Investors expect lower volatility; VIX at a glance 🔎

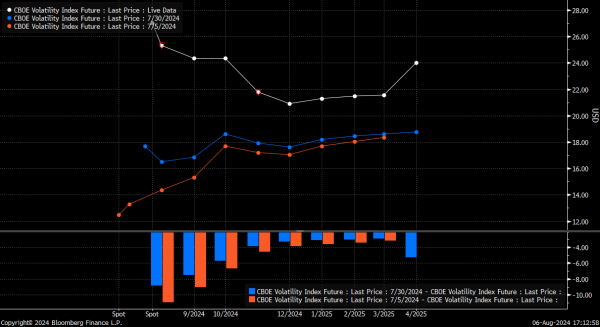

The VIX index experienced a sharp decline from yesterday's peak of around 38 to a current level of 27. This is due to investors perceiving less risk, leading to changes in the prices of options on the S&P 500 index. It is worth noting how the forward curve for VIX index contracts has clearly changed. Just a week and a month ago, the curve was very similar and indicated a slight contango. Currently, the curve has inverted and is in backwardation, which indicates still considerable uncertainty now but expectations of a volatility decline in the near future.

Forward curve for VIX contracts. Source: Bloomberg Finance LP

The VIX contract is dropping very sharply from minute to minute, related to a strong rebound in futures contracts on the S&P 500. The quotes have already fallen to around 23 points, with the closing on Friday. However, it is worth noting that a significant rise started from around 15 points at the turn of the month. Important support levels before this are 20 and 18. Theoretically, at this point, the volatility index has been reduced by 2/3 compared to the start of the previous week, with important support occurring around 20.

It is worth noting that since mid-June, we have observed a significant correlation between the VIX and the US500. A drop in volatility to the level of 20 should bring the US500 back to around 5400 points. However, it must be kept in mind that tomorrow will involve rolling, and this should be negative rolling and should not exceed 1 point. Earlier rollings in May, June, or July were positive, obviously related to a premium for future risk. Currently, it is expected that this volatility will drop from the current level. Source: xStation5