Global Market Quick Take: Asia – September 16, 2024

Key points:

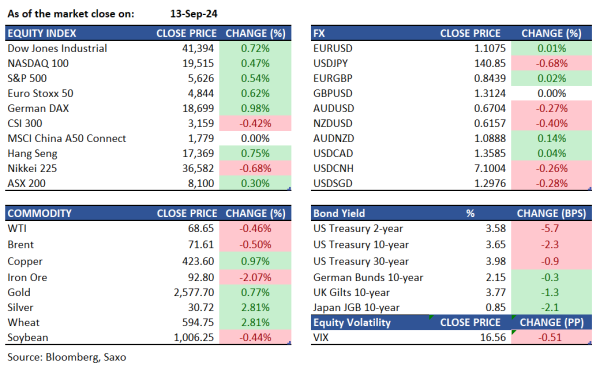

- Equities: US equities gain on speculation for 50bps cut this week

- FX: Japanese yen in focus with Fed and BOJ policy divergence in limelight this week

- Commodities: Gold reached an all-time high, while silver rallied above $30

- Fixed income: October fed funds futures trading hit its second-highest record

- Economic data: US Empire State Manufacturing

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

- Trump safe after another assassination attempt at his Florida golf course (Investing)

- US stock futures steady with Fed, rate cuts on tap (Investing)

- S&P 500, Nasdaq Mark Best Weeks of 2024. Investors Hold Onto Half-Point Rate Cut Hopes. (Barron’s)

- BoE rate cut helps boost UK housing market but concerns remain, Rightmove says (Investing)

- Alcoa to sell its 25.1% stake in Ma’aden joint venture for $1.1 billion (Yahoo)

- Japan's PM hopeful Takaichi warns BOJ against raising rates (Reuters)

Macro:

- US headline University of Michigan Consumer Sentiment beat in the prelim September reading, rising to 69.0 from 67.9, above the 68.5 forecast. Both the current conditions and forward-looking expectations rose and above expectations to 62.9 (exp. 61.5, prev. 61.3) and 73.0 (exp. 71.0, prev. 72.1), respectively.

- Key Chinese data out over the weekend. August credit data showed underwhelming showed a slowdown, with retail sales coming in at 2.1% YoY from 2.7% in July and 2.5% expected. Industrial production for August was at 4.5% YoY from 5.1% previously and 4.7% expected while fixed asset investment softened to 3.4% YoY YTD from 3.5% in July. These dismal numbers raise concerns about the odds of China achieving its 5% GDP growth target.

Macro events: US Empire State Manufacturing

Earnings: IpA, Hightide, RF Industries, Vince

Equities: U.S. stocks closed higher on Friday amid rising expectations of a larger interest rate cut at the Federal Reserve's upcoming meeting. The S&P 500 gained 0.5%, while the Nasdaq rose by 0.6%, both aiming for their fifth consecutive session of gains. Leading the rally were mega-cap tech and semiconductor stocks, with Super Micro Computer and ARM Holdings up by 3.4% and 6.9%, respectively while Uber surged 6.4%. Conversely, Boeing shares fell 3.7% due to a strike by its largest labor union, affecting airplane assembly while Adobe plummeted 8.5% following a bleak earnings outlook. Investors now see a 64% chance of a 50-basis-point rate cut by the Fed, up from 15% early last week.

Fixed income: Treasury yields dropped on Friday as traders adjusted their expectations to a half-point rate cut at next week’s Federal Reserve meeting, instead of a quarter-point cut. October fed funds futures trading surged to the second-highest level on record due to the prospect of a larger rate cut. Front-end yields fell by nearly 7 basis points, widening the 2s10s and 5s30s spreads by 4 and 3 basis points, respectively. The 2s10s spread hit 8.5 basis points, its steepest since July 2022, before settling around 7.5 basis points. Fed-dated Overnight Index Swap (OIS) contracts indicated further Federal Reserve easing. For September, 35 basis points of easing were priced in, equating to about 40% odds of a 50 basis point move. Approximately 115 basis points were priced in for December, up from 110 basis points at Thursday’s close. October fed funds futures volume exceeded 581,000 contracts, the second highest after September 6, when over a million contracts were traded following weak jobs data and comments from Federal Reserve Governor Christopher Waller. JPMorgan economists reaffirmed their prediction of a half-point rate cut next week. CFTC data showed hedge funds increased net short positions in long-bond and ultra-long bond futures up to September 10, while asset managers continued to extend duration long positions.

Commodities: Gold prices reached new all-time highs, increasing by 0.77% to close at $2,577.70. Silver also saw a significant rise, climbing 2.81% to $30.72, driven by a declining dollar and lower Treasury yields ahead of the FOMC policy meeting next Wednesday, where rate cuts are widely anticipated. Over the week, gold surged more than 3.5%, while silver jumped over 10%. Oil prices close lower for the day; however, they still managed to post a weekly gain for the first time in over a month (+1.45% WTD) due to output disruptions in the U.S. Gulf of Mexico caused by Hurricane Francine, which led to evacuations and production platform shutdowns. U.S. WTI crude oil futures settled at $68.65 per barrel, down 0.46%, while Brent crude settled at $71.61 per barrel, down 0.5%.

FX: The US dollar drifted lower on Friday, and closed the week down slightly with mixed performances against the major currencies. Most of the pressure on the greenback came from gains in precious metals and Japanese yen, as markets tilted back towards expecting a bigger rate cut of 50bps from the Fed this week. Swiss franc also rose on Friday but ended as the underperformer for the week, with Kiwi dollar and the Canadian dollar also in losses. Bank of Canada governor raised the prospect for faster rate cuts in an interview with the Financial Times, saying that the labor market is hinting to some downside risks. While the focus will be on the Fed this week, Bank of Japan and Bank of England also announce policy decisions and could be able to add resilience to the Japanese yen and British pound respectively.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.