July 2024 US CPI Recap: Nothing To Derail A September Cut

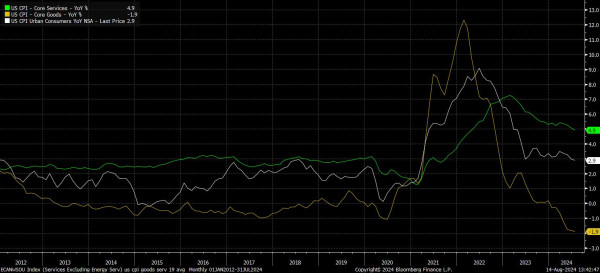

Headline CPI rose by 2.9% YoY in July, a touch below consensus expectations for annual headline inflation to have remained unchanged from its June rate. at 3.0% YoY, and the slowest annual inflation rate since March 2021. At the same time, core CPI – excluding food and energy from the headline gauge – rose by 3.2% YoY, bang in line with consensus, and the lowest rate since April of the same year, while the ‘supercore’ metric rose 4.5% YoY, the slowest annual pace since this February.

Preview

PreviewMeanwhile, on an MoM basis, with the data proving somewhat less noisy, and less prone to distortion from base effects than the annual metrics, headline prices rose by 0.2%, an expected uptick from June’s 0.1% decline, which was the first monthly decline since 2020. Concurrently, core inflation also rose 0.2% MoM, in line with consensus.

Annualising the MoM figures helps to produce a clearer picture of underlying inflationary dynamics, and produces the following:

- 3-month annualised CPI: 0.4% (prior 1.1%)

- 6-month annualised CPI: 2.5% (prior 2.8%)

- 3-month annualised core CPI: 1.6% (prior 2.1%)

- 6-month annualised core CPI: 2.8% (prior 3.3%)

Data of this ilk should continue to provide policymakers with confidence that the disinflationary process is continuing, and that a sustainable return towards the 2% target is in sight, unlocking the door to rate cuts from the September meeting onwards.

Digging into the data a little deeper is likely to provide further relief for policymakers. Goods deflation deepened last month, with core goods prices falling 1.9% YoY, comfortably the fastest annual decline in the last decade, while core services inflation fell below 5% YoY for the first time since the second quarter of 2022. Given the stubbornness of services prices of late, this decline is likely to be of particular relief to FOMC members.

Preview

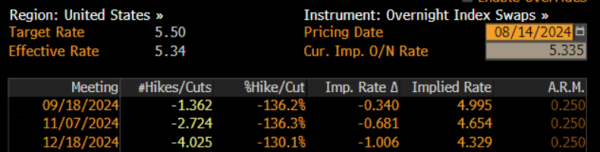

PreviewMarket pricing, however, moved little on the data, which is perhaps unsurprising given how close to consensus the majority of the report fell. The USD OIS curve continues to price just over 30bp of cuts for the September meeting, implying around a one-in-three chance of a 50bp cut next month, while also pricing just shy of 100bp of cuts by year-end.

Preview

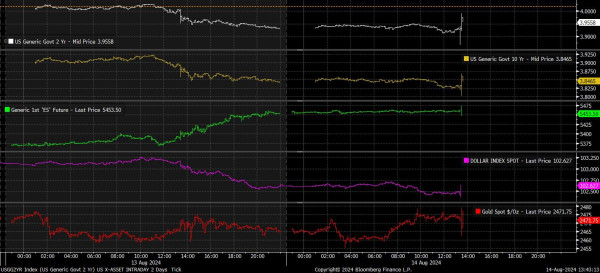

PreviewMarkets, more broadly, were also relatively little changed – ultimately – over the CPI report, though did initially see a knee-jerk hawkish reaction as the data was released. This likely owed to yesterday’s cooler-than-expected PPI report, and subsequent expectations for a cool CPI print, with those dovish positions then being unwound upon the CPI metrics crossing news wires.

Consequently, Treasuries ticked lower across the curve, led by the front-end, with 2s settling around 4bp above pre-release levels, and rising back above 3.95% on a yield basis. Moves elsewhere, however, were significantly more contained, with the front S&P and Nasdaq futures both hovering around pre-CPI levels, and the greenback continuing to linger close to session lows against most G10 peers. Gold, also, traded flat over the release.

Preview

PreviewOn the whole, it seems rather unlikely that the July CPI report will materially change the FOMC’s policy course. A September cut, which had already been strongly hinted at by Chair Powell at the July press conference, became an effective certainty after the softer-than-expected – albeit weather-impacted – jobs report at the beginning of August. Though market participants continue to engage in a tug-of-war over whether said cut will be 25bp or 50bp, a more modest 25bp move seems a reasonable first step on the road to normalising policy, with a larger cut likely to smack of panic.

That said, the near-term trajectory that the fed funds rate will take hinges more on the evolution of the labour market, than inflation developments, given how risks to both sides of the dual mandate have continued to come back into better balance, and as inflation, particularly when measured using the Fed’s preferred core PCE gauge, is withing touching distance of achieving the 2% target. Barring significant, unexpected, further labour market weakness, a total of 50bp of cuts this year – in September, and December – seems the most likely outcome, though an additional 25bp cut in November could well be on the cards if unemployment were to rise further.

Nevertheless, with earnings growth having remained resilient through Q2 reporting season, economic growth still strong, and the flexible 'Fed put' still in place, and as forceful as ever, the path of least resistance should continue to lead to the upside for equities, with dips likely to be bought in relatively short order. In the FX space, meanwhile, with the market continuing to price an overly aggressive 100bp of Fed cuts by year-end, a hawkish repricing of rate expectations should provide some support to the greenback, particularly if policymakers pushback on these expectations, though the same repricing poses downside risks to Treasuries, most notably at the front-end.