Greenback Rallies as Opponents Weaken Amid Technical Correction

The US Dollar Index (DXY), a crucial barometer of the Greenback's strength against a basket of major currencies, tested 104.50 mark on Monday. This appreciation is largely attributed to market participants' anticipation of the Federal Reserve's upcoming policy decision. While the consensus expects the Fed to maintain its interest rates in the 5.25%-5.50% range, traders are particularly attuned to the nuances in the Fed's communication regarding future rate cuts.

Recent macroeconomic indicators, such as the Flash Q2 GDP report and core PCE inflation data, have fueled speculation about the Fed's next moves. The GDP Price Index showed a sharper than expected deceleration to 2.3%, which dovetails with the narrative of subsiding inflationary pressures. Coupled with a modest increase in the core PCE index, these data points suggest that inflation is easing, potentially giving the Fed room to contemplate a rate cut later in the year.

However, the Fed's approach remains cautious. The labor market, while robust, shows signs of cooling—a factor that Fed Chair Jerome Powell and his colleagues will likely address in their policy statement and subsequent press conference. Market observers are keenly awaiting any hints of the Fed’s willingness to embark on a rate-cutting cycle, possibly starting in September, to cushion against economic headwinds.

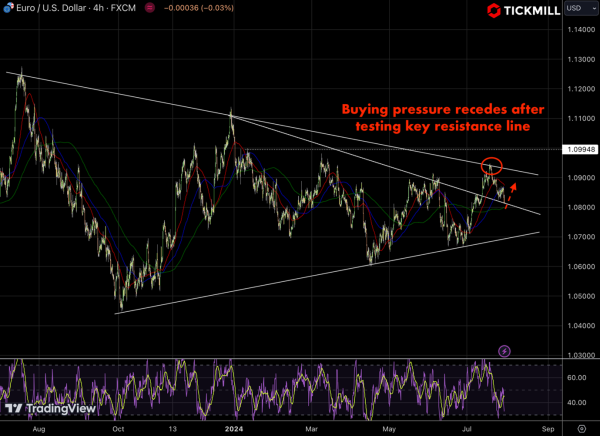

The EUR/USD pair has recently experienced a pullback after testing a significant descending trendline, which has acted as a resistance level around the 1.1000 region. This rejection suggests a waning buying pressure at that level, as indicated by the chart. However, the price has retreated towards a previously established resistance line, now potentially serving as a support near the 1.0800 mark. This could provide a base for a short-term recovery, especially if the price holds above this line and shows signs of stabilizing. The RSI indicator shows the market is approaching oversold conditions, which may further support a rebound scenario if buying interest resumes. Traders should watch for a potential bullish reversal pattern around this support area, which could signal the start of a new upward momentum:

Simultaneously, the British Pound has been losing ground against the Dollar, dropping to a fresh two-week low around 1.2810. The dip in GBP/USD reflects broader market sentiment and the Greenback's strength. Yet, it also highlights concerns specific to the UK economy and the Bank of England’s policy trajectory.

The BoE faces a challenging landscape. Although headline inflation in the UK has moderated to around the desired 2% target, inflationary pressures in the services sector remain elevated. This persistence in service inflation complicates the BoE's task of normalizing monetary policy without stifling economic growth. Market participants are closely monitoring the BoE’s signals, weighing the likelihood of rate cuts against the backdrop of these inflationary pressures.

The GBP/USD pair has recently faced a pullback after encountering resistance near the 1.3000 level, coinciding with the horizontal resistance visible on the chart. This retreat has led the pair towards a previous resistance area, now anticipated to act as a support around the 1.2800 region. The current price action suggests that this area could serve as a retracement target, providing a potential buying opportunity if the support holds. The Relative Strength Index (RSI) indicates that the pair is approaching oversold conditions, which could attract buyers looking for value at these levels:

As traders dissect central bank rhetoric, several upcoming economic releases will provide further clarity on the economic landscape. The JOLTS Job Openings, ADP Employment Change, ISM Manufacturing PMI, and Nonfarm Payrolls data are all on the docket.