JPY: BOJ’s Hawkish Policy Moves Leave Yen at Fed’s Mercy

Key points:

- The Bank of Japan (BOJ) raised its target for the unsecured overnight call rate to around 0.25% from the previous 0%-0.1% range and announced a reduction in its monthly JGB purchases.

- The decision was well-telegraphed, but still hawkish at the margin given that the BOJ has a history of disappointing the hawks.

- The timing of the BOJ’s rate hike appears strategic, particularly if it aligns with indications from the Federal Reserve about potential rate cuts.

- While the BOJ’s announcement wasn’t hawkish enough to markedly strengthen the yen, it also offers little reasons to stay in the bear camp.

- This has left the yen to Fed’s mercy, which is as good as it gets from the BOJ’s side.

The Bank of Japan raised its policy rate and unveiled a plan for reducing its bond-buying. While these policy normalization steps were anticipated by the markets, as discussed in our preview note, the BOJ’s delivery of these measures is still a hawkish outcome, considering its tendency to disappoint on hawkish expectations.

Rate Hike – A Hawkish Delivery Despite Leak

The BOJ raised its target for the unsecured overnight call rate to around 0.25%, a significant shift from the previous range of 0%-0.1%. The move was leaked ahead of the announcement, with Japanese media carrying reports overnight of BOJ considering raising the policy rate to 0.25%. Still, the BOJ delivering on a leak cannot be taken for granted.

This makes the central bank’s rate hike still a hawkish surprise, and aligns with Governor Kazuo Ueda’s focus on solid inflation numbers despite signs of slack demand in the economy. The central bank also said that it will raise rates further if inflation continues to follow its projections, and Governor Ueda's comments that 0.5% is not a rate limit were particularly hawkish and a significant shift in BOJ's stance.

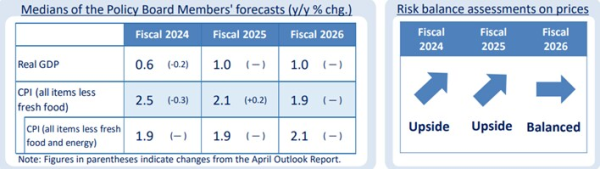

In its quarterly outlook, the BOJ maintained its view that inflation will stay near its 2% target. The central bank expects core consumer inflation, excluding volatile fresh food prices, to reach 2.5% for the fiscal year ending March 2025 (FY24), down from a previous forecast of 2.8%. Projections for core consumer prices in the fiscal years ending March 2026 (FY25) was however raised to 2.1% from 1.9%, while that for fiscal year ending March 2027 (FY 26) was left unchanged at 1.9%. The board assessed the risks are tilted to the upside on its inflation forecasts for FY24 and FY25. Three months earlier, they had said the risks were balanced.

Additionally, the BOJ forecasted the Japanese economy to expand by 0.6% in the current fiscal year, down from an earlier prediction of 0.8%, with 1.0% growth expected for the subsequent two years.

Tapering of Bond Buying – Modest vs. Expectations, but a Clear Timeline Could Fuel Repatriation Flows

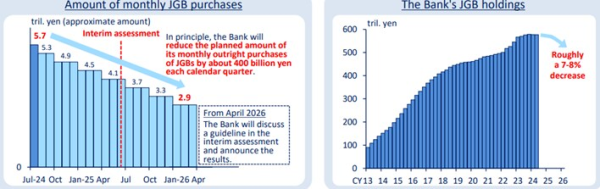

The BOJ also announced a reduction in its monthly Japanese Government Bond (JGB) purchases. Starting in August-September, the monthly purchase amount will decrease to ¥5.3 trillion from ¥5.7 trillion in July and ¥6 trillion currently. The BOJ plans to continue tapering by ¥400 billion each quarter, aiming to reach a monthly pace of about ¥3 trillion by the first quarter of 2026. This move is part of a broader plan to gradually reduce the central bank’s bond-buying program.

The bond-buying tapering appears more modest than expected, with reductions of ¥400 billion per quarter compared to the market's expectation of ¥1 trillion per month (or, ¥3 trillion per quarter). This took some of the hawkish impact out of the announcement today.

Nonetheless, the BOJ’s clear plan and established review timelines provide a structured approach to reducing its bond-buying program. This reduces uncertainty on Japan’s rate path, and may still prove to be attractive to insurers and pension funds to quicken their repatriation of capital as Treasury yields slip lower and currency hedging costs rise.

Yen – Waiting for the Fed

The BOJ’s announcement wasn’t hawkish enough to markedly strengthen the yen, but it also didn’t provide substantial reasons to maintain a bearish stance on the currency. The timing of the BOJ’s rate hike appears strategic, particularly if it aligns with indications from the Federal Reserve about potential rate cuts. With the BOJ’s move offering some support, the yen could be more prone to gain in response to the Fed’s dovish tilt.

USDJPY could peak at 155 if the Fed indicates a September rate cut. Conversely, upside pressures will resurface only if U.S. economic data shows re-acceleration. Risk-reward is however now tilted lower given the Fed is likely to start cutting rates. A break of the 200-day moving average at 151.62 in USDJPY could be key to watch, and a move towards 150 could risk another round of unwinding in carry trades, similar to what we saw last week, further influencing the yen’s trajectory.

