Italian BTPs are more attractive than Bunds in today's macroeconomic context

Summary:

- Italian BTPs are appealing asset in the event of persistent inflation, as they provide a stronger hedge against it.

- Their correlation with the Bunds puts them in a position to also benefit in the event of heightened tensions in the Middle East.

- Concerns about a weak euro leading to a second wave of inflation will limit the ECB rate cutting cycle, weighing on the Bunds and leaving long-term rates volatile.

Despite the ECB's preparations to cut rates, european sovereign bonds continue to decline. This can be attributed to the surge in commodity prices sparked by potential escalations in Middle East conflicts, hinting at sustained or even increased inflation in the latter half of the year.

Inflation plays a crucial role in bond performance. If it remains high, the chances of a bond bull rally are slim, as central banks would struggle to implement aggressive rate cuts. Expectations for Fed rate cuts in 2024 have dwindled from nearly six to less than two, while in Europe, they have decreased from almost seven to three.

Despite expectations that the ECB would be more aggressive in cutting interest rates than the Federal Reserve, this divergence hasn't halted the rise in Bund yields. Starting the year at 2%, ten-year yields have climbed to nearly 2.5%, showing an upward trend that could push them to test resistance at 2.5% and potentially reach 2.75% if breached.

Several factors could drive Bund yields higher:

- Slower progress in disinflation: With core inflation hovering around 3% in the eurozone, the ECB's real policy rate stands at approximately 100 basis points. If inflation persists around this level, the ECB's room to cut rates to stimulate the long end of the yield curve would be limited.

- Uncertainty surrounding the rate cut cycle: Policymakers have signaled their intent to cut rates in June but are managing expectations beyond that to prevent markets from anticipating aggressive cuts.

- Concerns about a weak euro leading to a second wave of inflation: ECB President Lagarde's recent remarks concerning the impact of currency fluctuations on inflation underscores this concern and should not be ignored. A weaker euro is good for European growth, but if it weakens too much it might provoke a rise in inflation. That will limit policymakers ability to cut rates.

Ten-year Bunds still offer an attractive risk-reward profile.

Assuming a one-year holding period, yields would need to exceed 2.8% to result in a loss. Considering the potential for persistent inflation or economic recovery, the upside of such a position in the event of a market downturn or disinflationary trends cannot be ignored. For instance, if 10-year Bund yields were to drop from 2.46% to 1.46%, the position would yield an 11% upside.

Italian government bonds present a compelling opportunity for investors.

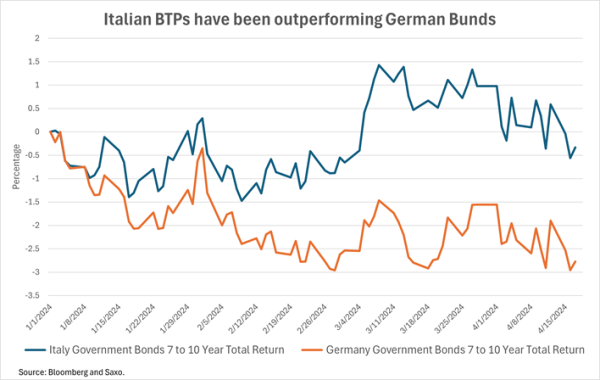

While 10-year Bunds have declined by approximately 2% since the start of the year, Italian BTPs have remained stable. This outperformance can be attributed to the fact that Italian BTPs offer the highest yields among European sovereign bonds.

This high yield makes Italian BTPs attractive as a "safe haven" asset if inflation persists, as they provide a stronger hedge against inflation. Additionally, they would benefit from their correlation with the Bunds in the event of heightened tensions in the Middle East. Recent years have shown that higher yielding fixed-income securities, such as junk bonds, have demonstrated resilience in the face of high inflation.

Considering a one-year holding period, Italian BTPs offer an appealing risk-reward profile:

- 2-year Italian BTPs yield 3.5% (IT0005557084), with yields needing to exceed 12% to result in a loss.

- 10-year Italian BTPs yield 3.9% (IT0005584856), with yields needing to surpass 4.4% to result in a loss.

- 30-year Italian BTPs yield 4.3% (IT0005534141), with yields needing to surpass 4.7% to result in a loss.

Other recent Fixed Income articles:

18-04 Micro Treasury Yield Futures Contracts: a simple way to trade interest rates markets.

17-04 All you need to know about the upcoming 20-year US Treasury auction.

16-04 QT Tapering Looms Despite Macroeconomic Conditions: Fear of Liquidity Squeeze Drives Policy

08-Apr ECB preview: data-driven until June, Fed-dependent thereafter.

03-Apr Fixed income: Keep calm, seize the moment.

21-Mar FOMC bond takeaway: beware of ultra-long duration.

18-Mar Bank of England Preview: slight dovish shift in the MPC amid disinflationary trends.

18-Mar FOMC Preview: dot plot and quantitative tightening in focus.

12-Mar US Treasury auctions on the back of the US CPI might offer critical insights to investors.

07-Mar The Debt Management Office's Gilts Sales Matter More Than The Spring Budget.

05-Mar "Quantitative Tightening" or "Operation Twist" is coming up. What are the implications for bonds?

01-Mar The bond weekly wrap: slower than expected disinflation creates a floor for bond yields.

29-Feb ECB preview: European sovereign bond yields are likely to remain rangebound until the first rate cut.

27-Feb Defense bonds: risks and opportunities amid an uncertain geopolitical and macroeconomic environment.

23-Feb Two-year US Treasury notes offer an appealing entry point.

21-Feb Four reasons why the ECB keeps calm and cuts later.

14 Feb Higher CPI shows that rates volatility will remain elevated.

12 Feb Ultra-long sovereign issuance draws buy-the-dip demand but stakes are high.

06 Feb Technical Update - US 10-year Treasury yields resuming uptrend? US Treasury and Euro Bund futures testing key supports

05 Feb The upcoming 30-year US Treasury auction might rattle markets

30 Jan BOE preview: BoE hold unlikely to last as inflation plummets

29 Jan FOMC preview: the Fed might be on hold, but easing is inevitable.

26 Jan The ECB holds rates: is the bond rally sustainable?

18 Jan The most infamous bond trade: the Austria century bond.

16 Jan European sovereigns: inflation, stagnation and the bumpy road to rate cuts in 2024.

10 Jan US Treasuries: where do we go from here?

09 Jan Quarterly Outlook: bonds on everybody’s lips.