How private lenders are winning the margin game

Highlights

- Spread between weighted average lending rate and deposit rate has widened for private sector banks

- Public sector banks have seen spreads narrow as they hiked deposit rates faster, also lost deposit market share

- Private sector banks have been more pragmatic in their deposit rate hikes

- High share of EBLR priced loans has helped private sector banks to get a better yield on their loans

- In coming months, public sector banks may get a boost from corporate loan growth

India’s private sector banks are managing their balance sheet in a deft manner to keep their net interest margins steady or even improve them amid the pressure to shore up deposit growth and meet growing credit demand. Public sector lenders, on the contrary, seem to be struggling on this front.

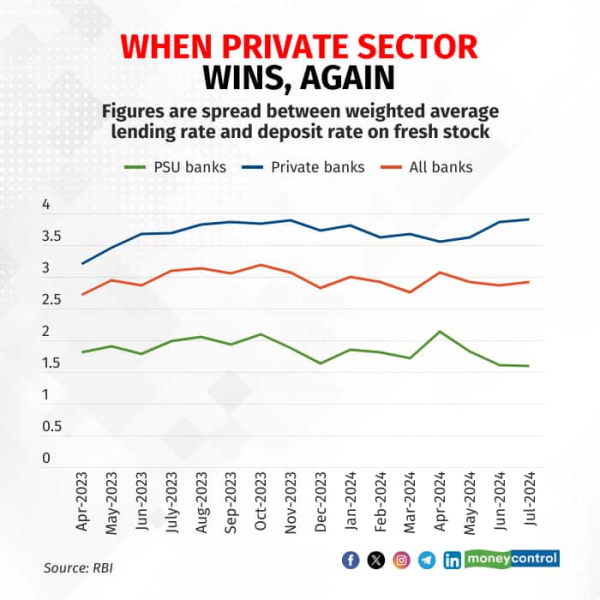

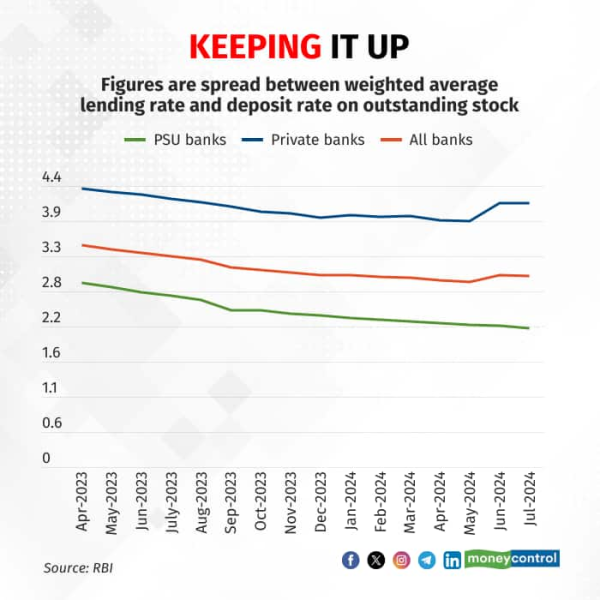

In July, the spread between the weighted average lending rate and the weighted average term deposit rate expanded for private sector banks, both in case of fresh and outstanding loans and deposits, latest data on lending and deposit rates from the Reserve Bank of India show. The spread for private sector banks widened marginally to 3.90 percent from 3.87 percent in June. Since April, the spread has widened by 28 basis points. A basis point is one hundredth of a percentage point. That is because private sector banks were able to charge a higher lending rate to borrowers amid a tightening liquidity situation. At the same time, lenders limited the hike in deposit rates and some even refrained from deposit rate hikes.

Loan-deposit rate spread increases for private sector banks

Loan-deposit rate spread increases for private sector banks

On the other hand, public sector banks saw their spreads contract on a month-on-month basis and shrink 54 basis points for the April-July period on fresh loans. While the weighted average lending rate for public sector banks has shown an increase, lenders have had to hike deposit rates by a big margin which has in turn compressed margins. The chart below and above shows how the spreads have evolved for lenders over the past one year.

PSU banks are falling behind private sector on margins

PSU banks are falling behind private sector on margins

Public sector banks continue to lose market share in deposits and credit to private sector banks. It is clear that public sector banks are under more duress to raise deposits or are resorting to high-cost bulk deposits in order to meet credit demand. As of June, the share of public sector banks in total deposits was down to 58 percent, down from 59 percent as of March and 61 percent at the end of FY23.

On the loan book side, there are a few factors that are working for private sector banks. One, the share of loans priced off external benchmark based lending rate (EBLR) is high in the case of private sector banks. The share of loans priced off EBLR was 83 percent for them while for public sector lenders the share was far lower at 55 percent as of March 2024. This is unlikely to have significantly changed in the June quarter too. Regulations mandate that all retail and small business loans (micro, small and medium enterprises) have to be priced off EBLR while large wholesale loans can still be priced at the marginal cost of funds based lending rate (MCLR).

Banks with high share of EBLR loans have been able to raise lending rates and pass on the RBI’s past policy rate hikes. Also, short-term benchmark rates such as the one-year treasury bill rate, which are some of the benchmarks used to arrive at EBLR, have inched up. Further, retail loans are margin-friendly, especially vehicle loans and personal loans which tend to fatten banks’ margins. Therefore, private sector lenders have been able to get a higher yield on their loan book.

Can private sector banks continue to trump their public sector peers in the margin game?

EBLR can cut both ways. Given tight liquidity and a hawkish monetary policy, lenders have been able to price loans higher. But the RBI is expected to cut policy rates soon which would put downward pressure on EBLR. The upcoming festival season may prompt lenders to give offers on loans which again would pressure margins.

Public sector banks, on the other hand, could see less pressure as their corporate loan book is expected to grow faster. As private capital expenditure grows, the demand for wholesale loans will increase and this has already begun. State Bank of India (SBI) management indicated during their quarterly earnings call for April-June that demand for corporate loans, especially from infrastructure firms, has risen in recent months.

Most banks have indicated that margins may remain under pressure for at least a quarter or two. In the coming months, loan portfolio mix, and the segments that grow would determine which banks are able to manage their margins better. Of course, the fight for deposits is another matter altogether.