Gold: glittering trading opportunities on Swiss DOTS

Gold is once again in demand as a safe haven currency and source of inflation protection, with the price per troy ounce recently approaching the USD 2'000 mark. Persistently rampant inflation, geopolitical tension and recent problems in the banking sector are all good arguments for an upward breakout. On the other hand, additional interest rate hikes by central banks could thwart the progress of the most important precious metal. Swiss DOTS, Switzerland’s leading OTC marketplace for leveraged securities, offers a full range of possibilities. Traders can use the products traded on Swiss DOTS to bank on both a continuation of the gold rally as well as falling prices.

This spring could be anything but relaxing for Jerome Powell, Christine Lagarde and Thomas Jordan, as the heads of the Fed, EXBCB and SNB undergo a kind of stress test. On the one hand, inflation rates in the USA, eurozone and Switzerland remain well above the levels targeted by central banks. The resulting interest rate hikes, combined with current geopolitical tensions, pose a threat to the global economy. As if these problems and flashpoints were not significant enough already, another story emerged in mid-March as the collapse of Silicon Valley Bank (SVB) caused genuine shockwaves to ripple through the global capital markets from California.

The failure of the start-up financier brought back bitter memories of recent financial crises. Just a few days after SVB’s shutdown, Credit Suisse began to falter significantly after ailing for some time. The SNB was only able to provide temporary stability by injecting CHF 50 billion of liquidity into the major Swiss bank. Only an emergency takeover by UBS supported by the SNB and Swiss government prevented the situation from deteriorating further. With share prices across the entire banking sector under significant pressure, this array of challenging situations provided a boost to arguably the most popular safe haven asset of all. In March, the price of a troy ounce of gold increased by as much as 10%. As a result, the precious metal passed the USD 2'000 mark for the first time in about a year.

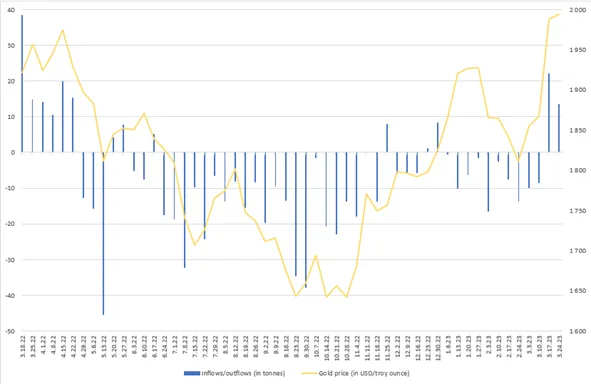

This new run on gold is also reflected in the volume of corresponding investment products. “Physically-backed gold exchange-traded funds (gold ETFs) are an important source of gold demand, with institutional and individual investors using them as part of well-diversified investment strategies,” explains the World Gold Council (WGC). Figures from industry associations show that inflows for these products soared in March. Specifically, providers of gold ETFs topped up their vaults by more than 35 tonnes in the space of two weeks (see chart). The segment recorded significant outflows in the previous two years, with global gold ETF holdings shrinking by a combined total of almost 300 tonnes in 2021 and 2022.

At the same time, the WGC attested to a marked surge in demand within the overall market during the past year, with 4'741 tonnes of gold sold worldwide — 18% more than in 2021. This volume was only slightly below the record figure recorded in 2011. On the one hand, the market was boosted by buyers who used gold bars and coins to brace themselves against inflation and geopolitical upheaval. Demand in this area rose by 2% to just under 1'107 tonnes in 2022. At the same time, central banks acquired an unprecedented amount of gold, increasing their holdings by 1'136 tonnes overall. This made these institutions net buyers of gold for the 13th successive year. “Geopolitical uncertainty and high inflation were highlighted as key reasons for holding gold,” said the WGC, explaining the behaviour of this buyer group.

As it is obviously not yet possible to give the all-clear in either of these areas, the industry association’s forecast did not come as a surprise: “Looking ahead, we see little reason to doubt that central banks will remain positive towards gold and continue to be net purchasers in 2023.” While the WGC shared this expectation even before the latest turbulence in the banking sector, there is also a counterpoint to the gold bulls’ arguments. Above all, further interest rate rises and a stronger US dollar could thwart the progress of the troy ounce. As gold does not generate any income itself, the opportunity costs for holding this precious metal increase with each additional basis point of return.

The latest round of monetary policy decisions shows that the battle against inflation has not yet been won. The ECB kicked things off by raising its key rate by 50 basis points to 3.50%. A few days later, the US Federal Reserve lifted its funds target rate for the ninth successive time to a range of 4.75% to 5.00%. Meanwhile, the Bank of England announced its 11th successive rate hike, with its key rate most recently rising to 4.25%. Even the SNB did not shy away from this trend despite the turbulence swirling around Credit Suisse, lifting the key rate by 50 basis points to 1.5% as part of their first monetary policy assessment of the year. “It cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability in the medium term,” the Swiss National Bank explained in a press release.

Despite the rigorous decisions made by central banks in March, there are indications that interest rates could reach their peak sooner rather than later.

This is particularly true of the USA, where the Fed has deleted the passage in its statement that outlines when further rate hikes might be appropriate. The Federal Open Market Committee headed by Fed president Jerome Powell is now suggesting that “some additional policy firming” may be appropriate. What is certain is that US interest rate expectations have shifted considerably in recent weeks. As recently as the end of February, it seemed a foregone conclusion that the cycle of monetary policy tightening would continue and the target rate would climb well above the 5.00% mark. According to the CME FedWatch Tool, the futures markets are not pricing in any further rate hikes. On the contrary, the Fed could lower interest rates in July. The probability of this happening has increased from 0% at the end of February to more than half today.

Movements in this well-regarded instrument are likely to continue influencing stock exchanges in general and the gold price in particular. Looking at the charts, the troy ounce managed to break free of a downward trend with its recent advances. The latest trend originated in March 2022, when the precious metal came within USD 30 of its all-time high from 2020. If gold prices are to take another run at this historic peak, they first need to pass the USD 2'000 mark.

Regardless of whether traders want to take a long position or are expecting prices to trend downwards once again, they can find the right instruments for any strategy on Swiss DOTS. One call warrant (Valor 122514461) from Bank Vontobel has a strike at exactly USD 2'000. This instrument, due in September, currently has a leverage of 9.3. Anyone wishing to take a more aggressive approach could opt for the call expiring in June (Valor 111039663), which boasts leverage of more than 13 with an identical strike.

The vast pool of Société Générale leveraged securities traded on Swiss DOTS includes a put warrant (Valor 123853969) on gold. With a strike of USD 2'000 and a maturity in mid-September, this product turns falling gold prices into profits with a generous leverage of 17.6. Another variant (Valor 123853971) generates even more money, with almost a quarter less leverage. The same principle applies to each of the products outlined above: if the underlying calculation does not come off, heavy losses await.

Gold: Price vs. ETF inflows and outflows

(weekly, in USD or tonnes)

Gold: bucking the downward trend

(in USD per troy ounce)

Swiss DOTS is Switzerland’s leading OTC platform for leveraged products. The gold derivatives presented here are just some of more than 90'000 ideas you can trade affordably between 08:00 and 22:00 each day from CHF 9.00 flat/trade.