Gold in Focus After Easing Inflation

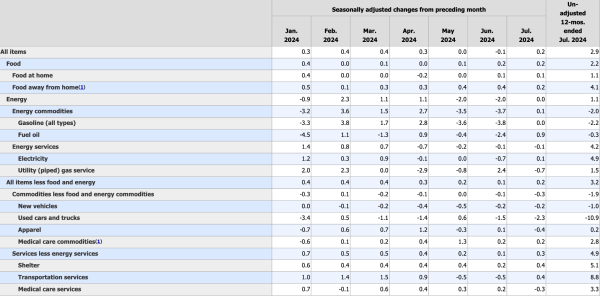

The financial markets have finished the second week of August, after receiving mild CPI report from Wednesday. Overall inflation rate had declined to 2.9% in July, whereas CPI index had slowed down it’s growth rate to 0.2%, which was already priced in.

Energy assets have stopped falling for the first month since May 2024, signaling a potential pivot for Crude oil and Natural gas. Inflation and CPI in August have chances to bounce back, but, at least for now, inflation is easing, and that pushes the US dollar index down, as well as yields of 30-year treasury bonds for the United States. Probabilities of interest rates for September have shifted back again to a single step decline.

Markets wobbled, with no significant rise of volatility. VIX, volatility index of S&P500 had dropped to 15 after a sharp growth to 65 at the begining of August. Stocks have bounced back with techs leading the rally, and Nasdaq getting back to 19500.

Market fear still remains to stay at high level inspite of the momentum for tech stocks.

There is an increased probability of volatility getting back, as market breadth and strength remain questionable. Under these circumstances, it’s possible to observe the pullback for techs (whcih we’ve been talking about in a previous review).

There are basically two models of working with increased volatility: selling equities or equity indices (via CFDs, for example), or buying defensive assets, such as Gold and treasury bonds. At the present moment, bonds might represent decent opportunities for a trader, but Gold is another option, more familiar to traders.

Gold

Gold can be a perfect protection against the strorm, but traders have to remember that when volatility goes up, first all investment assets move down except the US Dollar (which is not happening always, but it’s rather a rule than exception). After the initial panic, Gold starts to climb, as stocks continue moving down.

The support area of $2400 may provide a support before the next upswing, as displayed on the chart. Technical price action tends to stay strong, but Gold is locked in a consolidation in between $2400 and $2450, so the final breakout of this consolidation would probably be to the upside.

Events to keep an eye on: Building permits and Michigan Consumer Sentiment index on Friday, August 16th, 2024.