Johnson & Johnson gains after slightly beating expectations for 3Q24 📊

Johnson & Johnson (JNJ.US) released its 3Q24 results today. The company's sales in MedTech segment turned out to be lower than market forecasts, however, on the profitability level J&J positively surprised the market. The company's stock price is approaching the upper limits of the broad downtrend the company has been in since the beginning of this year.

Source: xStation

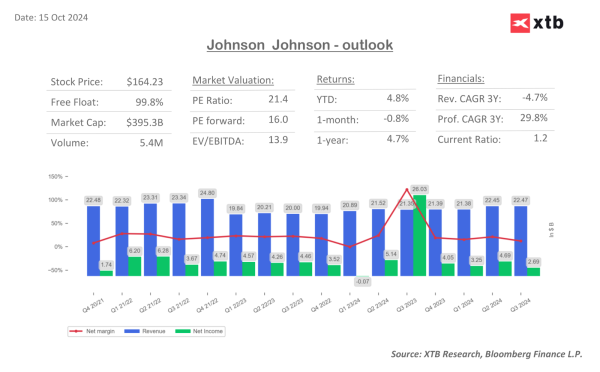

The company reported sales of $22.47 billion, a slight improvement over the previous year (+5.5% y/y). The strongest sales growth was recorded by the Darzalex product, whose revenues increased by 21% y/y. In the MedTech segment, the company reported PLN 7.89 billion, which was weaker than market expectations.

Adj. EPS fared better, coming in at $2.42, beating expectations of $2.19/share. The adjustment included about $3 billion in one-time event costs related to legal and acquisition costs.

Johnson & Johnson lowered its profitability projections for the full year 2024, mainly due to the V-Wave acquisition. The company's new projections call for adjusted earnings per share in the range of: $9.88-$9.98 (vs. previous projections of $9.97-$10.07).

3Q24 RESULTS:

- Sales $22.47 billion, estimates $22.16 billion

- MedTech revenues $7.89 billion, +5.8% y/y, estimates $8.03 billion

- Imbruvica revenues $753 million, -6.8% y/y, estimates $746.2 million

- Darzalex revenues $3.02 billion, +21% y/y, $2.94 billion estimate

- Erleada revenues $790 million, estimate $766.4 million

- Tremfya revenues $1.01 billion, +13% y/y, $1.06 billion estimate

- Remicade revenues $419 million, -9.1% y/y, $324.7 million estimate

- Stelar revenues $2.68 billion, -6.6% y/y, $2.61 billion estimate

- Zytiga revenues $150 million, -30% y/y, $144.2 million estimate

- Xarelto revenues $592 million, -5.3% y/y, $563.5 million estimate

- Simponi revenues $516 million, -18% y/y, $476.9 million estimate

- Adjusted EPS $2.42, estimate $2.19