Gold Lower As Traders Eye FOMC Mins & CPI

Gold Correction Deepens

Gold prices continue to grind lower from recent record highs ahead of tonight’s FOMC minutes. The US Dollar recovery has been gathering pace over the last week as traders scale back their November easing expectations in line with better US Data. A stronger set of labour market data last week helped dismantle market pricing for a deeper .5% cut in November, with traders now eyeing a .25% cut as the base case scenario with a small risk that the Fed stays on hold. Against this backdrop, USD has been squeezing late shorts, a dynamic which looks likely to continue this week unless we get any surprises.

FOMC Minutes Tonight

Despite the .5% cut at the last meeting, the tone of the statement was not conclusively dovish. As such, traders will be looking for greater clarity today around the amount of support for further, aggressive easing ahead of year end. If discussions were seen centering around having time/room to wait after that cut, USD looks likely to rally near-term, pulling gold prices lower.

US CPI Tomorrow

Beyond tonight’s FOMC minutes, the bigger focus will be tomorrow’s US CPI release. Any stickiness around prior levels, or a fresh uptick, should see traders further reigning in easing expectations, sending gold firmly lower. However, if we get a downside surprise tomorrow, this will muddy the outlook, causing a repricing of rate-cut expectations, sending USD lower and allowing gold to turn higher again.

Technical Views

Gold

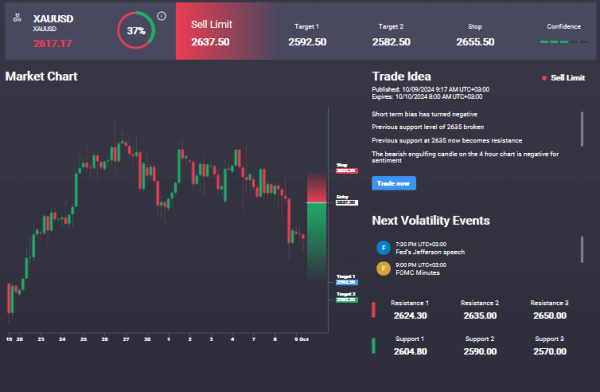

The market continues to correct lower from recent highs with price now approaching a retest of the broken bull channel highs. Below there, 25.30.59 is the next structural support to watch. While above here, focus is on further upside. Below, 2.483.27 will be next support to watch. In the Signal Centre today we have a sell limit at 2637.50, suggesting a preference to fade any bounces and stay short for lower levels.