Gold Prices Soar to an All-Time High

Stronger-than-expected manufacturing data from the United States published yesterday (Monday, April 1st, 2024), pushed the price of Gold (XAU) to new record highs slightly above $2,265 an ounce, as it reinforced many market participants’ belief that the FOMC members could start cutting interest rates next June.

This fresh economic data comes after a key inflation gauge for the Fed published last Friday (March 29th) showed that the core Personal Consumption Expenditures (PCE) came out in line with expectations for February at 2.8% year-on-year, moving towards its 2% target.

What other factors might have supported this precious commodity’s price? Can the rise continue in 2024? Let’s take a closer look:

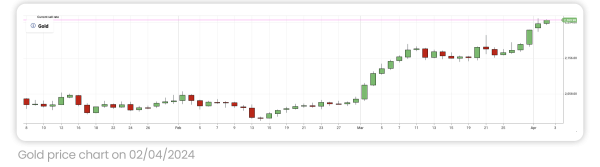

Gold Price Snapshot of 2024: April 2nd, 2024

Gold (XAU) has been trading within a relatively bullish market since the beginning of 2024. The commodity started the year at $2,063.15 and is trading at $2,257.45 at the time of writing (April 2nd, 2024). So far this year, the lowest level reached by the precious metal was $1,984,26 (on February 14th, 2024), while its all-time high was touched yesterday at $2,265.49 (April 1st, 2024).

What Might Have Pushed Gold Prices Higher?

As speculation around the US interest rate cuts’ calendar has been intensifying in recent weeks, with economic data showing that the Fed is likely on the right track to slow down inflation over time towards its target, Gold prices have been rising, mostly due to its negative correlation with interest rates. When rates fall, Gold tends to become more appealing compared to fixed-income investments, as lower rates mean that those investments offer weaker returns.

Other factors might also contribute to moving Gold prices higher, like overseas demand, especially among Chinese investors wanting to add Gold to their portfolio to offset the local real estate sector and the stock market’s poor performance. Impressive central banks’ purchases of Gold in 2022 and 2023, which have supported Gold prices over the last couple of years, are also expected to continue in 2024.

Bullish or Bearish: Is Gold Poised for Continued Growth in 2024?

Gold prices have already surpassed JPMorgan (JPM)’s price prediction published in January 2024 which predicted $2,175 an ounce by the end of 2024, as well as UBS Group (UBSG)’s 2024 target price of $2,200 per ounce forecast in February 2024. Will it now move towards Citigroup (C)'s forecast of a Gold price of $3,000 per ounce by June 2025?

Several factors could support this bullish trend for Gold, including a potential continuation of intensive central bank Gold purchases, the risk of relatively slow global economic growth coupled with high inflation and increasing unemployment (a situation known as stagflation), and higher American Dollar and Treasury yields due to a longer-than-expected adoption of restrictive monetary policy in the United States.

Additionally, geopolitical tensions and the outcomes of various elections worldwide could further support Gold prices by potentially threatening current trade dynamics and economic uncertainty, thus reinforcing its status as a safe-haven asset. (Source: Bloomberg)

Conclusion

Gold has already gained 9.42% since January 2024 and is up around 38% from a low reached after a relatively significant downward leg in 2022. Moreover, it has recorded its best two quarters since 2016.

Traders might want to be careful when considering adding Gold to their portfolio, as this rapid appreciation, especially since mid-February, could suggest a potential overvaluation. Moreover, there are still factors that could weigh on its price.