Honeywell to spin off advanced materials division; stock gains 1.6% 📣

Honeywell International (HON.US) announced plans to spin off its advanced materials division into a separate publicly traded company by early 2026. The division, which produces products like Solstice brand refrigerants and industrial solvents, is expected to generate approximately $3.8 billion in revenue in 2024, accounting for about 10% of Honeywell's total sales. The move aligns with CEO Vimal Kapur's strategy to streamline the company's focus on its three main segments: aviation, automation, and the energy transition. The standalone advanced materials business could be valued at over $10 billion.

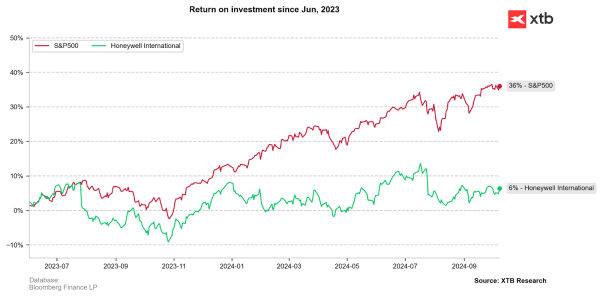

The spin-off aims to provide greater financial flexibility for future acquisitions, complementing recent purchases totaling over $8 billion including Carrier Global Corp.'s security business for almost $5 billion, CAES Systems Holdings for $1.9 billion, and Air Products and Chemicals Inc.'s liquefied natural-gas technology unit for $1.8 billion. Under CEO Vimal Kapur's leadership since June 2023, Honeywell is refining its portfolio to capitalize on industry megatrends, although the stock's performance has lagged behind the S&P 500's during the same period.

Honeywell (D1 interval)

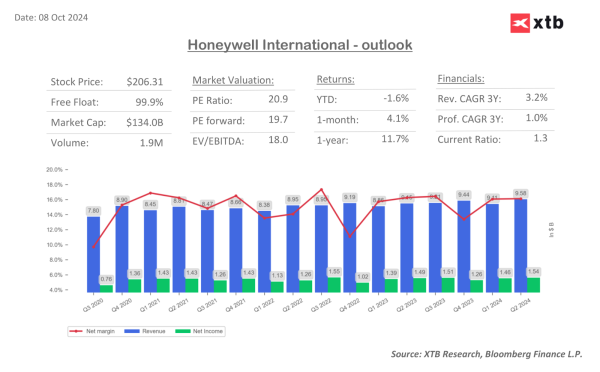

Following the announcement, Honeywell's shares rose nearly 3% in premarket trading to around $207. Currently, the stock has settled at about $206, up approximately 1.6%.