Libya supply disruptions propel crude prices higher

Key points

- Brent surged back above USD 80 on Monday, as the focus shifted back to supply concerns

- Libya’s Eastern government said it would stop all oil production and exports

- The bulk of the oil-rich nations +1.1 million barrels per day output is produced and controlled by the Eastern govt.

- A current weak demand outlook could see the mid-80's in Brent provide a ceiling for now

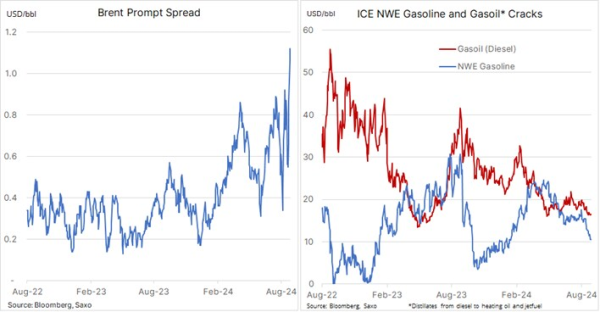

Brent crude oil trades back above USD 80 per barrel, having once again managed to bounce ahead of key support in the USD 75 area. Recent weakness was driven by demand fears, especially in China, the world’s top importer of crude, leading to lower refinery runs and diminished oil demand. Refinery margins, the key driver for crude demand, remain weak as well in Europe and the USA, leading to lower prices, potentially worsened by the prospect for rising non-OPEC and, not least, OPEC+ supply as the group begins to unwind voluntary cuts.

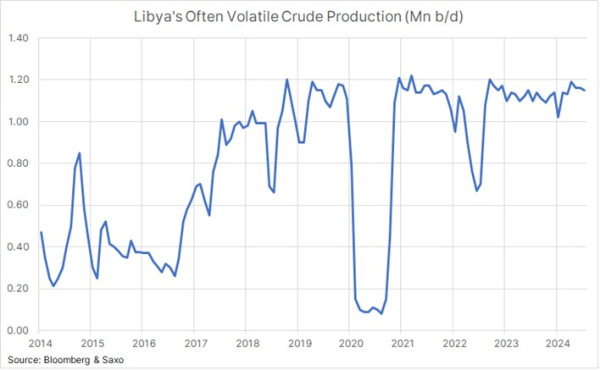

However, since the weekend when Israel and Hezbollah exchanged fire, the price has found fresh support, which was strengthened further on Monday when the risk of an actual disruption, not just the fear of one, helped boost prices. This after Libya’s Eastern government said it would stop all oil production and exports, as the struggle with its Tripoli-based rival for control of the central bank and the nation’s oil wealth heats up. This potentially threatens another conflict which, during the past decade, has seen production from this oil-rich nation gyrate between near-zero barrels to around 1.2 million barrels per day.

In the last year, Libya produced an average 1.13 million barrels per day, with the bulk of the production coming from the oil-rich east, which is now being shut in. Depending on the duration, a reduction of this magnitude will help tighten a fine-tuned market, leaving the door wide open for OPEC+ to go ahead with a planned October production increase. Since October 2022, when OPEC+ announced a 2 million bpd production cut amid concerns about potential oversupply and economic uncertainty, Brent crude has traded mostly sideways, averaging around USD 83. The group has managed to stabilise prices but, in doing so, has also supported increased production from non-OPEC+ members.

The jump in Brent to around USD 81 has primarily been driven by short-term supply worries, leading to short-covering from hedge funds who primarily trade the front end of the futures curve, thereby driving up the premium the prompt futures contract trades above the next month. At the same time, the weak demand outlook, especially for diesel, has driven down refinery margins across the world. It highlights an oil market that, without a prolonged Libyan supply disruption, may struggle to move much higher, with the mid-80s potentially providing a ceiling for now.

From a technical perspective, Brent remains stuck in a wide range that continues to offer support near USD 75, while the upside, for now, seems capped at the 200-day moving average, last at USD 82.30, ahead of USD 85 and USD 88. In the week to 20 August, large speculators, such as hedge funds, held a near-record low bullish belief in higher crude oil prices, and as the technical outlook shows signs of improvement, they may end up providing some tailwind to the current rally. Overall, however, as mentioned, we continue to see limited upside beyond USD 85 per barrel as the weak demand outlook and ample OPEC+ spare capacity offsets short-term supply risks.

Recent commodity articles:

26 Aug 2024: COT: Funds boost metals investment as dollar long positions halve amid weakness

23 Aug 2024: Commodities Weekly: Metal strength counterbalancing energy and grains

22 Aug 2024: Persistent supply contraints keep cocoa prices elevated

21 Aug 2024: Weak demand focus steers crude towards key support

19 Aug 2024: Resilient gold bulls drive price to fresh record above USD 2500

19 Aug 2024: COT Buyers return to crude as gold stays strong; Historic yen buying

16 Aug 2024: Commodities weekly: Gold strong as China weakness drags on other markets

9 Aug 2024: Commodities weekly: Calm returns to markets, including raw materials

8 Aug 2024: Sentiment-driven crude sell-off eases, allowing traders to focus on supply risks

7 Aug 2024: Limited short-selling interest observed during copper's recent aggressive correction

6 Aug 2024: Video: What factors are fueling the current market turmoil and gold's response

5 Aug 2024: COT: Broad commodities sell-off gains momentum; Forex traders seek JPY and CHF

5 Aug 2024: Commodities: Position reduction in focus as volatility spikes

2 Aug 2024: Widespread commodities decline in July, with gold as the notable exception

31 July 2024: Crude's month-long slide halted by fresh Mideast worries

30 July 2024: Record demand explains gold's current resilience

29 July 2024: COT: Energy and metals selling cuts hedge fund long to four-month low

4 July 2024: Sluggish US economic indicators boost demand for gold and silver

4 July 2024: Podcast Special: Quarterly Outlook - Sandcastle Economics

2 July 2024: Quarterly Outlook - Energy and grains in focus as metals pause

1 July 2024: COT: Crude long builds ahead of Q3 while grains selling accelerate