Japanese Equities - Still Warrant a Cautious Approach

Although the BOJ's hawkish stance wasn't enough to drive yen gains, it has positioned the yen to potentially benefit if the Federal Reserve adopts a dovish approach. This continues to warrant a cautious approach on Japanese equities, as highlighted earlier in the preview note, given that the index heavyweights could be negatively impacted by any yen strength coming in on the back of Fed’s easing.

However, structural tailwinds for Japanese equities are likely here to stay. This could call for more active management, with exposures tilted towards:

- companies that have high profitability and resilience to FX fluctuations

- domestic demand exposures with real wages accelerating and yen strengthening

- dividend plays amid corporate governance reform to increase shareholder returns

- geopolitical plays or companies that get a tailwind form restriction on China’s exports to US

- -value stocks, and particularly financials, may benefit as BOJ’s policy normalization progresses further in H2

- defense theme could continue to be relevant as US election related volatility increases

- structural themes like energy transition, nuclear and AI-related stocks

Disclaimer:

Forex, or FX, involves trading one currency such as the US dollar or Euro for another at an agreed exchange rate. While the forex market is the world’s largest market with round-the-clock trading, it is highly speculative, and you should understand the risks involved.

FX are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading FX with this provider. You should consider whether you understand how FX work and whether you can afford to take the high risk of losing your money.

Recent FX articles and podcasts:

- 31 Jul: AUD: Softer Inflation to Cool Rate Hike Speculation

- 26 Jul: US PCE Preview: Key to Fed’s Rate Cuts

- 25 Jul: Carry Unwinding in Japanese Yen: The Current Dynamics and Global Implications

- 23 Jul: Bank of Canada Preview: More Cuts on the Horizon

- 16 Jul: JPY: Trump Trade Could Bring More Weakness

- 11 Jul: AUD and GBP: Potential winners of cyclical US dollar weakness

- 3 Jul: Yuan vs. Yen vs. Franc: Shifting Carry Trade Strategies

- 2 Jul: Quarterly Outlook: Risk-on currencies to surge against havens

- 26 Jun: AUD, CAD: Inflation Rising, Can Central Banks Stay on Pause?

- 21 Jun: JPY: Three-Way Pressure Piling Up

- 20 Jun: CNH: China Authorities Loosening their Grip, But Devaluation Unlikely

- 19 Jun: CHF: Temporary Haven Flows Unlikely to Fuel SNB Rate Cut

- 18 Jun: GBP: UK CPI Details and Elections Will Keep BOE on Hold

- 13 Jun: BOJ Preview: Tapering and Rate Hike Talk Not Enough to Boost JPY

- 10 Jun: EUR: Election jitters and ECB rate cut add to downside pressures

Recent Macro articles and podcasts:

- 30 Jul: Bank of Japan Preview: Exaggerated Expectations, and Potential Impact on Yen, Equities and Bonds

- 29 Jul: Potential Market Reactions to the Upcoming FOMC Meeting

- 25 Jul: Equity Market Correction: How to Position for Turbulence?

- 24 Jul: Powell Put at Play: Rotation, Yen and Treasuries

- 22 Jul: Biden Out, Harris In: Markets Reassess US Presidential Race and the Trump Trade

- 8 Jul: Macro Podcast: What a French election upset means for the Euro

- 4 Jul: Special Podcast: Quarterly Outlook - Sandcastle economics

- 1 Jul: Macro Podcast: Politics are taking over macro

- 28 Jun: UK Elections: Markets May Be Too Complacent

- 24 Jun: Macro Podcast: Is it time to diversify your portfolio?

- 12 Jun: France Election Turmoil: European Equities Amidst the Upheaval

- 11 Jun: US CPI and Fed Previews: Delays, but Dovish

- 10 Jun: Macro Podcast: Nonfarm payroll shatters expectations - how will the Fed react?

- 3 Jun: Macro Podcast: It is a rate cut week

Weekly FX Chartbooks:

- 29 Jul: Weekly FX Chartbook: Mega Week Ahead - Fed, BOJ, Bank of England, Australia and Eurozone CPI, Big Tech Earnings

- 22 Jul: Weekly FX Chartbook: Election Volatility and Tech Earnings Take Centre Stage

- 15 Jul: Weekly FX Chartbook: September Rate Cuts and the Rising Trump Trade

- 8 Jul: Weekly FX Chartbook: Focus Shifting Back to Rate Cuts

- 1 Jul: Weekly FX Chartbook: Politics Still the Key Theme in Markets

- 24 Jun: Weekly FX Chartbook: US Presidential Debate is the Big Market Unknown

- 10 Jun: Weekly FX Chartbook: US CPI and FOMC dot plot have a low dovish bar

- 3 Jun: Weekly FX Chartbook: ECB and Bank of Canada likely to cut rates

FX 101 Series:

- 15 May: Understanding carry trades in the forex market

- 19 Apr: Using FX for portfolio diversification

- 28 Feb: Navigating Japanese equities: Strategies for hedging JPY exposure

- 8 Feb: USD Smile and portfolio impacts from King Dollar