Japanese Yen and Australian Dollar News: AUD/USD Eyes $0.67 on RBA Hold, China Hopes

Household Spending Crucial for a Bank of Japan Rate Hike

On Friday, November 8, Japan’s household spending figures influenced the USD/JPY pair and the Bank of Japan rate path. Household spending declined by 1.3% month-on-month in September after increasing by 2.0% in August. Economists had expected a 0.7% fall in household spending in September.

Decreased household spending may dampen inflationary pressures, reducing expectations for a December BoJ rate hike. Furthermore, the larger-than-expected decline could also affect Japan’s economy as private consumption accounts for around 60% of GDP.

Trump Victory, the Japanese Yen, and the BoJ

While weaker household spending might soften inflation, the recent USD/JPY return to 154 may enable the BoJ to raise rates.

Markets expect the US Federal Reserve to deliver fewer rate cuts in response to Trump’s inflationary policies. This means that the US and Japan’s interest rate differential may narrow less than previously anticipated, allowing BoJ rate hikes without significant market disruption.

In July, the BoJ raised interest rates and cut Japanese government bond (JGB) purchases, leading to the Yen carry trade unwind. Market disruption was broad-based, dragging the USD/JPY below 140 and bitcoin (BTC) to an August 5 low of $49,351.

Yen depreciation could incentivize the BoJ to hike rates as it raises import prices, affecting private consumption.

In June, BoJ Deputy Governor Ryozo Himino discussed the potential influences of a weaker Yen on the BoJ’s rate path, stating,

“Exchange-rate fluctuations affect economic activity in various ways. It also affects inflation in a broad-based and sustained way, beyond the direct impact on import prices.”

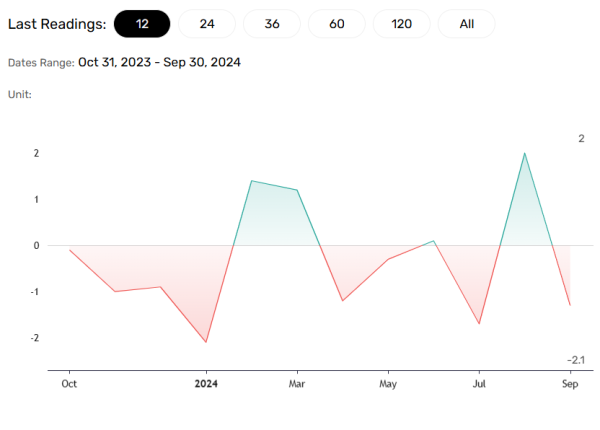

Japanese Yen Daily Chart

Turning to the US dollar, investor focus will shift to the Michigan Consumer Sentiment Index. A continued upward trend in consumer confidence could signal a pickup in spending, fueling demand-driven inflation.

Expectations for higher consumer spending may drive the USD/JPY toward the pivotal 155 level, a potential intervention zone. Conversely, an unexpected fall in consumer confidence might raise expectations for a December Fed rate cut, possibly dragging the USD/JPY toward 152.

Will RBA Assistant Governor Brad Jones Discuss US Election Impact?

Shifting focus to the AUD/USD pair, RBA Assistant Governor Brad Jones is on the calendar to speak. Recent inflation data supported a more dovish RBA rate path as the Monthly CPI Indicator dropped from 2.7% in August to 2.1% in September.

The RBA downplayed a December rate cut during Tuesday’s RBA press conference. However, Trump’s victory in the US election might change the narrative. Punitive tariffs on China could weaken demand from China, and consequently, Aussie exports. Australia has a trade-to-GDP ratio of more than 50%, with China accounting for one-third of Aussie exports.

Support for a December RBA rate cut could pull the AUD/USD toward $0.66.

Expert Views on Aussie Inflation and the RBA Rate Path

AMP Head of Investment Strategy and Chief Economist Shane Oliver commented on Tuesday’s RBA interest rate decision, stating,

“RBA held at 4.35% citing inflation still too high, excess demand & still tight labour mkt. But it revised growth underlying infl forecasts down slightly. Guidance looks balanced. We continue to see first cut in Feb. Dec possible but needs very low Oct trimmed mean and higher unemp.”

Will New Stimulus from China Counter Trump’s Tariffs?

While RBA forward guidance is crucial, stimulus measures from Beijing could impact Aussie dollar demand more.

Markets expect significant stimulus from Beijing to boost demand. Hao Hong, strategist/economist for AsiaMoney, commented:

“Chinese stocks surging again – //heard on the street // big stimulus worth 12 trillion coming: 6tn for local government bond swap + 4tn property bailout + 2tn consumption stimulus. If so, while the first ten trillion was previously discussed here, the 2tn for consumption stimulus is new and is what the market has been hoping for. It shows a change of ways to stimulate the economy. Market cheers.”

The AUD/USD rallied 1.66% to $0.66789 on Thursday, November 7, with speculation about a stimulus package intensifying. Concrete measures targeting consumption could ease concerns over Trump’s tariffs, potentially driving the AUD/USD above $0.67.

Australian Dollar Daily Chart

Shifting our focus to the US session, traders should consider Michigan Consumer Sentiment trends. A higher-than-expected Index rise may reduce bets on a December Fed rate cut, potentially dragging the AUD/USD toward $0.66. Conversely, an unexpected fall may soften US dollar demand, potentially driving the AUD/USD above $0.67.

Traders should stay vigilant, monitoring real-time data and commentary from central banks and experts. Stay updated with our timely insights.