🥇 GOLD drops 2%

🔽 Gold drops amid lack of further Middle East escalation

Gold and other precious metals are taking a hit at the beginning of a new week. GOLD is trading 2% lower, PLATINUM and PALLADIUM drop around 0.8-0.9%, while SILVER slumps almost 5%! There are no clear news behind the pullback. US dollar is neither strong nor weak compared to other major currencies today. While US yields are slightly higher compared to Friday levels, the scale of this increase does not justify the scale of declines on precious metals.

It looks like the move is driven by receding concerns over further Middle East escalation. Markets feared that the situation in the region will continue to deteriorate after Iran and Israel traded tit-for-tat airstrikes last week. However, no further escalation occurred on the weekend and it seems to be dragging precious metals down. Today's drop in oil prices, with Brent (OIL) trading over 2%, as well as relatively weak performance of safe haven currencies (CHF and JPY) also support this view.

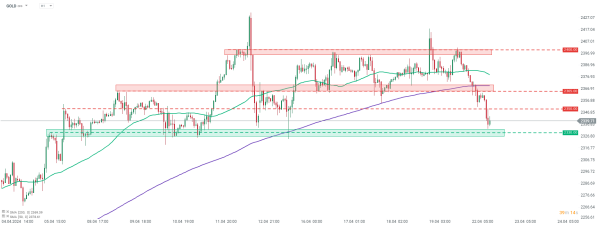

Taking a look at GOLD chart at H1 interval, we can see that the precious metal has been moving lower since the opening of futures market after the week. Price broke below 200-hour moving average (purple line) and continued to move lower. Gold priced slipped to the lowest level in a week and is testing $2,330 per ounce support zone.

Source: xStation5

Source: xStation5