Global Market Quick Take: Asia – September 27, 2024

Key points:

- Equities: Nasdaq Golden Dragon Index up 10.8% on China stimulus

- FX: Japanese yen has its eyes on LDP election race

- Commodities: Copper rose more than 3% on China’s expected stimulus measures

- Fixed income: 2/10 Treasury yield curve flattens

- Economic data: US PCE

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

- Super Micro Computer stock plunges on report of DOJ probe (Yahoo)

- Major global chip stocks rally on Micron’s surge; ASML up 4% (CNBC)

- Major insider slashes nearly all of its stake in Trump's media firm (Reuters)

- China cuts banks' reserve requirement ratio by 50 bps, effective from Sept 27 (Reuters)

- China stimulus, mighty gold puts silver on a streak, but not without risk (Reuters)

Macro:

- US initial jobless claims, for the week ending 21st September, fell to 218k from 222k (revised up from 219k), despite expectations for a rise to 218k - a sign of a robust labour market, while the 4wk average fell to 224.75k from 228.25k (revised up from 227.5k). The continued claims, for the week ending 14th September, which coincides with the usual NFP survey week, rose to 1.834mln from 1.821mln (revised down from 1.829mln), but was slightly below the expected 1.838mln.

- The final estimate for US Q2 GDP was unrevised at 3.0%, in line with expectations, and accelerating from the 1.6% growth seen in Q1. Upward revisions to private inventory investment and federal government spending were offset by downward revisions to non-residential fixed investment, exports, consumer spending, and residential fixed investment.

- The Swiss National Bank cut rates for a third time to 1% as expected and also guided for more cuts to come to ensure price stability over the medium term. Containing the strength of the franc was also a key message, but with the central bank reaching its neutral rate, room for further easing may be limited which could force them to switch to FX interventions.

- Japan’s Tokyo CPI for September came in as expected and softer than previous month. Headline Tokyo CPI was at 2.2% YoY from 2.6% previous while core measures eased to 2.0% from 2.4% YoY. Core-core measure remained steady at 1.6% YoY and focus now shifts to LDP election outcome later today. The new Prime Minister could re-set the agenda for the domestic economy and lean on the BOJ on rates. Focus also turns to US PCE release.

Macro events: Japan’s ruling LDP party leadership election, China Industrial Profits (Aug), German Unemployment (Sep), EZ Consumer Confidence Final (Sep), US PCE (Aug), Uni. of Michigan Final (Sep)

Earnings: No major earnings

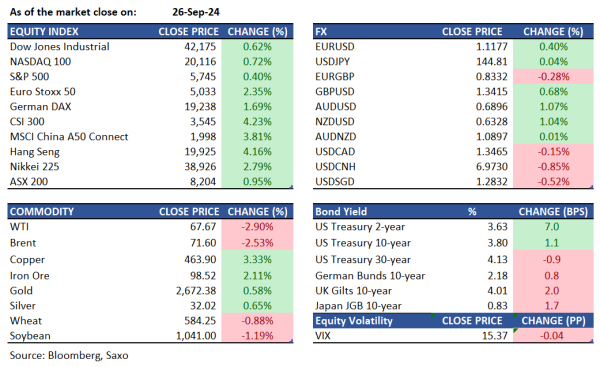

Equities: On Thursday, the S&P 500 rose 0.4% to reach a new record high, while the Nasdaq gained 0.6%, and the Dow Jones added 260 points. Investor sentiment was buoyed by strong corporate earnings and positive economic data. Micron Technology led the charge, surging 14.7% after an optimistic earnings forecast, which sparked gains across the semiconductor sector. Applied Materials climbed 6.2%, and Lam Research advanced 5.4%. The rally was further supported by encouraging economic reports, including weekly jobless claims falling to a four-month low, indicating a strong labor market. Additionally, second-quarter GDP growth was confirmed at a robust 3%. China stimulus continues to boost sentiment with the Golden Dragon Index up 10.8% and KraneShares CSI China Internet ETF up 11.5%. Hang Seng Index was also up 4.1% in Asia session yesterday and Hang Seng futures were up a further 2.7% overnight. For more on how China stimulus measures can impact markets, read this article.

Fixed income: The Treasuries curve flattened significantly as long-end yields declined and 2-year yields rose by 6 basis points from Wednesday's close, reflecting a reduced Fed rate cut premium in overnight swaps. Losses intensified ahead of the 7-year note auction, which concluded strongly, trading 0.7 basis points through the when-issued yield. Treasury yields were up to 6 basis points higher at the front end, with the 2s10s spread flattening by 6 basis points on the day. The US 10-year yield hovered around 3.785%, nearly unchanged, as the curve pivoted around this sector. The 2s10s spread saw its most significant flattening in over a month, dropping to as low as 16.2 basis points late in the session. Additionally, the amount of reserves in the banking system, a key factor for the Federal Reserve's balance sheet reduction, fell to its lowest level since April 2023.

Commodities: Gold rose by 0.57% to settle at $2,672, supported by China's stimulus commentary. It remains a strong uncorrelated hedge for equity portfolios, bolstered by central bank buying, though it may face profit-taking as momentum appears stretched. Silver extended its strong momentum to reach $32.5 per ounce in late September, its highest in 12 years, driven by expectations of incoming rate cuts by the Federal Reserve. WTI crude futures declined overnight and failed to rally despite positive China stimulus news and favorable economic data. The November contract fell by 2.9% to $67.67, while Brent dropped by 2.53% to $71.60. A Financial Times report suggested that Saudi Arabia might abandon its $100 per barrel target and increase production to regain market share, likely driving the price decline despite attempts by bulls to counter the story. Copper futures rose by 3.33% to $463.90, hovering close to over two-month highs on reports that top consumer China will be rolling out more stimulus measures to support the economy.

FX: The US dollar pared much of its gains as risk-on returned due to the optimism on China’s stimulus measures. The Chinese yuan was back below the 7-handle against the US dollar while the Australian dollar and kiwi dollar outperformed as commodity currencies remain in the spotlight amid optimism that China’s demand could return. High-beat British pound also rose higher. The Swiss franc also defied any pressures given the SNB rate cut was well-expected and there was also an odd chance of a 50bps cut. The only G10 currency that ended lower against the US dollar was the Japanese yen, but losses have been constrained ahead of the LDP elections due today and US PCE out later. The euro and Canadian dollar also underperformed.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.

In the news:

- Micron stock jumps as Q1 revenue forecast tops analyst estimates (Yahoo)

- Meta Connect: CEO Touts AI Chatbot Growth, Launches New Headset (IBD)

- HPE Stock Upgraded On AI Server Growth In Data Centers (IBD)

- Talks to resume between striking machinists, Boeing on Friday, says union (Yahoo)

- GM Stock Cut To Sell By Morgan Stanley On China Reversal (IBD)

Macro:

- US new home sales fell 4.7% in August to 716k from 739k, but above the expected 700k, whereby new home supply was 7.8 months' worth (prev. 7.3 months' worth).

- Sweden’s central bank, the Riksbank, maintained a dovish tilt at the September meeting, cutting rates for a third time by another 25bps to 3.25% and guiding for further rate cuts at the two remaining meetings this year to reach 2.75% by year-end. Next up today will be the Swiss National Bank, which is also expected to cut rates, but key will be to watch the language on FX as the central bank may not be too welcoming of the franc strength now that disinflation has returned.

