Intel gains 2% after unveiling new AI products 🔔

Intel (INTC.US) has introduced its next-generation AI solutions, the Xeon 6 CPU and Gaudi 3 AI accelerator, aiming to challenge Nvidia’s (NVDA) dominance in the AI market. The Xeon 6, built with P-cores, offers double the performance of its predecessor and is designed for AI and high-performance computing, while the Gaudi 3 targets large-scale generative AI applications. Despite the advancements, Intel faces stiff competition from Nvidia and AMD, with Nvidia’s stock up 140% year-to-date, while Intel’s has dropped 50%.

Intel is undergoing a major transformation under CEO Pat Gelsinger, focusing on advanced chip development and expanding its manufacturing capabilities. The company has faced recent challenges, including disappointing earnings and workforce reductions, making it a potential takeover target for Qualcomm. Despite these difficulties, Intel continues to secure significant clients like Amazon and Microsoft for its custom chip business and plans to separate its foundry segment from its design operations to enhance customer confidence.

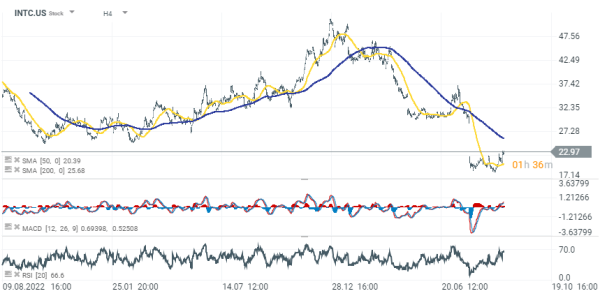

Intel (D1 interval)

Intel stock seems to be stabilizing after significant drops in late July. During August and September, the stock price has been hovering between $19 and $21, and in the last few trading sessions, there's been an attempt to break above this range. The stock is currently up 2.0% on a daily interval.

Source: xStation 5