How big a problem is Nvidia’s antitrust probe?

Key points

- Nvidia shares tumble on DOJ antitrust probe: Nvidia shares fell nearly 10% after the DOJ expanded an antitrust probe into the company's business dealings, raising concerns among retail investors. Nvidia responded by emphasizing its superior product value, though shares remain down in pre-market trading.

- Antitrust cases are difficult to win: Antitrust cases since the late 1970s have focused on consumer welfare rather than market power, making them hard to win outright. History suggests these cases have little long-term impact on business performance, and Nvidia's outlook is unlikely to change significantly in the short term from the antitrust probe.

- Increased recession risk weighs on semiconductor stocks: A weak ISM Manufacturing report heightened concerns of a recession, which could severely impact capital-intensive industries like semiconductors. Nvidia's share price may be reacting to this growing recession risk in addition to the antitrust probe.

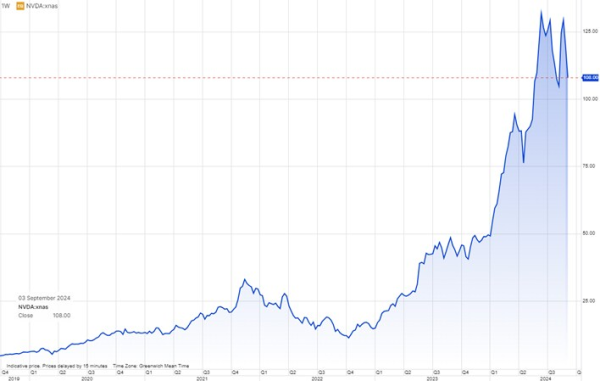

Nvidia shares tumble almost 10% on DOJ antitrust probe

US equities fell more than 2% yesterday driven by Nvidia shares down almost 10% as the DOJ sent a subpoena to Nvidia in an antitrust probe extending the case from previously just questions about Nvidia’s business dealings. The decline yesterday happened under more or less average volume potentially suggesting that the price pressure came from retail investors as we would likely have seen higher volume if institutional investors were also panicking about the antitrust probe. Nvidia said in an emailed statement to Bloomberg that it wins on merit and superior product value to customers. Nvidia shares are down 2% in pre-market trading.

The history of antitrust cases is murky

When idiosyncratic events hit a company it is important that an investor thinks about the base rate of the event. In other words, can we use history to infer the likelihood of this event causing a dramatic impact on the business.

The big picture is that the number of antitrust cases since the late 1970s has declined steadily as the enforcement of antitrust changed from focus on market power, which was the dominant characteristic behind the Standard Oil antitrust case, to that of consumer welfare protection. It was not seen as bad to have market power if it did not cause harm to consumers with Amazon and Walmart being cases of this new view that took hold after the late 1970s. Since then all statistics show that industry concentration, the amount of market share concentrated among a few companies, has gone up and up.

As long as antitrust laws focus on consumer welfare benefits and not market power government prosecutors know that cases are difficult to win outright. Therefore the recent strategy has involved an aggressive litigation strategy that sometimes can force companies to settle and change a little bit. But recent evidence from antitrust cases against big US technology companies shows that antitrust probes have little impact on the long-term business. Antitrust cases also take years which means that by the end of the case the industry has already changed so much that it makes little difference.

It is important to understand that this probe is not going to fundamentally change Nvidia’s outlook in the short-term. Investors should not ignore this risk, but they should not panic either. There are other key risks to consider including growing competition over time (the technology industry is collaborating to loosen Nvidia’s grip on the market) and a recession.

Higher recession probability also plays a role

Adding to the negative sentiment in semiconductor stocks including Nvidia was also the weak ISM Manufacturing report for August showing that new orders are now the weakest since early 2023 and on par with the 2012 period and the 2008 just before the credit crunch started after the Lehman Brothers bankruptcy. These figures raise the recession probability for at least the capital goods part of the economy. Why does that matter for Nvidia? Semiconductors are more sensitive to a recession than other industries because it is a capital intensive industry driven by long-term projects. In a recession companies will cut down on capital expenditure projects like semiconductors quickly and semiconductors are also used in every consumer device in the world so demand falls quickly in a recession. This scenario is likely also playing a role in Nvidia’s declining share price.

Previous weekly equity market updates

- Nvidia earnings: "Sees incredible demand for new Blackwell chips" (28 August 2024)

- Nvidia earnings will show another quarter of explosive growth (23 August 2024)

- The big rebound in equities, Palo Alto earnings on tap (16 August 2024)

- European banks: Strong Q2 earnings as rate cuts loom (14 August 2024)

- Low recession probability, strong earnings, and US inflation (9 August 2024)

- Election drama, Tesla bounce, and earnings kick-off (5 July 2024)

- US election heats up, Alfen rout, and Micron earnings (28 June 2024)

- French election, king Nvidia, and FedEx earnings (21 June 2024)

- Tech rally, inflation surprise, and EU trade war (14 June 2024)

- AI bonanza drives new highs and dangerous index concentration (7 June 2024)

- Chinese setback, AI woes, and ECB decision (31 May 2024)

- Nvidia earnings, electrification boom, and bubbles (24 May 2024)

- New all-time high on speculative stocks comeback (17 May 2024)