July market performance: A summer full of action

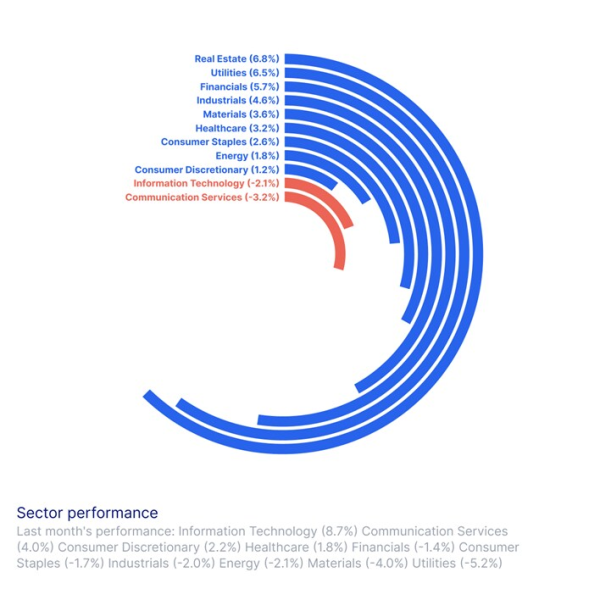

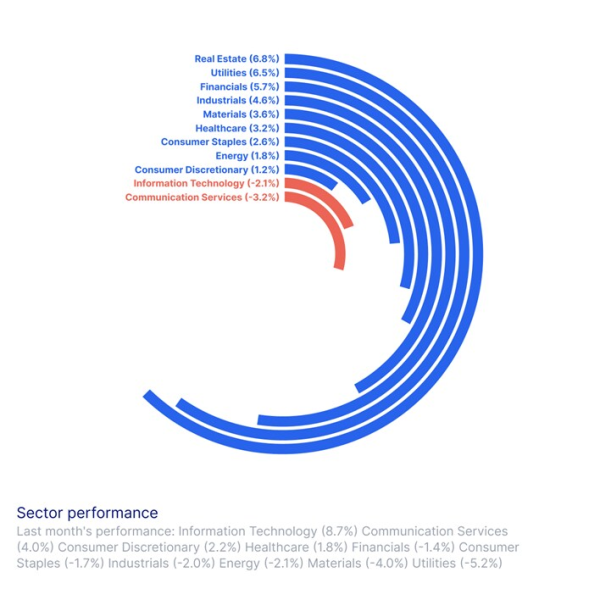

July was an action-packed month for financial markets, with global equities rising 1.7%. The political stage especially demanded attention with e.g. drama revolving around the US presidential election.

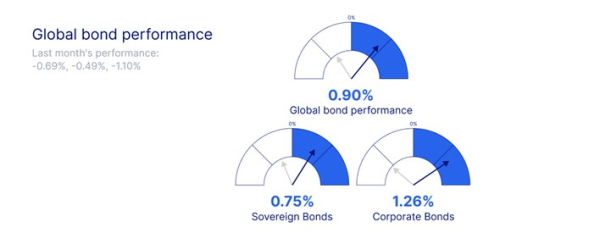

Sources: Bloomberg and Saxo

Global equities are measured using the MSCI World Index. Equity regions are measured using the S&P 500 (US) and the MSCI indices Europe, AC Asia Pacific, and EM respectively. Equity sectors are measured using the MSCI World/Sector indices, e.g., MSCI World/Energy. Bonds are measured using the USD-hedged Bloomberg Aggregate Total Return indices for total, sovereign, and corporate respectively.