Macro events: SNB Policy Announcement, US Durable Goods (Aug), GDP Final (Q2), PCE Prices Final (Q2), Initial Jobless Claims (w/e 21st Sep)

Earnings: Costco, Accenture and Jabil

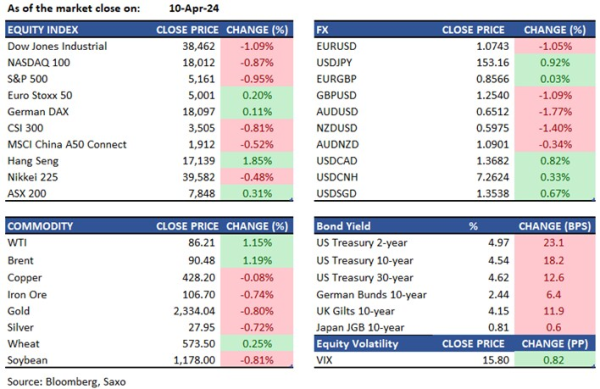

Equities: U.S. stocks saw mixed performances on Wednesday as investors evaluated the Federal Reserve's rate cut trajectory. The S&P 500 and the Dow declined by 0.2% and 0.7%, respectively, pulling back from earlier highs, with energy stocks such as Chevron (-2.4%) and Exxon Mobil (-2%) leading the losses. Conversely, tech stocks including Nvidia (+2.2%), Intel (+3.2%), and AMD (+2.3%) provided some support, helping the Nasdaq close flat. Micron surged 13% post market after reporting revenue and earnings that beat estimates and in additon projecting this quarter’s revenues to be between $8.5-$8.9 billion, above the $8.5 billion estimates. Looking ahead, investors are now focused on upcoming key economic data, including the GDP report tonight and the PCE inflation index on Friday.

Fixed income: Treasuries ended weaker across the curve as the market absorbed a $70 billion 5-year note auction and a surge in corporate bond supply. U.S. yields had decreased by 4 to 5 basis points across the curve, with spreads remaining within a narrow intraday range. The 10-year yields settled around 3.77%, down by 5 basis points for the day. With no major price catalysts, market focus shifted to duration events. The busy corporate issuance schedule was led by Oracle’s four-part offering, with the day’s total expected to exceed the top end of dealers’ forecasts of $25 billion for the week. The $70 billion 5-year note auction was solid, resulting in minimal price movement and stopping on the screws. Additionally, Treasury Secretary Janet Yellen is scheduled to speak at the U.S. Treasury Market Conference at 11:15 AM ET. Federal Reserve Governor Adriana Kugler expressed strong support for the central bank’s recent decision to lower borrowing costs by half a point last week, noting that further rate cuts would be appropriate if inflation continues to ease as anticipated.

Commodities: Oil stabilized after its largest drop in two weeks, as Libya's rival factions agreed on new central bank leadership, potentially allowing some crude production to resume. West Texas Intermediate stayed below $70 a barrel after a 2.6% decline on Wednesday, while Brent crude hovered near $73. Libya's eastern and western administrations "initialed an agreement" on the central bank board, with a signing ceremony scheduled for Thursday, according to the UN. A stronger dollar also pressured commodities priced in the currency, including oil. Spot gold hit a record $2,670.57 an ounce before trimming gains, having surged 29% this year, while silver climbed 34%. Indian gold demand is expected to be strong due to a reduction in import tax and an anticipated robust festival and wedding season. Base metals steadied as investors assessed the impact of a Chinese stimulus package on the world's largest metals consumer.

FX: The US dollar turned back higher due to its safe-haven appeal after significant Middle Eastern escalations and focus will turn back slightly to Fed today as Chair Powell and NY Fed’s Williams take to the wires along with a host of other committee members. Labor market focus also makes it key to watch the weekly US jobless claims print that will be out today. Activity currencies led the losses against the US dollar, with kiwi dollar plunging back below 63 cents and Aussie dollar failing at 69 cents and back below 0.6850. Japanese yen and Swiss franc were also in red despite being safe-havens with the former reaching three-week lows against the US dollar. The offshore Chinese yuan also retreated after trading below the key 7 handle against US dollar for a brief period yesterday.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.