Global Market Quick Take: Asia – September 30, 2024

Key points:

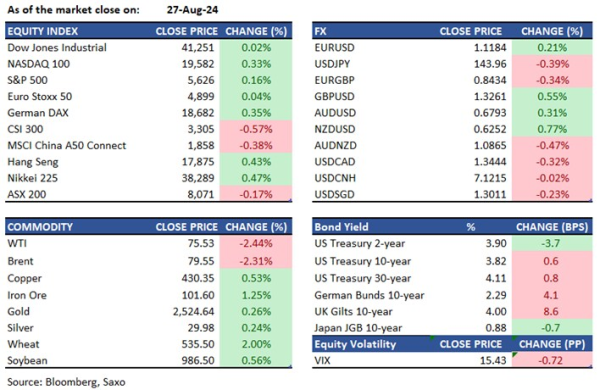

- Equities: Chinese markets had best week in 16 years, up 15.7%

- FX: Japanese yen rallies on Ishiba’s nomination as ruling party leader

- Commodities: Oil fell 4% last week on Libyan deal and Saudi easing OPEC+ curbs

- Fixed income: Treasury yield curve bull steepens

- Economic data: China PMIs, Germany flash CPI

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

In the news:

- China to cut existing mortgage rates by the end of October (CNBC)

- Costco Posts Major Earnings Beat, But Misses On These Metrics (IBD)

- European shares close at record high; luxury giants rally on China stimulus (CNBC)

- Australia revises down commodity revenue forecasts as prices trend lower (Reuters)

Macro:

- US Core PCE rose 0.13% in August, in line with the 0.15% forecast and prior 0.16%. The Y/Y print rose by 2.7%, accelerating from the prior 2.6% pace, but in line with the 2.7% forecast. On an annualised basis, the 6-month rate fell to 2.4%, the lowest since December, with the 3-month rate at 2.1%. The headline PCE rose 0.09% (exp. 0.1%, prev. 0.16%), with the Y/Y rising 2.2%, beneath the 2.3% forecast and falling from the prior 2.5%. This added to conviction that consumer prices are on track to hit 2% target in September, and could continue to allow the Fed to focus on the labor market mandate instead.

- The University of Michigan survey’s headline for September was revised up to 70.1 from 69.0, above the expected 69.3. Current conditions and forward-looking expectations were both revised higher to 63.3 (prev. 62.9) and 74.4 (prev. 43.0), respectively. On inflation, 1- and 5-year expectations were left unchanged at 1.7%, and 3.1%, respectively.

- Japan’s ruling party elections resulted in Shigeru Ishiba defeating his dovish opponent Sanae Takaichi. Ishiba has said he supports the Bank of Japan’s independence and normalization path in principle, and that the country needs to defeat deflation. Reports suggest that the new Japan PM is planning a general election for October 27.

- Fresh streaks of stimulus out of China on Friday and over the weekend. The National Development and Reform Commission (NDRC) hosted a meeting on Friday and assured support to private enterprises. On Sunday the People's Bank of China announced it'd be instructing banks to lower mortgage rates for existing home loans before October 31. Guangzhou city announced it'd be lifting of all restrictions on home purchases. Shanghai and Shenzhen said they would ease restrictions on housing purchases by non-local buyers and lower the minimum downpayment ratio for first homebuyers to no less than 15%. To read more about how to position as China blasts a series of stimulus measures, reads this article.

Macro events: Chinese NBS & Caixin PMIs (Sep), Germany Retail Sales (Jun), UK GDP (Q2 F), German Flash CPI (Sep), Fed’s Powell, ECB’s Lagarde

Earnings: Carnival

Equities: In Asian markets, the Nikkei Index rose 2.32% to 39,829, the Shanghai Index increased 2.88% to 3,087, and the Hang Seng Index jumped 3.55% to 20,632. Chinese markets had their best week in nearly 16 years, with the CSI 300 rallying 15.7% due to central bank stimulus measures. The Hang Seng Index recorded a 12.75% weekly gain. In the US, stocks finished mixed on Friday as investors assessed new inflation data. The S&P 500 lost 0.1%, the Nasdaq fell 0.4% due to a 2.1% drop in Nvidia shares, while the Dow Jones gained 0.3% to hit a new record. The August PCE index showed a mild 0.1% increase, suggesting cooling inflation and raising expectations for a potential Fed rate cut. US consumer sentiment reached a five-month high, supporting hopes for inflation to reach the Fed’s 2% target by 2024. Costco shares fell 1.7% after missing fiscal fourth-quarter revenue expectations, and HP shares dropped 1% following a downgrade by BofA. For the week, the S&P 500 rose 0.5%, the Dow Jones increased 0.7%, and the Nasdaq gained 0.8%.

Fixed income: Treasuries rose after August PCE data showed slightly softer-than-expected inflation gauges, with personal income and spending increases also missing estimates. The trend continued into the afternoon amid a risk-off environment following Israel’s bombing of Hezbollah’s Beirut headquarters. The front-end outperformed, re-steepening the curve and partially reversing Thursday’s sharp flattening. Treasury yields were richer by 7 to 3.5 basis points across the curve, with front-end gains steepening the 2s10s and 5s30s spreads by 1.8 and 3 basis points, respectively. The 10-year yield traded around 3.75%, richer by 5 basis points, ending near the lower end of the weekly range of 3.72% to 3.82%. Most gains came after the August PCE data, prompting a bull steepening as front-end yields led the rally. By session's end, Fed OIS priced in around 37 basis points of rate cuts for the November meeting, up from 36 basis points on Thursday, and a combined 76 basis points of cuts by the December FOMC, compared to 73 basis points prior. Following the Fed’s half-point rate cut on September 18, asset managers appeared to take profits on front-end positions, with both SOFR futures and two-year note futures seeing a reduction in net-long positioning.

Commodities: Gold prices fell by 0.53% to around $2,658 on Friday, following a record high of $2,672 in the previous session, as investors took profits. Despite this retreat, gold gained approximately 1.6% for the week, driven by the Federal Reserve's half-percentage-point rate cut and China's stimulus measures. Silver also declined by 1.41% to $31.57. U.S. WTI crude oil futures rose by 0.75% to $68.18, and Brent Crude futures increased by 0.53% to $71.98. However, oil prices dropped about 4% for the week due to progress on a Libyan deal that could boost exports and Saudi Arabia's commitment to easing OPEC+ production curbs. U.S. natural gas futures surged by 5% to a 14-week high as Hurricane Helene impacted the U.S. Southeast, leading to production cuts in the Gulf of Mexico and widespread power outages in Florida, Georgia, and the Carolinas.

FX: The US dollar ended the week lower by 0.3%, mostly on the back of gains in the Japanese yen on Friday after the nomination of Ishiba as the ruling party leader. Ishiba’s support for further policy normalization from the Bank of Japan sent a strong tremor of hawkish wave in the market. General risk-on also prevailed in the market on the back of stimulus measures from China, and commodity currencies kiwi dollar and Aussie dollar outperformed on the week, while the euro ended flat as markets continue to assess the ECB’s rate cut path. Germany’s flash inflation due today could bring further pressure on the single currency if they are softer than expectations.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.