Global Market Quick Take: Asia – September 18, 2024

Key points:

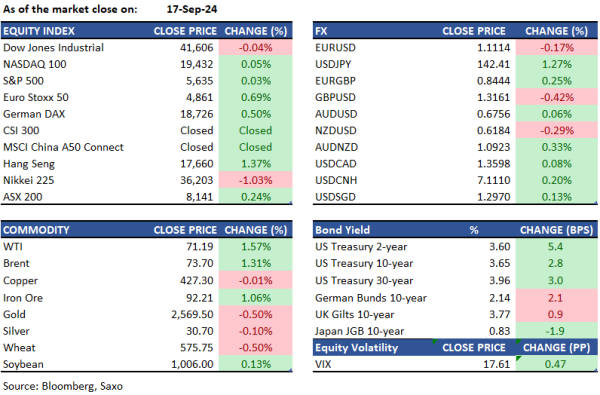

- Equities: Stocks retraced from highs after retail sales data

- FX: JPY underperformed as US yields rose ahead of FOMC

- Commodities: Oil rose ahead of Fed rate decision

- Fixed income: Both 10-year and 2-year yields end a two-day losing streak

- Economic data: FOMC & Chair Powell Conference, UK CPI

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

- Japan trade balance shrinks less than expected in Aug; Imports, exports lag (Investing)

- Japan exports rise 5.6% year-on-year in August (Investing)

- Microsoft, Blackrock plan $30 bln fund for AI infrastructure (Investing)

- US economy on solid ground as retail sales surprise on the upside (Reuters)

- Fed to go big on first rate cut, traders bet (Reuters)

- US dollar strengthens ahead of expected Fed rate cut (Reuters)

- Canada's 2% inflation rate in August raises hopes for large rate cut (http://Reuters)

Macro:

- US retail sales beat expectations with headline up 0.1% in August vs exp. -0.2% and the prior revised up to 1.1% from 1.0% initially. Core measures were, however, below expectations. Ex-autos rose by 0.1%, missing the 0.2% forecast and down from the prior 0.4%. The super core, ex gas and autos, rose 0.2%, down from the prior 0.4%. The control metric, a good gauge of consumer spending in GDP, rose by 0.3%, in line with expectations while the prior (July) was revised up by 0.1% to 0.4%, which bodes well for Q3 consumer spending. Atlanta Fed GDPNow (Q3) was revised upwards to 3% (prev. 2.5%). The report highlighted US exceptionalism still remains intact but it did not shift the odds of a 50bps rate cut from the Fed later today.

- Germany’s investor confidence plunged to its lowest levels in a nearly one year signaling hard landing risks for the German economy as the manufacturing sector is struggling. The ZEW institute’s gauge of expectations plunged to 3.6 in September from 19.2 the prior month (consensus 17.0). That is below the 10-year average of about 13. The index for current conditions fell to -84.5 from -77.3 in August. The 10-year average is about 3.8.

- Canada’s inflation plunged into negative territory in August, making a clear case for a 50bps rate cut from the Bank of Canada in October. Headline CPI fell 0.2% MoM and the YoY print was back to the 2% target. Core measures also continued to signal a strong pace of disinflation.

Macro events: FOMC Policy Decision, UK CPI (Aug), EZ HICP Final (Aug), US Building Permits/Housing Starts (Aug), New Zealand GDP (Q2)

Earnings: General Mills, Steelcase, Sangoma

Equities: U.S. stocks saw minimal changes on Tuesday amid growing uncertainty over the expected rate cut size. The S&P 500 and Dow Jones closed flat after rallying to all-time highs, while the Nasdaq rose by 0.2%. The FOMC's two-day meeting starts today, and traders anticipate the Fed's first interest rate cut since 2020. However, opinions vary on the cut's magnitude, with over 60% considering a significant 50bps reduction likely. Among mega-cap stocks, Nvidia dropped 1.1%, while Microsoft gained 0.9% after raising its quarterly dividend. Intel surged 2.6% following a new business partnership with Amazon, taking their 2-day gains to 9%. Additionally, U.S. retail sales unexpectedly rose by 0.1% in August, beating expectations of a 0.2% decline and following an upwardly revised 1.1% increase in July.

Fixed income: Treasury yields closed the session near their highest levels of the day after early gains in the long end were reversed ahead of the 20-year bond auction, which lagged the WI by about 2 basis points. A rebound in oil prices added to the downward pressure on Treasuries, although overall price movements remained stable ahead of Wednesday’s Federal Reserve rate decision. Treasury yields had increased by 2 to 3.5 basis points across the curve, with the front end experiencing the most significant losses, flattening the 2s10s curve by 1.5 basis points compared to Monday's close. The US 10-year yield ended at approximately 3.64%, up around 2 basis points. Fed-dated OIS remained steady ahead of Wednesday’s FOMC meeting, indicating about 39 basis points of expected rate cuts for the meeting and a total of 116 basis points of cuts over the remaining three meetings this year. Balances at the Federal Reserve’s overnight reverse repurchase facility increased on Tuesday as Treasury-bill paydowns and incoming cash from government-sponsored enterprises helped ease funding market pressures.

Commodities: Gold prices declined ahead of tomorrow's Federal Reserve rate decision, following an all-time high the previous day. Gold dropped 0.50% to settle at $2,569.50, largely due to profit-taking and positioning in anticipation of the Fed's decision, with concerns that the Fed might only cut rates by 25 basis points. WTI crude futures remained stable overnight but saw early gains as Core Retail Sales met expectations. Despite concerns about the Fed's potential aggressiveness and ongoing demand issues, crude prices rose into the early afternoon before profit-taking reduced some gains. October futures rose 1.57% at $71.19, while Brent crude increased 1.31% to $73.70.

FX: The US dollar saw modest gains in the overnight session as US exceptionalism was highlighted by retail sales remaining supported while economic data from Germany and Canada signaled recession concerns. Markets are still split on 25 or 50bps of rate cuts from the Fed today, with odds of a bigger cut sitting at 65% and US dollar is trading back lower in the Asian morning. The Japanese yen was the underperformer among the major currencies amid rising US yields and focus is on the Fed decision today. British pound and Kiwi dollar also plunged lower, and both have key data to watch for in the day ahead. UK’s inflation print is on the wires today and stickiness of the services inflation will be key input for the pace of easing from the Bank of England, and New Zealand’s Q4 GDP risks sending recession signals. Australian dollar closed in small gains despite the strength of the greenback.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.