Gold gains 1.5%🪙

📈Precious metal hikes towards new historical highs

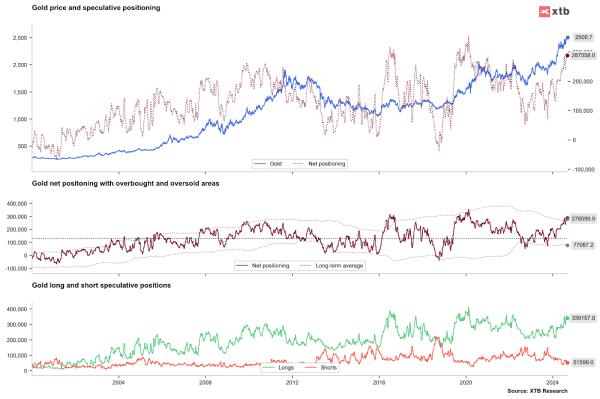

Gold’s price is breaking its recent resistance to achieve new historical highs, remaining in its months-long upward trend. Lower PPI in the US and increasing number of jobless claims are reassuring in terms of the upcoming rate cut in the US. Lower interest intrates in the world’s first economy will lower profitability of the bond market, thus accelerating the demand for the precious metals.

Gold is soaring above the ceeling of the local consolidation, achieving new historical highs. For a moment, it is crucial to sustain the price above the $2530 level to determine if gold will remain in its long term upward trend. Source: xStation5

The European Central Bank (ECB) just lowered interest rates, but didn't give any hints about what they might do next. This caused the euro to become stronger than the US dollar, driving gold prices up.

Historically, gold has often increased in value right after initial rate cuts by the central banks. In the first few weeks, gold prices have typically risen by more than 10%, and they've rarely dropped by more than 5%. Over the next two years, gold has usually gained about 20% on average. However, the biggest increases have been around 30%, and the biggest decreases have been less than 2%. In some extreme cases, gold has gained more than 40% or lost more than 15% (like in 1984).

Source: XTB Research / Bloomberg Finance L.P.