JPY: BOJ’s Back to Being Dovish – Can it Cool the Yen Short Squeeze?

Key points:

- Bank of Japan Deputy Governor Shinichi Uchida's dovish remarks following the rate hike on July 31 provided relief to markets, resulting in a rebound in Japanese equities and a depreciation of the yen against the dollar. Uchida emphasized that the BOJ would not raise interest rates while markets remain unstable.

- The recent unwinding of yen-funded carry trades was influenced not only by the BOJ’s rate hike but also by heightened US recession fears, which led to concerns about rapid Fed rate cuts. This environment still presents challenges for new carry trades.

- Historically, the yen has appreciated significantly during financial crises. As of August 6, the yen has appreciated about 10% from its recent low. Current positioning in yen remains short, indicating potential for further movement depending on future Fed actions and economic conditions.

Bank of Japan Deputy Governor Shinichi Uchida conveyed a strong dovish stance in the first public statement from the central bank since the rate hike on July 31. He asserted that the BOJ would avoid raising interest rates while the markets remain unstable, after the central bank has been under the radar for its hawkish moves, which sent ripples across the Japanese and global equity markets. Japanese indices plunged into bear markets before a sharp rebound on Tuesday. Meanwhile, the Japanese yen witnessed a sharp strengthening, upending carry trades that were a mainstay for many global funds.

Uchida suggested that the bank will carefully consider the state of financial markets in future decisions on rate policy. He said that authorities in Japan can afford to wait for the markets to calm before making any decisions. “In contrast to the process of policy interest rate hikes in Europe and the United States, Japan’s economy is not in a situation where the bank may fall behind the curve if it does not raise the policy interest rate at a certain pace,” he said. “Therefore, the bank will not raise its policy interest rate when financial and capital markets are unstable.”

Uchida noted that authorities need to monitor any potential impact on prices and the overall economy coming from market moves. The trajectory for Japan’s interest rates could shift depending on that impact.

This was a relief for financial markets. The yen depreciated over 2% against the dollar, bond futures surged, and stocks experienced an immediate rebound.

Markets have reduced the odds of another increase in BOJ’s policy rate by the end of the year. Pricing in swaps markets is now factoring in just 25% odds of a 25bps hike by the December policy meeting, down from more than 75% the day after last week’s meeting.

Is the Yen Short Squeeze Over?

The recent unwinding of yen-funded carry trades wasn't solely driven by the BOJ’s rate hike; that was just one factor. The move was also intensified by US recession fears following the NFP data last Friday, which sparked concerns about a potential US recession and the possibility of rapid Fed rate cuts.

Although today's reversal in USDJPY came with the BOJ adopting a dovish stance, it's unlikely the Fed will turn hawkish in the near term. This environment could still favor carry trades.

Uchida-san's remarks may provide temporary stability for the Japanese equity market, but they can't overshadow the ongoing concerns about US economic data and recession risks. Given the narrowing yield differential between the US and Japan, the Fed would need to make more substantial moves than the BOJ to close that gap—a situation that remains unchanged.

Uchida’s comments might stabilize the yen and Japanese equity markets around current levels, but initiating new carry trades remains challenging due to higher volatility and concerns about the US economy. The risk-reward balance still leans towards further yen strengthening, with the timeline dependent on the Fed's approach to rate cuts. If the US economy’s soft-landing scenario gains traction, yen weakness might resurface. However, as it's an election year, the Fed is likely to step in if economic weakness worsens.

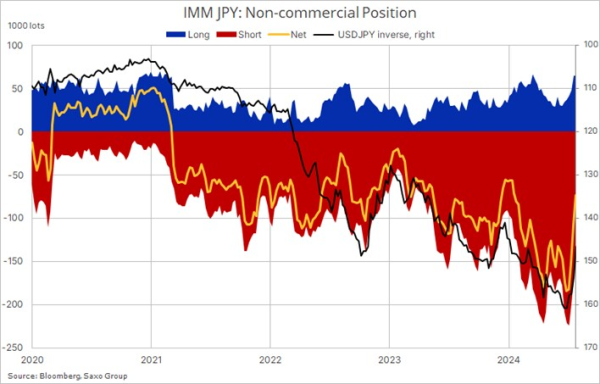

Positioning-wise, many yen shorts have been cleared. While positioning is less extreme, it remains short and could still have room to run. Historically, in 2007, during the sub-prime mortgage crisis, and in 1998, following the collapse of Long-Term Capital Management, the yen appreciated by 20% from its trough. As of August 6, the yen has only appreciated about 10% from its recent low against the dollar.

Disclaimer:

Forex, or FX, involves trading one currency such as the US dollar or Euro for another at an agreed exchange rate. While the forex market is the world’s largest market with round-the-clock trading, it is highly speculative, and you should understand the risks involved.

FX are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading FX with this provider. You should consider whether you understand how FX work and whether you can afford to take the high risk of losing your money.

Recent FX articles and podcasts:

- 6 Aug: AUD: Hard to Buy in RBA’s Hawkishness

- 1 Aug: GBP: Bank of England Cut Won’t Damage Pound’s Resilience

- 31 Jul: JPY: BOJ’s Hawkish Policy Moves Leave Yen at Fed’s Mercy

- 31 Jul: AUD: Softer Inflation to Cool Rate Hike Speculation

- 26 Jul: US PCE Preview: Key to Fed’s Rate Cuts

- 25 Jul: Carry Unwinding in Japanese Yen: The Current Dynamics and Global Implications

- 23 Jul: Bank of Canada Preview: More Cuts on the Horizon

- 16 Jul: JPY: Trump Trade Could Bring More Weakness

- 11 Jul: AUD and GBP: Potential winners of cyclical US dollar weakness

- 3 Jul: Yuan vs. Yen vs. Franc: Shifting Carry Trade Strategies

- 2 Jul: Quarterly Outlook: Risk-on currencies to surge against havens

Recent Macro articles and podcasts:

- 2 Aug: Singapore REITs: Playing on Potential Fed Rate Cuts

- 30 Jul: Bank of Japan Preview: Exaggerated Expectations, and Potential Impact on Yen, Equities and Bonds

- 29 Jul: Potential Market Reactions to the Upcoming FOMC Meeting

- 25 Jul: Equity Market Correction: How to Position for Turbulence?

- 24 Jul: Powell Put at Play: Rotation, Yen and Treasuries

- 22 Jul: Biden Out, Harris In: Markets Reassess US Presidential Race and the Trump Trade

- 8 Jul: Macro Podcast: What a French election upset means for the Euro

- 4 Jul: Special Podcast: Quarterly Outlook - Sandcastle economics

- 1 Jul: Macro Podcast: Politics are taking over macro

Weekly FX Chartbooks:

- 5 Aug: Weekly FX Chartbook: Dramatic Shift in Market Narrative

- 29 Jul: Weekly FX Chartbook: Mega Week Ahead - Fed, BOJ, Bank of England, Australia and Eurozone CPI, Big Tech Earnings

- 22 Jul: Weekly FX Chartbook: Election Volatility and Tech Earnings Take Centre Stage

- 15 Jul: Weekly FX Chartbook: September Rate Cuts and the Rising Trump Trade

- 8 Jul: Weekly FX Chartbook: Focus Shifting Back to Rate Cuts

- 1 Jul: Weekly FX Chartbook: Politics Still the Key Theme in Markets

FX 101 Series:

- 15 May: Understanding carry trades in the forex market

- 19 Apr: Using FX for portfolio diversification

- 28 Feb: Navigating Japanese equities: Strategies for hedging JPY exposure

- 8 Feb: USD Smile and portfolio impacts from King Dollar