Gold Rally Continues As Traders Await FOMC Minutes

Gold Rally Continues

Following the breakdown early last week, gold prices have since rebounded and are traidng firmly this week. The downturn in the US Dollar on the back of Thursday’s weaker-than-forecast US retail sales data has helped fuel a recovery across the board in commodities, with gold price benefiting nicely. Despite a hotter-than-forecast inflation reading early last week, it seems that traders are focusing on the chink in the armour with January’s dismal retail sales release being viewed as a potential omen for forthcoming economic weakness.

Shifting Fed Expectations

USD has been well supported in recent months amidst a continued stream of strong US data and relatively hawkish Fed commentary. Fed members have continued to outline their commitment to keeping rates at current level while needed to bring inflation down. Robust economic readings have helped quell the argument that Fed tightening would lead to a recession. However, the post retail sales reaction shows that the market is highly sensitive to downside risks and should we see any further US data weakness, this is likely to drive USD down lower, allowing gold prices room to run higher.

US Data on Watch

Looking ahead this week, traders will be watching the release of the latest FOMC minutes, due tomorrow, along with US PMI readings on Thursday. If the minute show the Fed having moved any closer to starting easing, this will be firmly bullish for gold, as will any fresh weakness in PMI readings. A hawkish tone to the minutes, however, or upside surprise in Thursday data, will likely see the gold rally softening near-term as USD recovers.

Technical Views

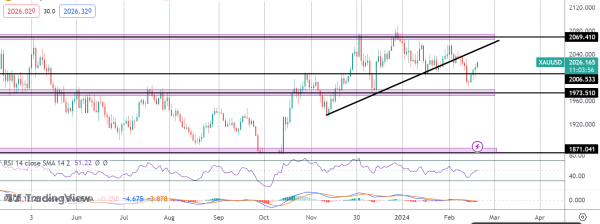

Gold

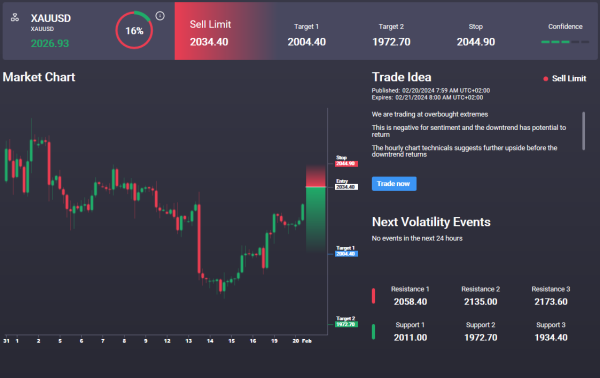

The market is now moving firmly back above the 2006.53 level and with momentum studies turning higher, the focus is on a continuation north and a test of the broken bull trend line and the 2069.41 level. To the downside, 1973.51 remains the key support to note below current lows. Notably, the Signal Centre is giving a sell signal a touch above market at 2034.40 today, suggesting a preference to fade current strength.