks while lowering borrowing costs. EURUSD dropped to a session low of 1.0811 as the ECB cut interest rates for the third time this year, bringing the key deposit rate to 3.25%. The yen weakened past the critical 150 level after US data strengthened the dollar, with USDJPY reaching a session high of 150.30, its highest since August 1, leading G-10 losses. USDCAD reversed Wednesday’s decline, climbing 0.3% to 1.3795. The Australian dollar outperformed after Australia's unemployment rate remained steady, prompting traders to delay their expectations of RBA rate cuts next year.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.