Long call options and dividend payout (part 1 of 2)

For a large group of equity investors, this is an important time of year: the annual dividend payout season. But did you know that the dividend payout can also be negative for you as an option investor? This article explains how it works.

Call options and dividend

A call option owner is not entitled to receive dividend. Fortunately, the computer models that calculate option prices consider this. This means that call options on dividend-paying stocks will be a little more expensive and put options will be a little more expensive.

But what about call options that are deep in the money just before dividend payout?

It is possible for an in-the-money call option to be worth more the day before the fund goes ex-dividend than the day the fund is quoted ex-dividend. Failure to act may result in loss.

Should you exercise your options rights or sell them?

This depends on what you want. If you bought a call option to buy shares, it is clear that you should exercise your rights and receive the shares. This will entitle you to the dividend. This must be done before 17:30 on the day before the stock goes ex-dividend. If you bought a call option to profit from a rise in the stock, it may be wiser to sell the options before the dividend payout.

Example

The XYZ share is quoted at EUR 25. Now there is a call option on this share with a strike price of EUR 20 and a maturity of three months. The price shown on the screen for this option is EUR 4.95 bid and EUR 5.05 ask price, which means the call option quotes intrinsic value. The put option with the same strike price quotes EUR 0.40. Tomorrow, the stock goes EUR -1 dividend. What does this mean for the call option with strike price 20?

Theoretical call price

Now we need to look at how the price of a call option is normally constructed. It is made up of the intrinsic value (this is the difference between the strike price and the stock price) and the time value. This time value is made up of an interest rate component and a volatility component. With this, we can start to figure out what the theoretical price of the call option should be the next day. The intrinsic value of the call option has become EUR 4 when the stock opens at EUR 24. What we need to add to this is the interest on the strike price during the term. With an interest rate of 4%, this is 4% of EUR 20 over a three-month period = EUR 0.20. What is added to that is volatility. And through a mechanism called put call parity, you know this is worth EUR 0.40. This is the premium of the 20 put!

So,

Intrinsic value EUR 4.00

Interest EUR 0.20

Volatility EUR 0.40 +

Theoretical call price EUR 4.60

In this example, I assume that the stock opens at the spot closing price of yesterday price minus the dividend; this is the best estimate you can make. You can see that the call option, which was worth EUR 5 yesterday, is now worth only EUR 4.60. This means that not selling this option (or exercising your right to get the shares and become entitled to dividend) will cost you EUR 0.40 per option. (But you know that 1 option contract is about 100 shares, so the loss will be EUR 40 per option contract).

What you need to remember

An in-the-money call option is an early exercise candidate if of the premium of the put (with the equal strike price and time to maturity) where plus the interest over n the strike price over the time to maturity is less than the dividend.

Premium of the put + interest cost < the dividend? Sell or exercise the option.

This sounds more complicated than it is. In the example, the sum becomes: EUR 0.40 + EUR 0.20 = EUR 0.60. This is less than EUR 1 dividend, so the choice is between selling the call or exercising your rights to buy the shares at the exercise price.

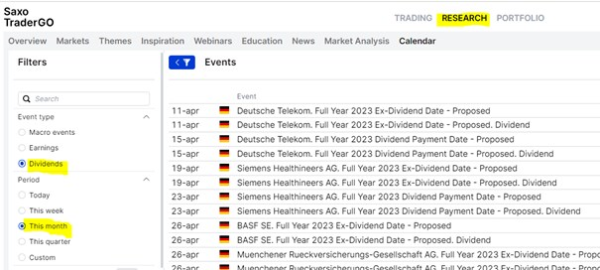

Find upcoming dividend in the SaxoTraderGo platform

The upcoming dividends can be found within the platform. Go to 'Research', select on the left side 'Dividends' and choose the desired period.

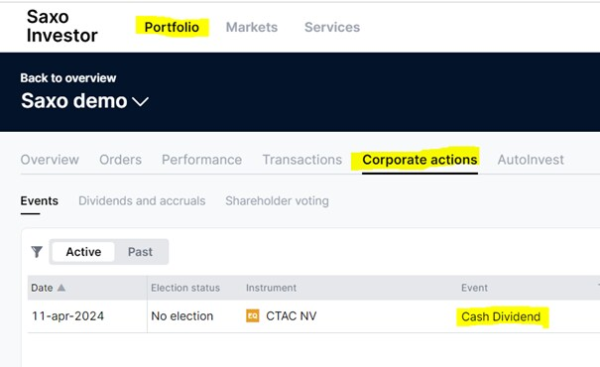

Find upcoming dividend in the SaxoInvestor platform

In this platform you can only find the upcoming dividends for the stocks in your portfolio. You can find those here: