Global Market Quick Take: Asia – September 5, 2024

Key points:

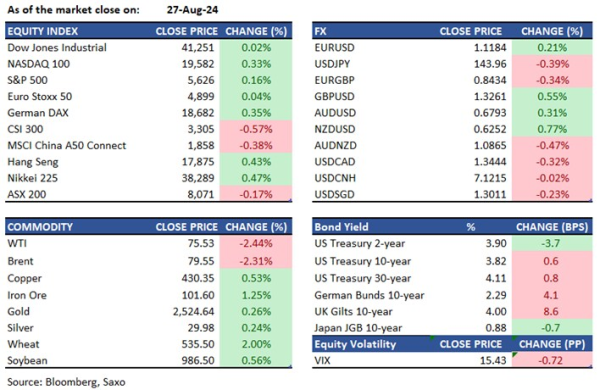

- Equities: US equities closed mixed after weak US JOLTS jobs report

- FX: Yen outperforms again on haven flows

- Commodities: Oil prices decline further; WTI drops below $70

- Fixed income: 10-year yield lowest in more than two weeks

- Economic data: US ISM services, Jobless claims

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

In the news:

- Stocks tumble as market leaders turn losers (Investing)

- Stocks fall with safe haven assets in demand, growth concerns in focus (Investing)

- C3.ai misses quarterly subscription revenue estimates as enterprises cut costs, shares plunge (Yahoo)

- Sept 50bps cut rate gets boost as JOLTS report flags labor market weakness: Citi (Yahoo)

- Nvidia did not receive a US Justice Department subpoena, spokesperson says (Yahoo)

Macro:

- US JOLTS job openings for July printed 7.673mn falling from the prior 7.91mn (revised lower), and well short of the expected 8.1mn. The job openings was also the lowest since early 2021. The dip in the vacancy rate and rise in the quits rate is also notable, the vacancy rate fell to 4.6% (prev. 4.9%, rev. 4.8%), with the quits rate rising to 2.1% (prev. 2.1%, rev. 2.0%). Regarding the vacancy rate, Fed Governor Waller has previously said that if it were to dip beneath 4.5%, it would likely suggest that excess labour demand has been worked off, and the unemployment rate could start to rise. The number of vacancies per unemployed worker, a ratio the Fed watches closely, declined to 1.1, still the lowest in three years. At its peak in 2022, the ratio was 2 to 1. Overall, the report send slowdown shivers to market and expectations are now starting to tilt more in favour of a 50bps Fed rate cut at the September meeting.

- The Bank of Canada cut rates as expected to 4.25%, marking its third consecutive 25bp rate cut. The statement was largely as expected and providing inflation continues to ease, and the price increases in shelter and some other services don't see inflation reverse higher, the BoC look set to continue on their easing path. The market currently fully prices in 50bps of easing through year-end, implying two 25bp rate cuts in October and December. BoC Governor Macklem, in the opening remarks, warned that inflation may bump up later in the year as base effects unwind, and that there is a risk that the upward forces on inflation could be stronger than expected. Macklem acknowledged that in the meeting, there was a strong consensus for a 25bps move, but alternative scenarios were discussed, including slowing the pace of cuts and also a 50bps move. Overall, the decision was less dovish than expected.

- Japan’s July wage report strengthened the case for more rate hikes from the Bank of Japan. Labor cash earnings rose 3.6% YoY, less than a revised 4.5% gain in June, but higher than the consensus forecast of 2.9%. Adjusted for inflation, wage growth slowed to 0.4% YoY from 1.1% in June, but again it was stronger than the consensus expectation of -0.6%.

Macro events: Swiss Unemployment (Aug), German Industrial Orders (Jul), EZ/UK Construction PMIs (Aug), EZ Retail Sales (Jul), US Challenger Layoffs (Aug), ADP (Aug), Initial Jobless Claims (w/e 31st Aug), ISM Services PMI (Aug), Final Composite/Services PMIs (Aug)

Earnings: NIO, FuelCell, SAIC, Broadcom, UIPath, DocuSign

Equities: US stocks ended mixed on Wednesday following their worst day since early August in the previous session. The S&P 500 dipped by 0.1%, the tech-heavy Nasdaq 100 dropped 0.3%, while the Dow Jones gained 37 points. Investors were assessing the JOLTS report, which showed a decline in July job openings, leading to a fall in bond yields and increasing speculation that the Federal Reserve might implement a 50 basis point interest rate cut in September. Energy stocks were among the biggest decliners, with Exxon Mobil and Chevron falling 1.2% and 1.7%, respectively. Tech stocks also underperformed, with Nvidia dropping 1.6% due to AI concerns, and Intel losing 3.3% after reports of failed silicon wafer tests by Broadcom. Conversely, GitLab surged 21.6% after raising its fiscal 2025 sales outlook to $742-$744 million, exceeding the prior estimate of $733-$737 million.

Fixed income: Treasury futures surged, driven by softer-than-expected July JOLTS job openings and sustained US afternoon trading momentum. Swaps priced in additional Fed easing, steepening the yield curve and briefly disinverting the 2s10s spread. Front-end yields had dropped 10 basis points, while long-end yields were richer by around 6 basis points. This steepened the 2s10s and 5s30s spreads by about 3 and 2 basis points, respectively. The 10-year yield ended at 3.76%, its lowest since August 21. Options tied to the Secured Overnight Financing Rate saw a surge in open interest for call contracts expiring on September 13. The Bank of Canada cut rates by 25 basis points, slightly reducing gains for Canadian bonds; the impact on Treasuries was limited. Over $43 billion of new high-grade bonds were sold, the third-busiest day on record. Spreads on most tightened in the secondary market on Wednesday, with Mastercard Inc.’s $3 billion deal trading 11 basis points tighter. An additional $29 billion of investment-grade notes were priced on Wednesday.

Commodities: Oil prices exhibited significant volatility, with Brent Crude futures closing at $72.70 per barrel, a decline of 1.42%, and WTI U.S. crude oil futures settling at $69.20 per barrel, down 1.62%. This movement comes amid increasing pessimism about future demand, as crude producers provided mixed signals regarding potential supply increases. Both benchmarks initially dropped by $1 before rebounding to gain $1 from Tuesday’s closing prices, following reports that OPEC+ was considering delaying a potential output increase due to anticipated rises in Libyan production. However, they eventually succumbed to selling pressure in the afternoon. Notably, Brent crude futures have plummeted by as much as 11%, or approximately $9, in just over a week. Meanwhile, gold prices edged up by 0.11% to $2,495, and silver increased by 0.81% to $28.27 on a relatively quiet day, as markets await key jobs data.

FX: With risk aversion remaining in play, it was another positive day for Japanese yen. The currency rose 1.2% against the US dollar, and 1% against the Kiwi dollar and Australian dollar each. Gains of another 1.9% also came against the Mexican peso. We wrote about the yen in the FX note yesterday and discussed how it might stand to benefit both from haven flows and risks of carry unwind ahead of the key US jobs data on Friday. Safe-haven Swiss franc was also higher which activity currencies like Australian dollar and kiwi dollar, and the British pound, lagged in the G10 FX leaderboard as markets are starting to worry about risks of a hard landing. Despite a softer US dollar, the euro has not moved above 1.10 and the Canadian dollar hold above 1.35 as the Bank of Canada cut rates for a third time.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.