Gold (XAU) Daily Forecast: $2,720+ Level Secured with Bullish Momentum—Is More Upside Ahead?

Market Overview

Gold prices soared above $2,720 per ounce on Friday, driven by mounting geopolitical tensions in the Middle East and growing uncertainties surrounding the upcoming U.S. elections.

According to Alexander Zumpfe, a precious metals trader at Heraeus Metals Germany, “With conflict intensifying, particularly following Hezbollah’s declaration to escalate the war, investors are increasingly turning to gold as a traditional safe haven.”

Geopolitical Concerns and Policy Expectations Boost Safe-Haven Appeal

The ongoing conflict, compounded by pledges from Israel and Hezbollah to continue fighting, has heightened market fears. Investors are seeking stability in gold, amid risk aversion and concerns over global market instability. The rising tension has effectively dashed hopes for a swift end to the hostilities.

Zumpfe noted that “anticipation of more relaxed monetary policies is adding fuel to the rally.” Traders are closely watching central banks, as lower interest rates enhance gold’s appeal, given it yields no interest on its own.

Gold’s price surge this year has been remarkable, with gains exceeding 30% in 2024—marking its strongest annual performance since 1979, according to data from LSEG.

Central Banks Poised for Further Rate Cuts

According to market sources, the European Central Bank (ECB) is likely to cut rates again in December, unless economic indicators show a robust improvement.

The CME FedWatch Tool shows traders pricing in a 92% probability of a rate cut by the Federal Reserve in November. Analysts expect such policy adjustments to bolster gold prices further.

Citi Forecasts Gold Reaching $3,000 in 2024

Max Layton, Global Head of Commodities Research at Citi, predicts that gold could reach $3,000 per ounce within six to twelve months.

Layton attributes this projection to heightened economic uncertainty in the U.S. and Europe, which he expects to drive increased investment demand and higher ETF inflows.

With multiple factors aligning, gold’s outlook remains firmly bullish. It continues to assert itself as a premier safe-haven asset amid global economic and political turmoil.

Short-Term Forecast

Gold prices are expected to stay strong above $2,715, driven by geopolitical tensions and central bank policy expectations, with resistance levels targeting $2,736 and beyond amid positive market sentiment.

Gold Prices Forecast: Technical Analysis

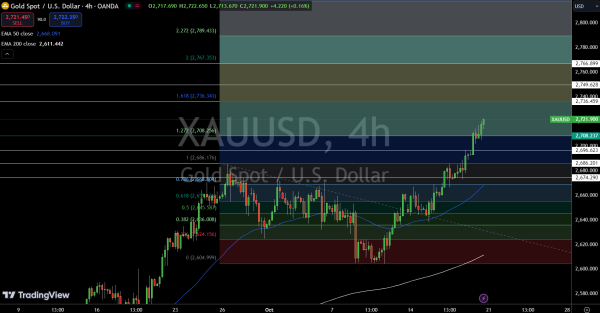

Gold prices hover around $2,720, showing strong upward momentum after surpassing key levels. On the 4-hour chart, gold has broken through the 127.2% Fibonacci extension, indicating further upside potential. The next resistance sits at $2,736.46, and a push beyond this level could target the $2,749 to $2,766 range.

Technically, the 50-day EMA at $2,668.09 and the 200-day EMA at $2,611.44 suggest continued bullish support. Immediate support holds firm at $2,696.62, and breaking below $2,715 could signal a shift in sentiment, prompting a potential sell-off.

For now, the trend remains positive above $2,715, with cautious optimism as long as key support levels hold.